Deutsche Bank har i en omfattende analyse af den tyske bilindustri konkluderet, at Tyskland som det førende europæiske produktionssted for biler vil falde år for år. Tyskland vil opleve det, som Detroit oplevede: At bilindustrien svinder ind. Den udvikling er farligere for Tyskland end coronakrisen. Men det er Tyskland som produktionssted, der er problemet, ikke de tyske bilproducenter, hedder det.

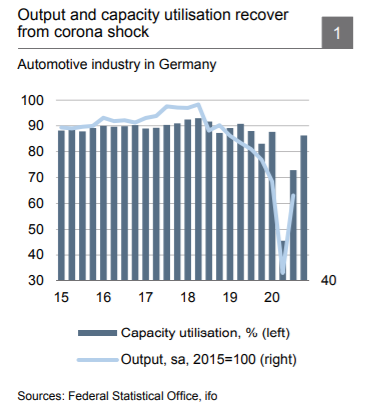

The COVID-19 pandemic has triggered unusual cyclical volatility in the German auto sector. However, structural challenges are much more relevant for the sector. They may endanger Germany’s status as a carmaking location.

Tight EU CO2 targets for new cars will force carmakers to introduce more electrical vehicles. This will lead to higher costs and exacerbate the structural change in the sector. Hardly anybody expects the structural changes to be ultimately beneficial for value added and employment in the auto sector in

Germany.

Germany.

Germany’s auto sector has recovered from the two major crises of the past 30 years (1993 and 2008/09), even though the recovery took several years in each case. However, the structural challenges raise the question of whether the sector will ever return to its former highs.

We are afraid that it may become more and more difficult to keep mass market car production competitive in Germany.

Germany’s share in both global and European car production may decline over the coming years. We may see a similar development to that in Michigan (Detroit) where car output is now much lower than at the beginning of the century.

The German car industry is better prepared for the electric mobility future and other structural challenges than Germany as a production location.