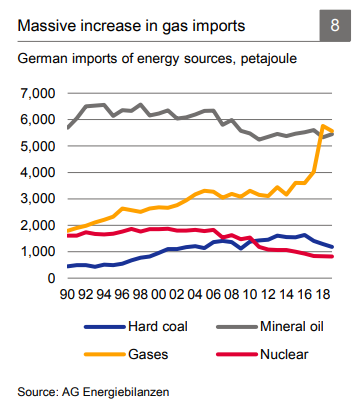

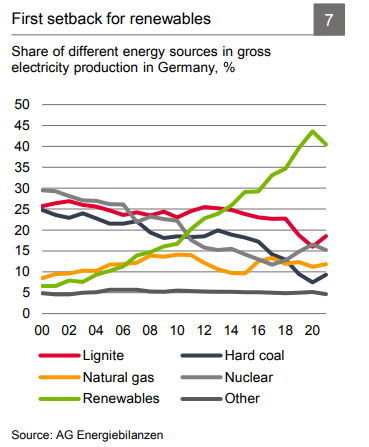

Tyskland er det europæiske land, der er mest i klemme i Ukraine-krigen, fordi Tyskland er så afhængig af russisk energi, især af gas, og gas bruges hovedsagelig til boligopvarmning. Det gør det ekstrem svært for Tyskland at deltage i et olie- og gasstop, som alle taler om nu, fordi det rammer borgerne øjeblikkeligt. Importen af gas er steget eksplosivt de seneste få år, og desuden er der sket et fald i den vedvarende energiproduktion, skriver Deutsche Bank i en analyse. Tyskland er altså kommet i en ekstremt sårbar situation – mere end nogen sinde – og det betyder, at selv om Tyskland er nødt til at komme ud af gas- og olie-klemmen, så er der ingen hurtige løsninger, skriver banken.

German energy supply at a

historical turning point

Despite many years of expansion of renewable energies, Germany is – as most other industrialised countries in the world are – still dependent on fossil fuels. Germany imports close to 70% of its energy resources, with Russia currently the

most important supplier of fossil fuels.

Russia’s war against Ukraine has led to a historical turning point in German energy supply. Germany aims to reduce its

dependency on energy imports from Russia as rapidly as possible. The energy links between Germany and Russia that have endured for decades, even during the hottest times of the Cold War, are to be loosened in the years to come. From today’s perspective, a renaissance of these energy links is hard to imagine given the current political regime in Russia.

Germany plans to massively expand renewable energies but will also invest in LNG infrastructure to diversify gas supply; new gas-fired power plants; power grids; energy efficiency of buildings, industrial processes, and mobility services; low-carbon heating technologies such as electric heat pumps; charging infrastructure for electric vehicles; power storage technologies, and infrastructure to produce, transport and use (green) hydrogen in energy intensive industries.

All these goals face many limitations, such as capacity and skilled labour constraints in the craft, construction, and capital goods producer industries; limited financial resources at the consumer, corporate and state level; time required for planning and approval procedures or local resistance against wind parks; and new power plants and/or grid expansion.

The short-term risk of being cut off from Russian gas and oil supply is more pronounced in the heating market and less severe in the electricity sector. While it seems very likely that gas supply is secured until autumn 2022, bottlenecks cannot be ruled out for winter 2022/23.

The major (political) tasks in the short term are increasing LNG imports on a European level, filling up gas storage capacities over the summer months and securing hard coal supply. When it comes to the crunch in the next winter, demand-side measures could come into play. This could include scheduled and orderly shutdowns of industrial plants with high gas consumption. Private heating purposes would likely be treated with priority compared to industrial applications. A faster expansion of renewables is a consequence of the current energy crisis, but no short-term solution given limitations on the supply side.