Two tailwinds

Easier financial conditions and the strongest earnings beats in four years are giving confidence to the bulls. With yields plunging and S&P 500 earnings revisions rising, the market’s optimism is anchored in these two tailwinds.

Lowest since April

10-Year Treasury Yield plunges to lowest level since April.

Source: @barchart

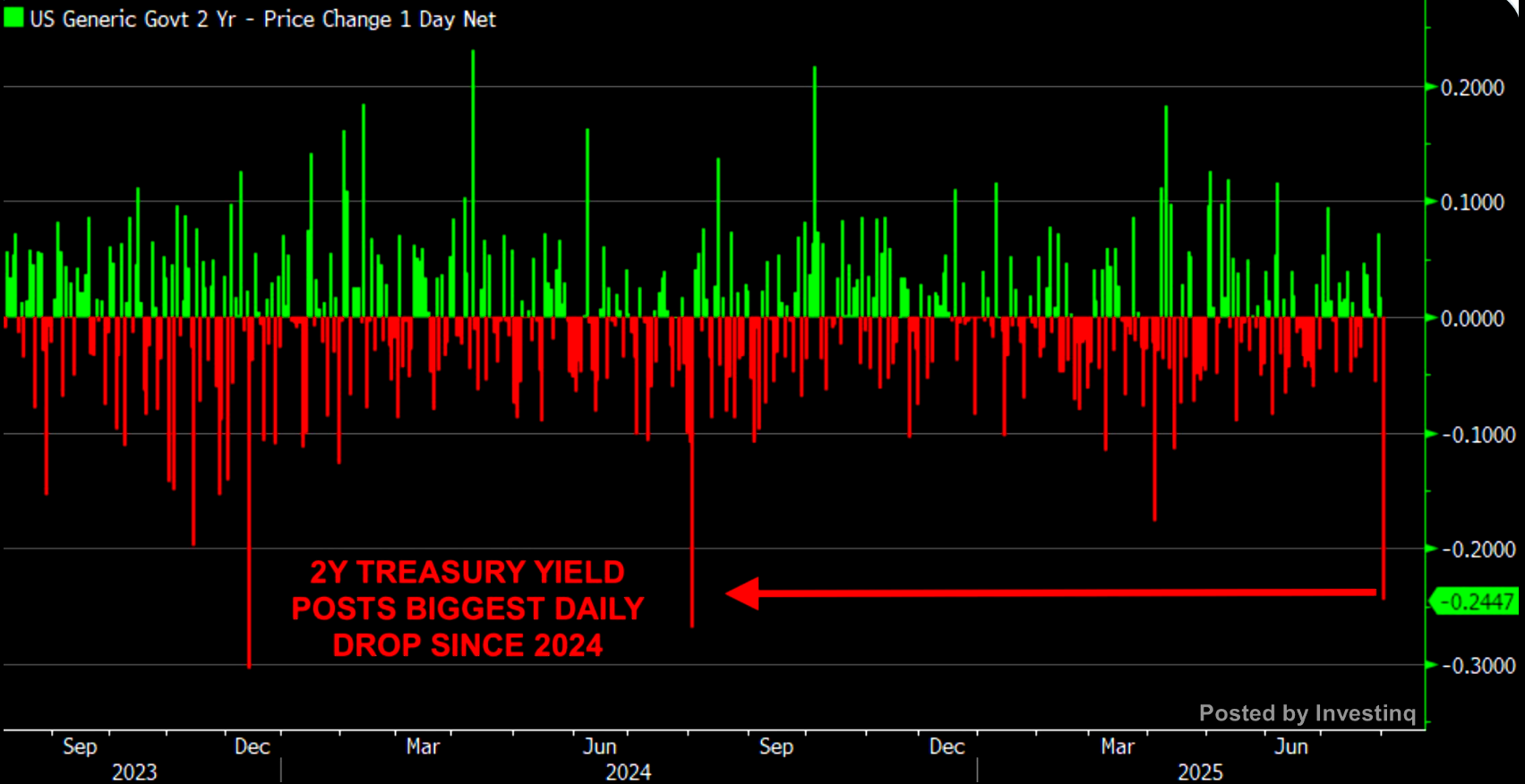

Biggest drop in over a year

The 2-Year Treasury yield just made its biggest drop since 2024.

Source: @_Investinq

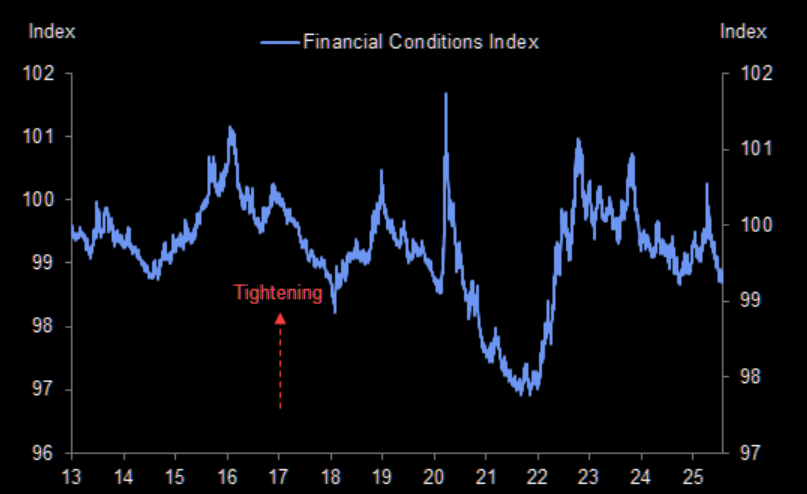

Loosening

Financial conditions are loosening aggressively – trying to take out a 3-year low.

Source: Goldman

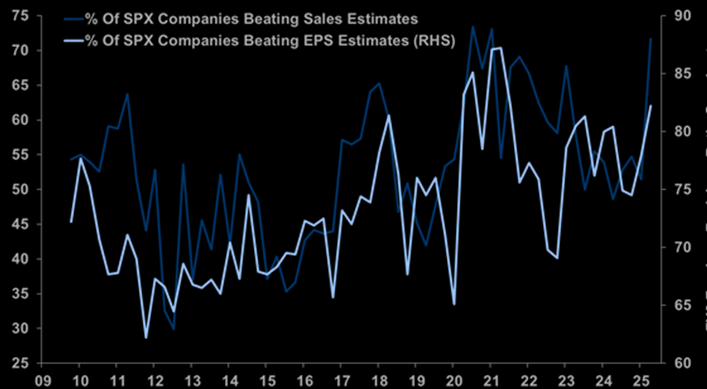

Broadest beats in 4 years

At the same time, corporate America is delivering strong number vs. expectations. US revenue and earnings seeing broadest beats in 4 years.

Source: Morgan Stanley

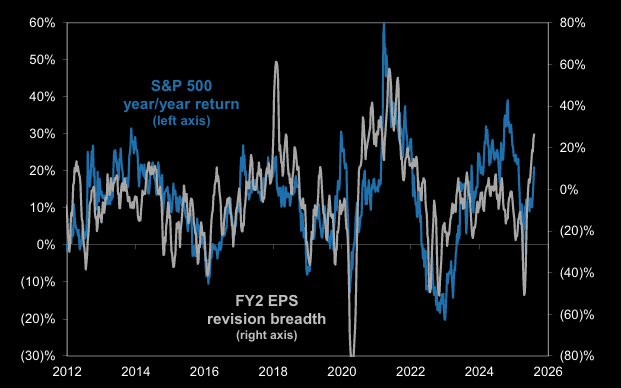

Revision breadth bull

S&P 500 EPS revision breadth has risen sharply.

Source: FactSet

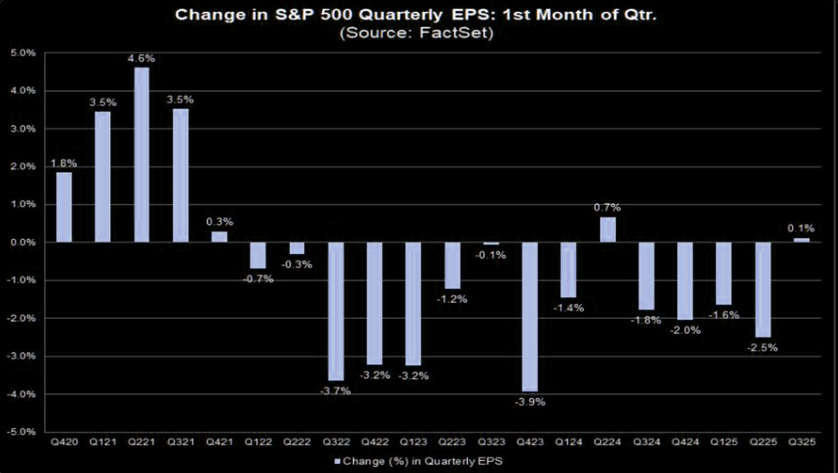

Q3 numbers

Earnings estimates for Q3 are holding up pretty well.

Source: Factset

Buy the dip in Quality

This might be a good time to buy quality stocks. The drawdown in quality looks advanced relative to post-covid trends.