Uddrag fra Zerohedge:

Well, it’s been a morning.

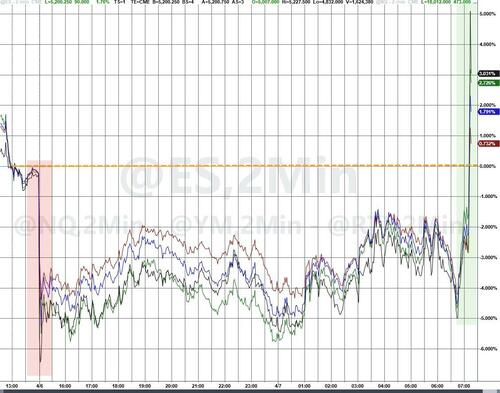

- Futs down 5% pre-open

- Rally begins on EU saying “ready for negotiations”

- Rally explodes on ‘report’ that Trump is considering 90-day pause on tariffs

- Stocks crash back to earth as White House confirms it is “fake news”

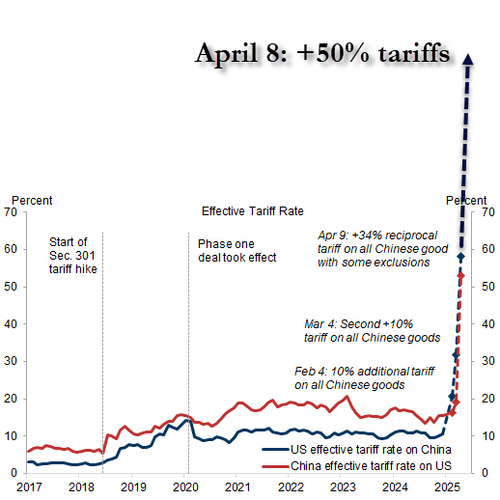

- Trump re-escalates on China, threatening 50% retaliatory tariffs.

And here we are (S&P futs are down 13% from the tariff announcement)…

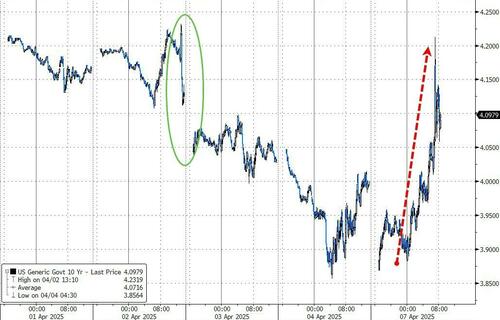

While Treasury yields are now unchanged post-tariffs…

* * *

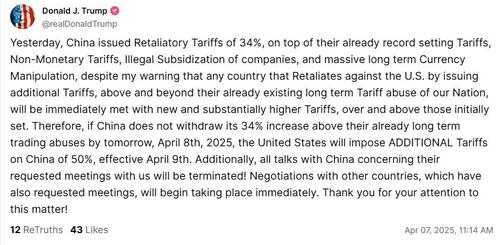

Update (1115ET): President Donald Trump threatened to “impose ADDITIONAL Tariffs on China of 50%” unless Beijing withdraws a 34% retaliatory duty on US goods.

“If China does not withdraw its 34% increase above their already long term trading abuses by tomorrow, April 8th, 2025, the United States will impose ADDITIONAL Tariffs on China of 50%, effective April 9th,” Trump posted on social media.

The president also said “all talks with China concerning their requested meetings with us will be terminated!”

“Negotiations with other countries, which have also requested meetings, will begin taking place immediately,” he added

Additionally, Trump said that all talks with China will be terminated.

And that sent us back into the red…

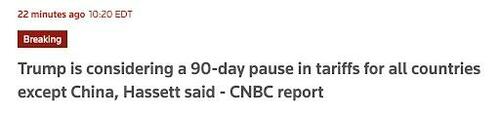

Update (1015ET): US futures have exploded higher following reported (by Reuters) comments from Kevin Hassett that Trump will consider a 90-day pause in tariffs for all countries (except China).

And that sparked a massive bid (after Friday’s record shorting, remember)…

This is the clip that apparently triggered the move. Did some Reuters reporter suddenly rewatch it and post a headline for effect? Or was this the ultimate strawman?

And now back down…

- *CNBC: NO ONE AT WHITE HOUSE IS AWARE OF 90 DAY PAUSE

And that sent prices plunging back to earth…

And now, CNBC is reporting that White House Press Secretary Karoline Leavitt has confirmed this 90-day pause is “fake news”.

The White House’ Rapid Response (@RapidResponse47) account has confirmed this is:

“Wrong. Not only did Director Hassett not say this (clip above), @POTUS has been clear — “it all has to change, but especially with CHINA!!!”

For context that was a swing for Russell 2000 from a 5% loss pre-market to a 5% gain and now back to a 1.5% loss on the day!!

This is entirely unprecedented.

Bloomberg’s JavierBlas posted a very good point on X:

The fact the White House came quickly and strongly to deny the rumour of a 90-day delay on the tariffs ***despite*** the positive impact the chatter had on the equity markets tells you all what you need to know: for now, Trump isn’t backtracking.

* * *

The US equity open saw buyers return (buying the dip) in size sending the S&P futs from -5% to +1% following comments from European leaders that suggest the negotiations are beginning:

Goldman Sachs Alberto Bacis noted that today was an important day to execute some price discovery post 2nd April news. The EU commission met today with Foreign/Trade Ministers of member states.

For now, EU is waiting for reciprocal tariffs to be implemented on April 9th. Any actions will come after that. Reading through the headlines, what follows stand out

EC

Ready to negotiate.

EC will set up import surveillance task force.

European Commission President Ursula von der Leyen said on Monday that the EU had offered the United States “zero-for-zero” tariffs on flows of industrial goods as it works to avert an all-out transatlantic trade war.

“We stand ready to negotiate with the United States. Indeed, we have offered zero-for-zero tariffs for industrial goods, as we have successfully done with many other trading partners, because Europe is always ready for a good deal,” she said, adding that the offer was made before Trump’s announcement last week of sweeping new tariffs.

Zero-for-zero is a good start…

…ultimately this is what Navarro said:

*NAVARRO: TRADE PARTNERS ZEROING TARIFFS IS FIRST START

EU Commissioner for Economic Affairs and Productivity (Dombrovskis)

A list of products involved in retaliatory tariffs should be announced today and voted by Wednesday. This list started being created after the steel and aluminium levies announced 2 weeks ago.

The list dropped bourbon….. after heavy lobbying from France, Italy and Ireland, which are seeking to shield their alcohol industries from the escalating trade war.

“If there are no solutions, we are ready to respond by imposing counter-tariffs. This week, member states will discuss and probably already decide on the retaliatory tariffs”

He also explained that the last package of tariffs still needs to be assessed, “showing a willingness to take counter-measures on one hand, but leaving time for further negotiations on the other hand,” Dombrovskis said.

EU DIPLOMACY

A diplomat said:

“Our first strategy is that China will impose tariffs on the United States, so we will probably wait and see what the United States will do, what this will cause,”

FRANCE, GERMANY, AUSTRIA

Paris has been pushing for the EU to consider targeting US services, including digital

France and Germany have specifically raised the possibility of deploying a new tool called the anti-coercion instrument (ACI)

French Trade Minister Laurent Saint-Martin said “We must not exclude any option on goods, on services… and open the European toolbox, which is very comprehensive and can also be extremely aggressive,”

German Economy Minister Robert Habeck said Monday “We have to take a close look at the anti-coercion instrument, which are measures that go far beyond tariff policy,”

IRELAND

Dublin is fiercely against any actions that would target Us services.

Ireland relies heavily on US investment, particularly in the pharmaceutical and tech sectors.

Irish Trade Minister Simon Harris told reporters. Targeting services “would be an extraordinary escalation at a time when we must be working for de-escalation” “It is in many ways the nuclear option if you start talking about the use of the anti-coercion instruments and the likes.”

“What’s important here is that Europe reacts in a calm and measured way,”

ITALY & SPAIN

They seem close to Irish position.

Spanish Trade Minister Carlos Cuerpo said the EU should “convey a message that we do not want to escalate any conflict”, while Italy’s Antonio Tajani said Europe had to “avoid uncontrolled reactions that would cause damage” to both sides.

“We absolutely have to work to avoid a trade war, which would be exacerbating for the US and our businesses,” Foreign Minister Antonio Tajani stressed. “We must negotiate; a united EU must do it.

For what it matters, Goldman’s Bacis is optimistic:

I think this looks good for risk in general…no retaliation from Europe, they re-tabled the zero-for-zero proposal, very strong opposition from Ireland to involve tariffs on services and ACI tool.

>>> There is a bid and there is an offer: admittedly you can park a bus in that bid-offer but there is room….just needs a salesman to bridge the 2 sides, send the vcons and move on to more interesting things in life…

Jokes aside: call me optimist but below highlights read good for risk