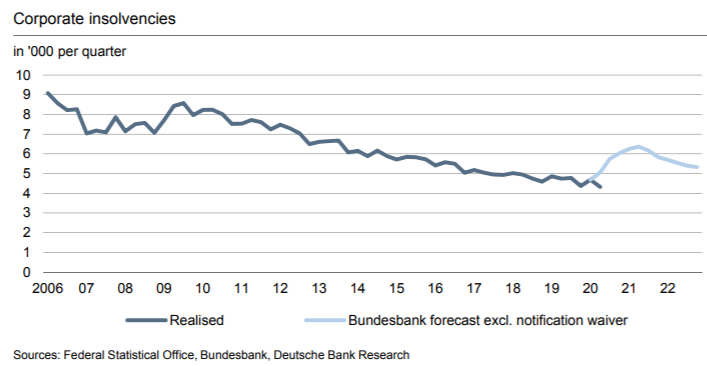

Deutsche Bank venter en kraftig stigning i antallet af tyske konkurser næste år, og at det også vil ramme de tyske banker. Bundesbank venter en stigning i konkurserne på 36 pct. indtil andet kvartal 2021, men det kan blive værre, fordi de tyske virksomheder har fået kunstigt åndedræt fra regeringen og centralbanken med lave renter og udskydelse af konkursbegæringer. Det kan alt i alt give bankerne voksende problemer med nødlidende lån.

Surge in corporate insolvencies hitting German banks

The corporate sector in Germany has become less vulnerable in terms of

funding over the past two decades. The equity capital ratio has risen a lot and

the share of bank loans in total liabilities has declined materially.

This is

particularly true for small and medium-sized enterprises whose funding structure

has become more similar to that of large firms.

This improved resilience should help the sector to weather the corona shock.

In addition, financing conditions remain clearly favourable: banks have hardly

tightened lending standards, the government has issued unprecedented credit

guarantees, lending rates are still close to record lows, and the ECB is eagerly

buying corporate bonds which many companies are currently issuing.

Nonetheless, corporate insolvencies inevitably will rise as a result of the deep

recession, with the economy expected to shrink this year by about as much as

during the Great Recession.

The German government has waived until September/December the obligation to file for bankruptcy if insolvency is caused by the corona crisis. As a consequence, until now, insolvency numbers have continued to fall instead of rising but this may change soon.

Bundesbank expects a maximum increase of 36% until Q2 2021, to a level last seen in 2013, but it leaves out the waiver effect. Including this, the surge may be delayed

somewhat, and the number of zombie firms may increase.

Rising loan losses will have a significant impact on the German banking sector.

It is already among the weakest in Europe and exhausted by many years of

zero interest rates and low structural growth. Banks were moderately profitable

post-financial crisis only thanks to loan loss provisions far below the historical

norm.

With those climbing considerably – and possibly tripling – the industry will

probably dip deeper into loss-making territory in 2020.