Indekset for den amerikanske industriproduktion faldt i september til 55,4 point, men indekset ligger fortsat højt – dvs. over 50 point. ING vurderer, at der er en række tegn på en stærkere industriaktivitet i de kommende måneder, f.eks. med et højt niveau for ordrer fra udlandet. Forbruget er også stærkt, mens servicesektoren ligger lidt underdrejet. Bygge- og konstruktionssektorer ventes at vise en meget stærk fremgang i 3. kvartal på mindst 30 pct.

US: Manufacturing and construction boost 3Q GDP hopes

The ISM dipped very modestly, but the details suggest strong manufacturing activity will continue in coming months while completely revised construction numbers indicate we should be looking for 30%+ GDP growth for 3Q20

Mild ISM disappointment, but nothing to worry about

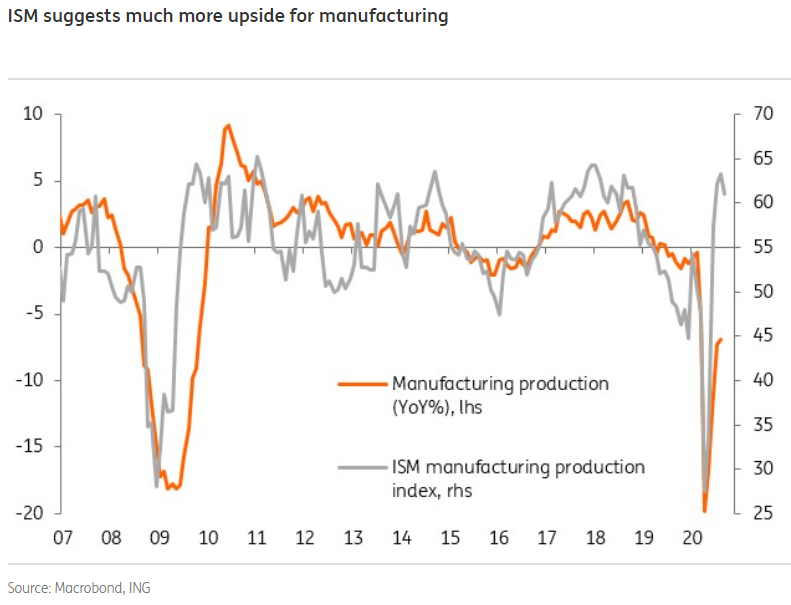

The ISM manufacturing index has historically been the best lead indicator for US economic growth and unfortunately it is a little soft given where the decent regional indicators suggested it should have come in.

That said, while the headline dipped to 55.4 from 56 (consensus 56.5) it is still in very strong growth territory – it is a diffusion index so anything above 50 is expansion and the further you are from 50 the greater the pace of that expansion.

New orders dropped to 60.2 from 67.6, but that is still very, very good given the 6M average is 50.8. Production dipped to 61 from 63.3, again well above the 6M average of 50.7. Employment improved to 49.6 from 46.4, but seeing as that is below 50 it means jobs continue to be lost in major manufacturing firms, just at a very moderate rate.

More upside to come

Manufacturing is doing well as inventories are rebuilt following the shutdowns brought about by Covid-19 containment protocols.

The recovery in global trade is also providing benefits with new export orders up at 54.3 from 53.3 and much better than the 6M average of 46.7.

Throw in strong US consumer demand, particularly for cars and housing, which in turn fuels demand for big ticket items such as washing machines, fridges, electronics etc, and the prospects for the sector continue to look decent.

There is more concern about the service sector, which is more heavily impacted by Covid containment measures and social distancing.

Revised construction data another boost for GDP growth

We have also had some very good construction numbers with major upward revisions to the history, reinforcing the view we should be looking for a 30%+ 3Q GDP growth rate.

Construction spending beat expectations by 0.7ppt in August (came in at 1.4% growth), while July was revised up 0.6ppt, June 1.5ppt and May 0.4ppt to tell a completely different story to what the numbers had previously been suggesting.

To be honest this better reflects the housing start numbers we have been seeing and is indeed largely attributable to the residential construction numbers completely changing.

With mortgage applications and pending home sales remaining very robust, thanks to record low mortgage rates and the fact that the average age of a home buyer is in their late 40s so better insulated from the economic distress, residential construction will remain a key growth driver in 4Q.