Trods OPEC-landenes beslutning om at begrænse olieproduktionen er der ifølge ABN Amro udsigt til en lidt lavere oliepris i 2020 og i 2021.

Uddrag fra ABN Amro:

Last week, the OPEC has decided, together with her partners (combined OPEC+), to increase its production cut agreement. The existing agreement to lower crude production by 1.2 million barrels per day (mb/d) was raised with another 503 kb/d to a total of 1.703 mb/d. In March 2020, the OPEC+ will re-evaluate the market situation. The biggest share of the increase will be handled by OPEC members (372 kb/d) while the rest of the production will be lowered by the non-OPEC oil producers (131 kb/d). This headline seems to be good news for oil market and oil prices. Lower production to stabilize the oil markets should lead to a balance between global supply and global demand. As a result , oil prices should be supported. However, there are two important dynamics to keep in mind.

In the first place, OPEC already produced significantly less than originally agreed. The second remarkable point is that the OPEC+ alliance was not able to officially succeed in lowering production together. This is because of the differences of opinion and the lack of unity within the organisation.

Abundant supply to remain

As described above, global supply will be 2.1 mb/d less than would be possible during the coming months. Nevertheless, this is not the complete picture. After all, crude oil production in Venezuela and Iran also dropped significantly in recent months due to the US sanctions. And although both countries are OPEC-members, these production declines are not part of the production cut agreement.

The growth inf oil production in non-OPEC related countries is larger than the net production cut agreement of the OPEC+ alliance. Especially in the US, but also in Norway, Canada, Mexico and Brazil, oil production is growing. In the US we do see a decline in the number of active drilling rigs. A part of the production growth comes from earlier drilled-but-uncompleted-wells. The International Energy Agency (IEA) expects that non-OPEC production will grow even faster in 2020 (by +2.3 mb/d) than in 2019 (+1.8 mb/d). If these forecasts materialize, the announced OPEC policy will not lead to a tightening of the global supply-and-demand balance.

Demand may fall under pressure

A larger supply of oil will not automatically have to lead to lower oil prices as long as oil demand will increase in a similar pace. However, this may not be the case. The IEA expects a net global growth of demand of 1.2 mb/d in 2020 (versus +1.0 mb/d in 2019). This scenario takes into account moderate global economic growth. This is in line with our own forecasts. Furthermore, the IEA scenario takes into account a stable increase of oil demand by China. This is where we disagree.

In 2019, Chinese oil imports has grown again by more than 10% y-o-y. Chinese oil demand for consumption will, similar to last year, grow further in 2020. The build-up and policy of Chinese strategic reserves will however cloud the horizon .

Downward adjustment oil price forecasts

The expected oversupply in the first and second quarter of 2020 will possibly be somewhat smaller than anticipated earlier. The OPEC+ policy as well as the extra action taken by Saudi Arabia to cut the production with an extra 400 kb/d will bring the market closer to a balance. Nevertheless, as we think that oil supply from non-OPEC countries will rise even stronger. As a result, total supply will remain ample. On top of that, we see that oil demand growth stays under pressure. Not only modest global economic growth but also the risk of less crude imports by China on behalf of strategic reserves, could lead to increased pressure on crude demand.

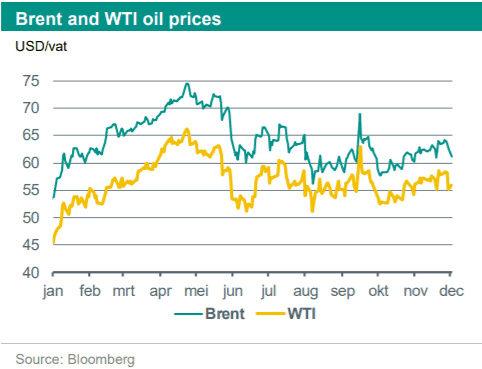

The market is neutral positioned. This means that there are no specific positions taken to benefit from either price gains of price declines. This will thus not trigger a lot of direction for oil prices. On top of that , the forward curve is rather flat. Technical analysis learns us that we are already trading within a neutral USD 50-70 bbl trading range since the start of the year. Initially, we expected oil prices to gain some support towards the upper band of this trading range. Currently we judge that downside price risks have been risen. We think that it is more likely that we will continue to trade at the lower side of the trading range. As a result, we have lowered our price forecasts for the second half of 2020 and 2021.