Uddrag fra finanshuse:

The index looks calm. Under the surface, it’s anything but.

Market internals just did something they’ve only done 13 times since 2007. Dispersion is sitting in the 98th percentile. Semis and software are pulling apart. Small caps are quietly crushing mega caps. Emerging markets are beating U.S. tech. And investors are still crowded into the same AI names.

When the surface stays quiet while the undercurrents turn violent, it usually pays to pay attention.

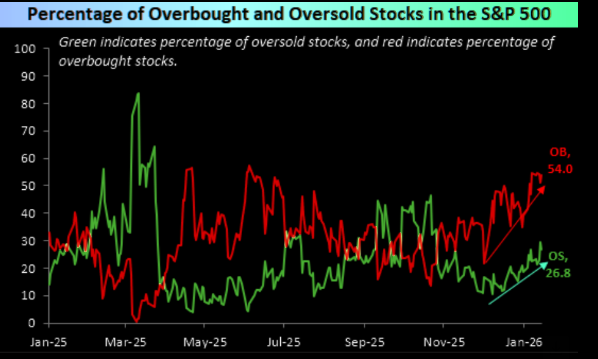

Rare breadth

Since Bespoke began tracking the data in 2007, Friday was just the 13th time both oversold and overbought readings jumped by 10 percentage points in a single month. This is rare.

Source: Bespoke/Authers

Rare jaws

Semis vs software beyond extreme. Chart 2 shows the SOX/IGV ratio.

Source: LSEG Workspace

Source: LSEG Workspace

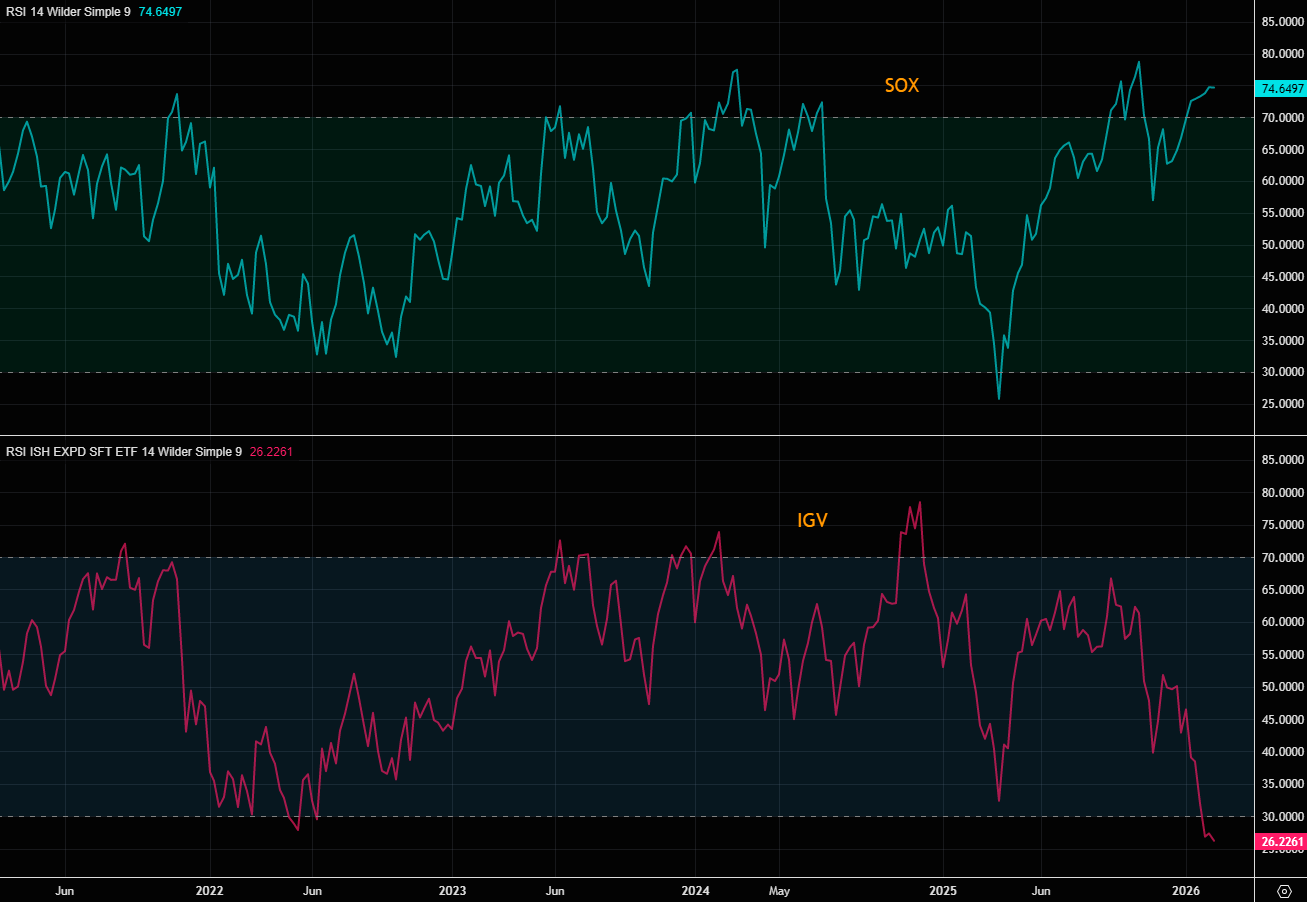

RSI rare

Semis vs software weekly RSI basically total opposites here.

Source: LSEG Workspace

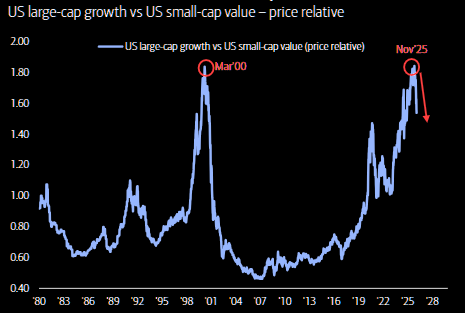

Rare Russell

Over the past three months, the Russell has left the MAGs far behind. Chart 2 puts the longer-term move into perspective. What if this is only getting started?

Source: LSEG Workspace

Source: LSEG Workspace

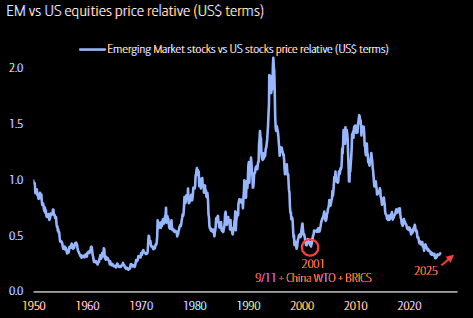

EM vs tech

EEM has beaten the QQQ by miles over the past months. But zoom out and you realize this is nothing if the rotation is “real” (chart 2).

Source: LSEG Workspace

Source: BofA

Don’t stay boring

Six months of nothing in NDX. A breakout surge in KOSPI. If you keep trading what’s familiar, you’ll keep missing what’s working.

Source: LSEG Workspace

Not all AI is boring

While many are still crowding into NVDA and the familiar AI giants, Asian AI names have delivered the real upside. The edge isn’t in what everyone already owns, it’s in what they’re ignoring.

Source: LSEG Workspace

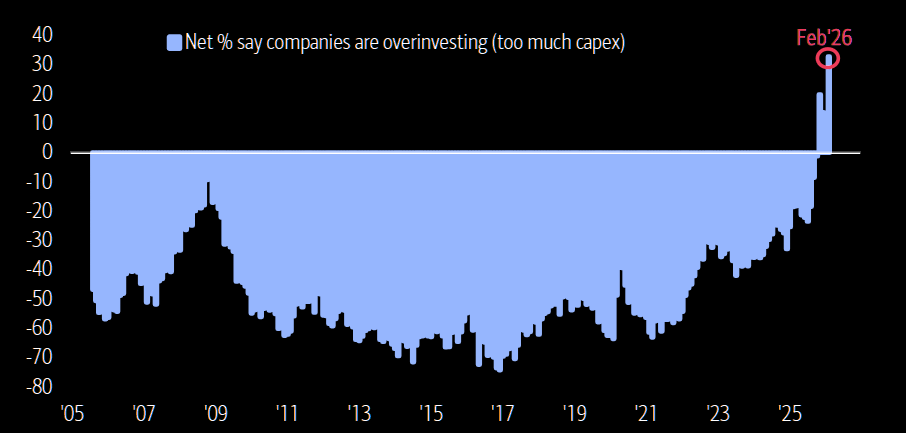

Rare overinvesting

CIOs telling CEOs to slow capex. Chart shows net % of FMS investors saying companies are “overinvesting”.

Source: BofA FMS

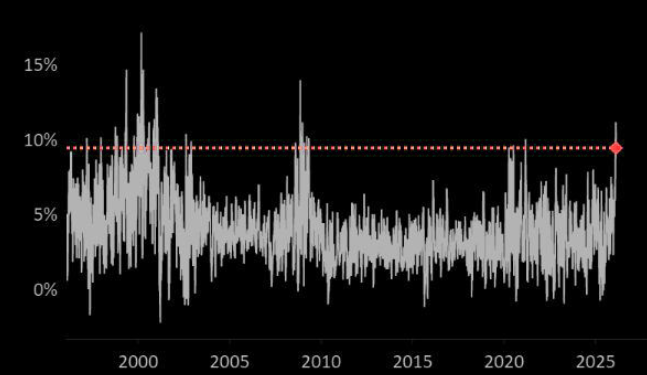

Rare dispersion

Dispersion is at extreme levels. Over the past month SPX moved 1.8%, stocks on average moved 11.2%. This is in the 98th %tile over the past 3 decades according to Nomura.