Uddrahg fra Bank of America/ zerohedge:

It was back in mid-May when BofA’s Michael Hartnett previewed the big pain trade of the second half and wrote that “investors are very long cash, IG bonds, stocks/tech, some long 2-year UST to play Fed cuts, but no one is long 30-year (annualizing 15% loss in ’24) on debt dynamics/concern slowdown = more fiscal excess; this means that lower long yields is a very obvious “pain trade” in H2.”

What has happened since then? Well, as Hartnett writes in his latest flow show note titled “It’s coming home, Jerome” “over the past 3 months, 10-year UST has rallied from 4¾% to below 4¼%; bonds “big, fat & trendy”…. and predicts that if we “break below 4% (100-week ma) on 10-year Treasury and narrative shifts pronto from “soft” to “harder” landing.”

This also leads into Hartnett’s zeitgeist quote of the week, namely that “until investors need to buy bonds, they ain’t selling tech” and according to Hartnett, that time almost here. But it’s not just the end of the relentless tech frenzy.

The BofA strategist believes that the upcoming unwind of the Anything But Bonds trade he noted first early this year, is especially positive for three downstream trades:

- 1. UK FTSE, as the local value index is the anti-Nasdaq (although whether anyone will want to put their money into this Labour juggernaut is another matter”.

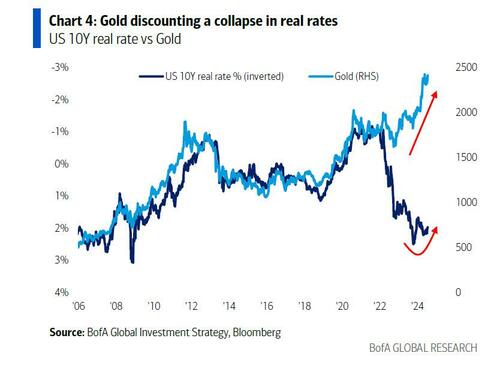

- 2. EM stocks as investors will sell US$ into 1st rate cut – just look at gold saying same as real rates dive below 2%

- 3. Distressed leverage like REITs & small cap (Thursday’s outperformance of Russell vs S&P 500 was the 5th largest in 45 years), as “ABB” means unwind of mass “long monopolies, short leverage” trade.

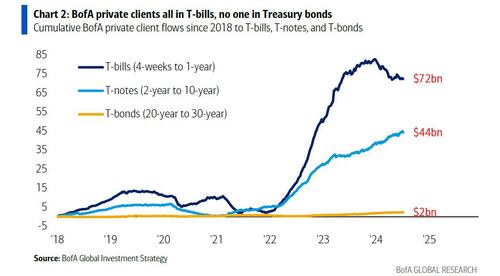

And then there are technicals and sentiment: here, BofA’s own private client flows to Treasuries are a good window on investor bond sentiment… which as shown in the chart below are all in T-bills, and no one is buying Treasury bonds:

So instead of buying bonds, private clients are seeing duration exposure in the best performing stock sector this year: their holdings of Magnificent 7 stocks are now two-thirds of holdings in all Treasury bonds with duration >1 year; and as Hartnett notes, the same is taking place on the institutional side “where there is zero evidence clients selling stocks to buy bonds” but all this will change instantly and significantly once hard landing risk jumps.

Going back to Hartnett’s conviction that now is the time to buy bonds, the BOfA strategists falls back to his favorite letter, and writes that the 4Ps all say “long the long bond.”

1. Positioning: BofA private client flows to Treasuries are a good window on investor bond sentiment; inflows in ‘22/’23 (chart above) were $80bn to T-bills, $34bn to T-notes & puny $1bn to T-bonds; in ’24 flows to T-bills have partially reversed ($10bn outflows), steady but no-great-shakes into T-notes ($5bn inflow), and investors continue to resolutely avoid long-end (still-puny $0.5bn inflow to T-bonds); meanwhile as noted above, BofA client positioning in Magnificent 7 stocks is now two-thirds of their holdings in all Treasury bonds with duration of more than 1 year; all mirrored on institutional side where as of yet zero evidence via BofA FMS clients selling stocks to buy bonds.

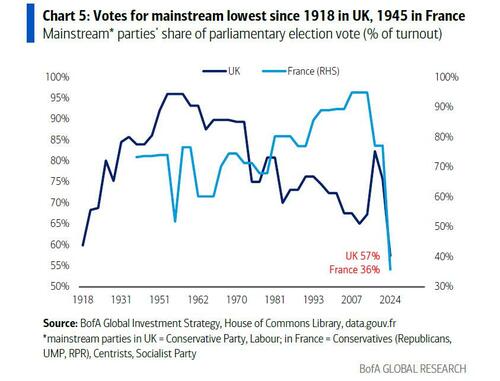

2. Politics: echoing his observation from last week, Hartnett notes that in recent elections the percentage of the electorate voting for mainstream parties fell to lowest since 1918 in UK (57%), and lowest since 1945 in France (36%);

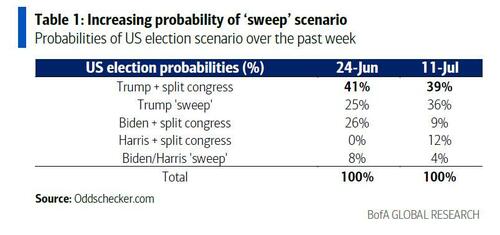

This “electoral distrust in mainstream politics mirrored by investor distrust that mainstream fiscal & monetary policies will be enacted” – Hartnett believes that this is one big reason for “buyers’ strike” in government bonds in recent years (investors don’t want to lend to Western politicians); also of note, from a cyclical H2 perspective, bond bulls thrilled bonds rallying despite consensus concerns of US election “sweep” rising in recent weeks (latest probabilities = Trump & split Congress 39%, Trump sweep 36%, Biden or Harris & split Congress 21%, Biden/Harris sweep 4%).

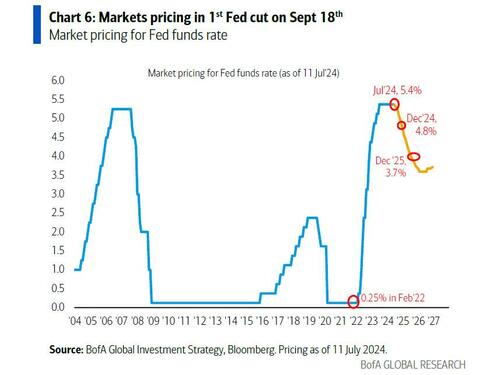

3. Policy: markets pricing in 100% probability of 1st Fed cut on Sept 18th (and 9% probability of cut Jul 31st – Chart 6); BofA forecasts 56 global interest rate cuts in 2H’24…bonds love rate cuts.

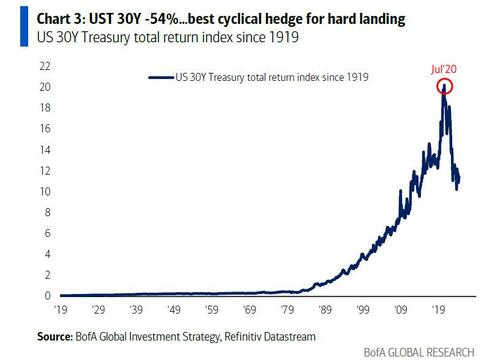

4. Profits: “soft landing” expectations are rising again, as consensus expects any US slowdown to be “transitory” as rate cuts work quickly & forcefully (despite rate hikes having slow & largely impotent negative impact); to this Hartnett – again – says say “sell the 1st rate cut” for credit & stocks as hard landing probabilities set to rise given trajectory of US labor market, consumer spending & capital spending; 30-year Treasury best cyclical hedge for hard landing: soft = yields >4%, hard = yields <4%.

Finally, here is how Hartnett is trading it: the coming ABB reversal means contrarian winners in Q3:

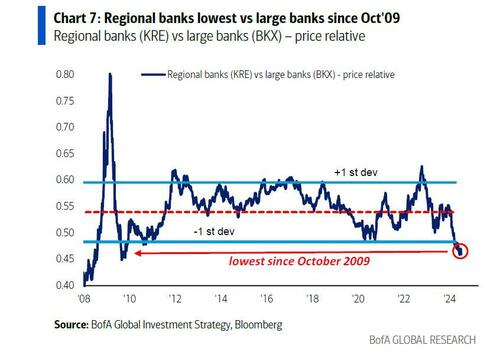

- long assets with “leverage” such as REITs (UW according to May’24 BofA FMS highest since Jun’09), small cap stocks, regional banks (KRE vs BKX lowest since Oct’09)

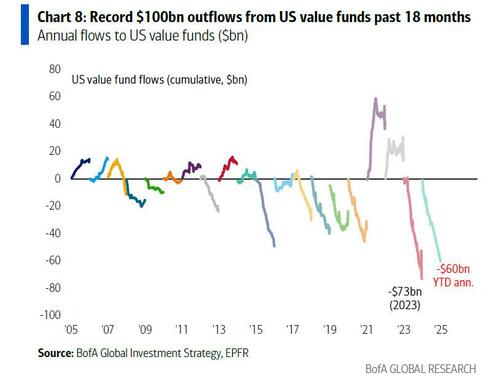

- long “value” (record $100bn outflows from US value funds past 18 months), especially indices with bulky exposure to resources, banks, staples such as UK FTSE (the “anti-Nasdaq”);

- long “long duration” assets, e.g. biotech;

- long EM: EMXC (EM stocks ex-China) at all-time high, and EEM (EM stocks incl. China) trying to break above 2018 high… EM the play for weaker US dollar as Fed starts cutting and negative impact of strong US$ on US EPS reveals itself; EM-kicker would be positive surprise from China “Third Plenum” July 15-18th, e.g. more aggressive use of SPVs (Special Purpose Vehicles) to reduce excess property stock;

- long Japanese yen…yen ripped today, and BoJ likely hawkish in July;

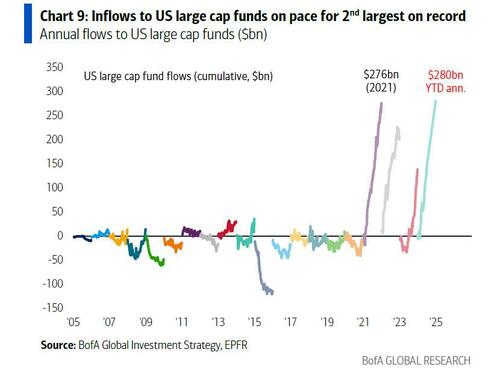

- Finally, and most controversially, short large-cap growth: inflows to US large-cap funds annualizing 2nd largest on record…

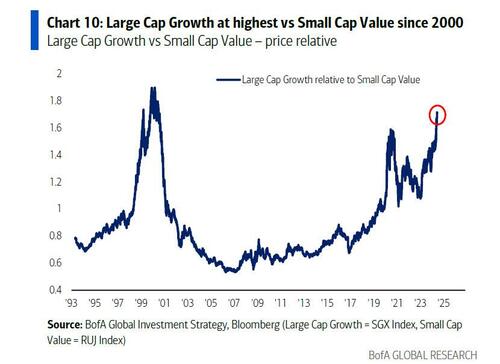

- and large-cap growth stocks at highest level vs. small-cap value since Jul’00 (Chart 10).

Which brings us to the punchline: when to go long treasuries and start selling tech giants? According to Hartnett, the trigger to dump ABB (Anything But Bonds) winners is when “Harder” Soft Landing mutates to plain Hard Landing. This is how Hartnett frames it:

if data confirms soft landing (limited deterioration in labor market, yields remain 4%-ish), this is finally bullish for market breadth (leverage, value, EM and so on) but “sellers’ strike” in mega-cap tech/AI won’t change, which means stocks sideways but breadth much better (although many cyclical sectors have discounted this outcome); in contrast, if data confirms harder landing (U-rate moves toward 4.5%, payrolls <140k) trade much more straightforward as asset allocation flip to bonds, from stocks, and will be likely very painful tech; we say market not sufficiently pricing in risk of harder landing.