Uddrag fra Zerohedge:

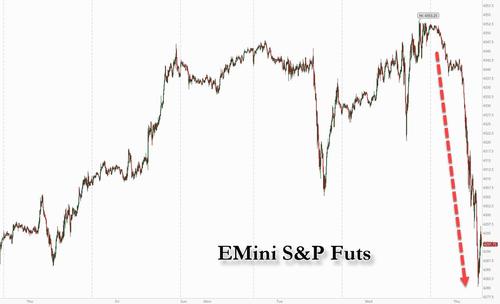

After S&P futures printed at new all time highs on 8 of the past 9 days, one can almost feel sorry for the euphoric bulls (and meme stock traders) who woke up this morning to headlines such as this:

- *S&P 500 INDEX FUTURES RETREAT 1.5%

- *NASDAQ FUTURES DROP 1.5%

- *STOXX EUROPE 600 INDEX DROPS 1.5% TO SESSION LOW

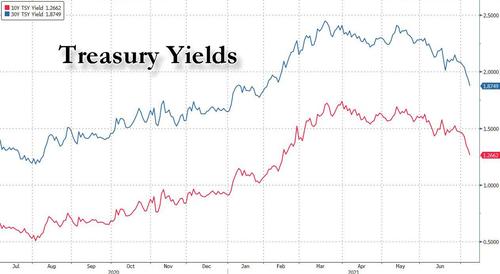

And sure enough, just one day after it appears that nothing could stop markets from exploding to recorder highs day by day by day, on Thursday morning both the reflation and growth trades were a dumpster fire, with Dow e-minis plunging 475 points, or 1.37%. S&P 500 e-minis were down 58 points, or 1.34% and Nasdaq 100 e-minis were down 190 points, or 1.3%, the VIX jumped above 20 after trading at 14 just a few days earlier and 10Y yields dropped as low as 1.25%. Bitcoin tumbled back down to $32,000.

At the same time, the collapse in yields accelerate, with 10Y yields tumbling as low as 1.25% while 30Y dropped below 1.90% for the first time since February as inflation expectations eased.

The catalyst for the rout? The same we predicted more than a month ago when we warned that the most important credit impulse in the world had collasped – China’s slowdown, now confirmed by Beijing itself which is preparing to cut RRR rates in coming weeks as proof positive even China is willing to risk much higher inflation to offset an economic slowdown. Not helping is also China’s widening crackdown on the tech sector in China coupled with doctored – pardon the pun – fears of pandemic resurgence via the delta covid variant.

“The message markets are sending is that the economic situation is not strong enough to pull back on stimulus and start the tapering process, as the Fed has signaled it will do,” said Ricardo Gil, head of asset allocation at Trea Asset Management in Madrid.

Virtually every sector was down, led by Chinese listed stocks such as e-commerce giant Alibaba Group dropping 2.6%, while internet search engine Baidu shed 3.8%. Didi Global, whose app takedown by the Chinese government had sparked a recent selloff, fell 6.5%, while FAANG gigacaps dropped between 0.9% to 1.7% despite the continued drop in yields as traders now use their FAANG gains to offset margin calls elsewhere. Meme stocks were hit especially hard as all upward momentum was crashed.Here are some of the biggest U.S. movers today:

- Cryptocurrency-exposed stocks like Riot Blockchain (RIOT) and Marathon Digital (MARA) fall 7% and 6.2% respectively in premarket trading with Bitcoin sinking back below $33,000 per token.

- Dare Bioscience (DARE) advances 12% in premarket trading after it announced Wednesday it had been awarded with a Gates Foundation grant of up to $48.95m.

- Didi (DIDI) shares fall 6% in premarket trading, extending the losses suffered by the ride- hailing giant since its U.S. IPO. Other Asian stocks listed in New York also drop following a day of declines for tech companies in Hong Kong.

- Retail-trader favorites mostly decline in U.S. premarket trading, with AMC Entertainment (AMC) dropping 7.7%, ContextLogic (WISH) sliding 5.3% and cannabis firm Sundial Growers (SNDL) falling 7%.

- SeaSpine Holdings (SPNE) jumps 15% as Piper Sandler sees “great things” going forward after the medical-technology company announced Wednesday it has received FDA clearance for its 7D percutaneous spine module for minimally invasive surgery.

- Tessco Technologies (TESS) shares soar 39% in premarket trading after the company said Wednesday evening it expects 2022 1Q total revenue of $105m, 9% higher than a year earlier.

The selloff was global, with the MSCI’s index of global stocks down 0.5%, extending early session losses and tracking a 1.7% decline in the equivalent index of Asia shares outside Japan to its lowest level since mid-May.

“We believe valuations to be frothy not just in India but in different geographies across the world,” Nikhil Kamath, Co-Founder and CIO at asset manager True Beacon, said. “We are hedged as much as 55% today, our net exposure to the market is only about 45%.”

In tandem with Beijing’s tech crackdown, guidance toward rate cuts from Chinese policymakers has also spooked some investors by highlighting softness in China’s economy – weak loan growth and slow demand – which threatens the pace of the global recovery. As reported yesterday, the Chinese cabinet said on Wednesday that policymakers will use timely cuts in the bank reserve requirement ratio (RRR) to support the real economy, especially small firms. The yield on 10-year Chinese sovereign debt posted its sharpest fall in nearly a year on Thursday, dropping to 2.998%, the lowest since August.

“Worries about variant strains have hurt investor confidence that the pandemic’s effects on the global economy are truly past us,” Nicholas Colasand Jessica Rabe of DataTrek Research wrote in a note. “Our working theory is that we’re in the middle of a modest global growth scare.”

European stocks tumbled, with the Stoxx 600 dropping 1.8%, led by the Stoxx Europe 600 Basic Resources Index which dropped as much as 2.8%, as broad risk-off mood prevails following the Fed Minutes. Metals fell on a stronger dollar, while China signaled more efforts to help firms deal with soaring commodities prices. Here are some of the biggest European movers today:

- Knorr-Bremse shares climb as much as 10%, the most of record, after the company dropped its pursuit of a stake in Hella.

- Betsson rises as much as 10% in the steepest intraday gain since October last year, making the stock the second-best performer in Stockholm’s all-share index on Thursday.

- Danske Bank gains as much as 4.7% after the company raised its full-year profit outlook as Scandinavian countries emerge from Covid lockdowns with their economies in better shape than initially feared.

- Deliveroo rises as much as 5.4% after the food delivery company increased its transaction growth forecast for the year. JPMorgan sees “small upgrades” to consensus estimates.

- TeamViewer slumps as much as 14%, the most in more than 2 months, after the company reported what Morgan Stanley called a “softer-than- expected” 2Q, with trends that underscored 1Q’s weaker performance being intensified.

- Chr Hansen falls as much as 7.5%, the most since January 2020, after net profit and organic growth missed estimates.

- Carrefour drops as much as 4.2% after Bernstein called the French grocer a “dying behemoth” and rated the shares underperform as it initiates coverage of the sector.

- Oncopeptides falls as much as 22%,the most since December 2018, following an updated study for its melflufen drug. While the trial now meets a previously missed primary endpoint, a higher risk of death is concerning, Jefferies said.

- Electrocomponents falls as much as 4%, despite what analysts said was a robust trading update, with Shore Capital saying higher costs will push margins lower.

Asian equities dropped amid continued losses in Hong Kong-listed Chinese tech stocks and concern over rising coronavirus cases in various countries. Tencent and Alibaba were once again the biggest drags on the MSCI Asia Pacific Index, which headed for its seventh loss in eight sessions. Hong Kong led declines around the region, with the Hang Seng Index falling 3% on its way to eight straight losses and its longest losing streak since 2015. Stocks in China also fell amid the broad regional selloff. China’s State Council signaled the central bank could make more liquidity available for banks to boost lending to businesses, including by cutting the reserve requirement ratio. The country’s rising private-sector debt amid credit expansion coupled with accelerating inflation “may conspire to decelerate economic growth,” CICC analysts wrote in a note. Tech Stocks Drag Key China Index in Hong Kong Toward Bear Market Japanese stocks slid as the government planned to declare a new state of emergency in Tokyo, and as some stock positions were expected to be liquidated to pay dividends on exchange-traded funds. South Korean stocks fell as daily virus cases hit a new high and Thai stocks dropped as the government is mulling a partial lockdown. Malaysia’s benchmark was on track to enter a correction as the biggest party in the ruling coalition withdrew from the government. Stocks extended losses as the country’s central bank kept interest rates on hold

Indian stocks declined in line with Asian peers as concerns over the spread of Covid-19 variants hurting economic recovery and business activities sapped risk sentiment. The S&P BSE Sensex fell by 1% to 52,531.62 as of 3:09 p.m. in Mumbai after surging to a fresh record on Wednesday. The NSE Nifty 50 Index also plunges by a similar magnitude. All but one of the 19 sector sub-indexes compiled by BSE Ltd. fell, led by a gauge of metal companies. Tata Steel was the worst performer on the Sensex, falling 2.8%, followed by 2.6% decline in Bajaj Auto. Of the 30 stocks in benchmark Sensex, 28 traded lower. ICICI Bank and HDFC Bank contributed the most to the index’s decline. Tata Consultancy, which will kickoff corporate earnings season for June quarter later Thursday, also traded lower, easing 0.5%. “The earnings season would provide some direction to the market and offer cues about the economic revival,” Siddhartha Khemka, head of retail research at Motilal Oswal Financial Services, wrote in a note. “Consistent earnings delivery versus expectations are critical for further outperformance in our view.”

In rates, global bonds rallied, with the U.S. 10-year yield down around 7 basis points and the German 10-year yield down 3 basis points, extending price moves seen earlier in the week and leading to a “serious debate” about their cause, said Deutsche Bank analyst Jim Reid. Treasury yields were lower by nearly 8bps across long-end of the curve, flattening 2s10s by ~5bp, 5s30s by ~3bp; 10-year yields drop as low as 1.248%, below 200-DMA for the first time since November, while 30-year yields reach 1.855%; 2s10s spread touched 104.4bp, flattest since Feb. 12.

Some consider the move a sign the market is re-pricing the potential for the economy to be hit by secular stagnation after the pandemic, while others point to technical drivers including reduced supply from the Fed and higher demand to buy.

Mark Haefele, Chief Investment Officer, UBS Global Wealth Management, said despite the dip in U.S. yields, the Swiss adviser to many of the world’s super-rich expected the benchmark to bounce back. “With the expectation of a taper announcement from the Fed over the next few months, robust economic growth driving continued strength of nonfarm payrolls, and further [post-pandemic economic] reopening, we expect the 10-year yield to reach 2% by the end of the year.”

In currency markets, the Bloomberg Dollar Spot Index hovered near a three-month high and the dollar traded mixed versus its Group-of-10 peers and Treasuries rallied as soon as London trading got underway. A wave of long-end buying appeared after a calm Asia session, with a spike of activity in long bond futures driving the move. Haven currencies the yen and the Swiss franc led an advance while commodity currencies were the worst performers; the euro inched higher to trade above $1.18 as it recovered after touching a three-month low Wednesday and European bonds rallied, yet underperformed Treasuries.

The pound fell, trading near the middle of the G-10 pack, with analysts focused on the nature of Britain’s economic recovery amid few short-term U.K.-specific catalysts; British travelers who have received both doses of a coronavirus vaccine will no longer need to isolate when they return home from moderate-risk countries, under a plan officials expect to come into force this month. The Australian dollar hit a new low for the year after RBA Governor Philip Lowe highlighted the importance of achieving full employment for driving inflation. The yen advanced to the strongest in over two weeks with investors liquidating stale long dollar positions through technical support and amid losses in key Asian stock indexes; Japanese bond futures rose to an 11-month high as U.S. Treasury yields fell.

Cryptocurrencies were sold on yet another round of negative comments from Chinese policymakers and bitcoin fell to a more than one-week low.

Oil was under pressure as investors awaited further signals from the OPEC+ alliance on production plans after a breakdown in talks. Brent futures were last down 1.1% at $72.65 a barrel while U.S. crude fell 1.3%. Iron ore futures dropped after China signaled more efforts to help firms deal with soaring commodities prices and the nation pushed ahead with its pledge to clean up the emissions-heavy steel industry.

Looking at the day ahead now, and the main highlight will be the release of the ECB’s strategy review and President Lagarde’s press conference. Otherwise, there’s also the release of the ECB’s minutes from their June meeting, whilst the ECB’s Hernandez de Cos is speaking as well. On the data side, releases include the German trade balance for May and the weekly initial jobless claims from the US.