Tom Keene was out with a chart today referencing Zerohedge’s point that a large percentage of the non-farm payroll growth has been a result of lower paying industries, such as food and drinking places – or as they would put it, more bartenders.

While a job is a job, the composition and strength of gains is quite important, as it gives us an understanding of aggregate health.

If total growth is strong, but is the result of only a few sectors, the breadth of the overall market is weak. This typically provides us with a signal on where the overall market is heading – and this goes both ways.

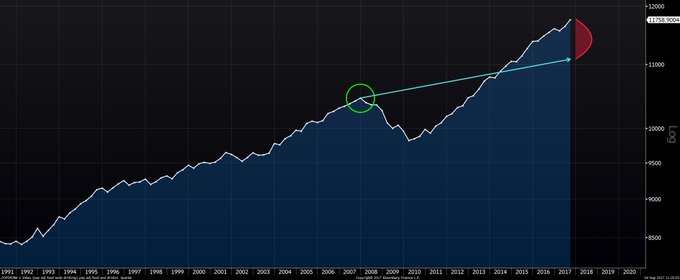

This brings me to an indicator that I built out over the past year – labor market breadth – which seeks to measure the aggregate health of the labor market by looking at its sub-components. While I don’t break out how it’s calculated, I will say it is comparable to the breadth of the stock market.

Following Friday’s employment report of 209k new jobs, beating estimates of 183k, labor market breadth fell to an un-smoothed cycle low, as shown below. So while the headline number was strong, it’s aggregate sub-components continue to slow, which is not indicative of strength.

We can see this by sharp decreases in total job growth of retail trade, which many will attribute to the rise of Amazon.

And information, which is not affected by the retail giant.

As well as arts, entertainment, and recreation.

And health care, which has slowed materially over the past four months.

There is some strength however in wholesale trade.

And durable goods

But this today was offset by weakness in a previously strong industry – real estate.

And a slowing financial sector.

In total, the current breadth of the labor market is indicating that wages and salaries will move lower over the next 6 months, as shown below.

We’ll see if this manifests or not.