UniCredit analyserer de europæiske virksomheders gæld og konkluderer, at den stærke stigning i bruttogælden i virkeligheden over vurderer virksomheders sårbarhed. Men det er dette tal, der ofte indgår i beregninger. Nettogælden er derimod lavere end i flere år. Under coronakrisen har virksomheder øget deres gæld voldsomt for at have et rygstød, men det er altså ikke en reel stigning i deres gældsbyrde, mener UniCredit. Derfor er de europæiske virksomheder reelt mere solide, end mange analyser indikerer.

Spike in indebtedness overstates the vulnerability of eurozone firms

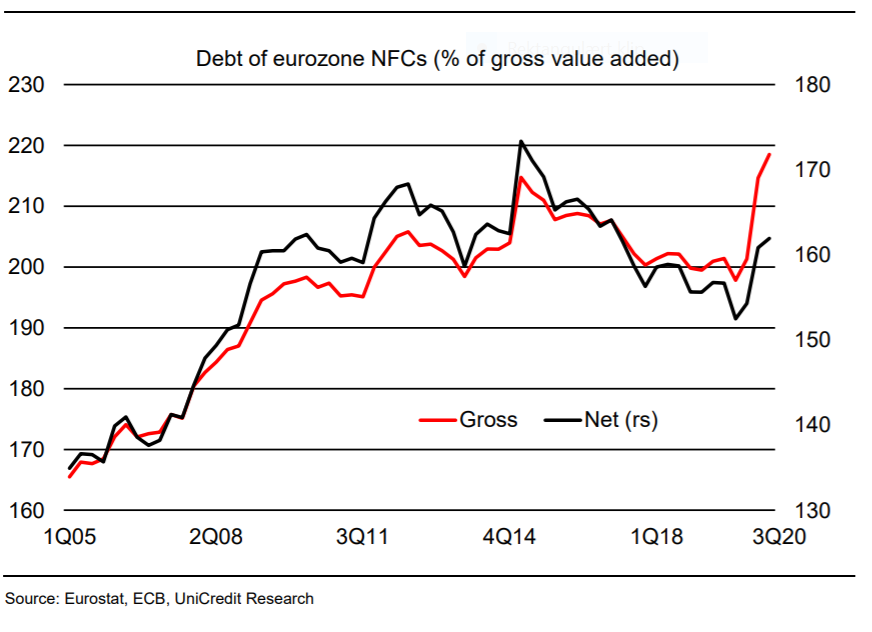

■ Our Chart of the Week shows the evolution of two measures of indebtedness of eurozone non-financial corporations (NFCs). Gross debt includes loans and debt securities, while net debt subtracts from gross debt the liquid assets held by firms, namely currency and deposits.

■ The pandemic has pushed up both gauges. However, gross debt (as a share of gross value added) has increased significantly more and currently stands at its highest level on record, while net debt remains comfortably within the range prevailing since the credit crisis of 2008-09, and clearly below the peak reached in the aftermath of the sovereign-debt crisis.

■ Gross debt tends to be used more frequently in economic analysis, but we argue that at this juncture, net debt provides a more informative picture.

As a matter of fact, the increase in net indebtedness since the outbreak of COVID-19 has been totally driven by a denominator effect (i.e. the contraction in gross value added), while the numerator – the level of net debt – has hardly changed. The reason is that eurozone firms have boosted their

borrowing during the pandemic mainly to increase their liquidity buffers for precautionary motives amid the lack of visibility.

borrowing during the pandemic mainly to increase their liquidity buffers for precautionary motives amid the lack of visibility.

Therefore, the spike in gross debt overstates the vulnerability of eurozone firms to increased

leverage.

■ As a note of caution, one should consider that our chart provides an aggregate picture, while the pandemic has created unprecedented divergence among sectors. Those businesses most hit by COVID-19 (such as tourism and transport) are likely to have suffered a much more significant deterioration in their financial position than is suggested by our chart.

leverage.

■ As a note of caution, one should consider that our chart provides an aggregate picture, while the pandemic has created unprecedented divergence among sectors. Those businesses most hit by COVID-19 (such as tourism and transport) are likely to have suffered a much more significant deterioration in their financial position than is suggested by our chart.