Den italienske bank UniCredit har analyseret forskellen på vækstraterne i USA og eurozonen under coronakrisen og konstaterer, at forskellen ligger i ganske få brancher, nemlig handel, rejser og services samt high tech. Det skyldes, at USA ikke har haft nær så megen lockdown som Europa. Den stærkere lockdown i Europa har ikke ført til væsentligt færre coronatilfælde, men den har bremset økonomien markant i forhold til den amerikanske linje. Amerikanerne har haft en mere normal tilværelse end europæerne.

US-euro area growth divergence due to a small number of industries

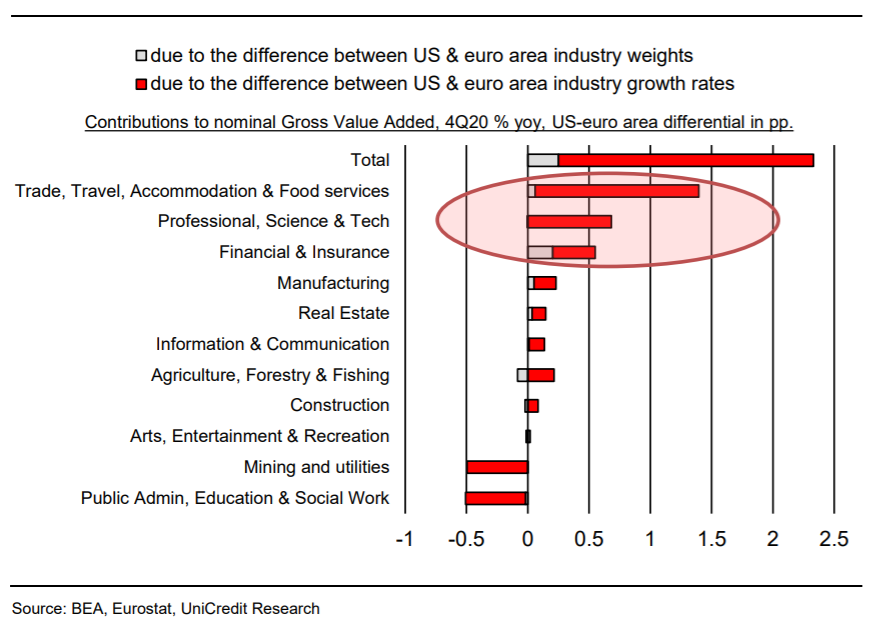

Our Chart of the Week shows that the outperformance of the US economy compared to that of the euro area during the pandemic is accounted for by a relatively small number of industries, namely “trade, travel accommodation and food services”, “professional, science and tech” services, and “financial and insurance” services.

Together these industries explain 2.6pp of the nominal GDP growth differential between the US and the euro area, more than accounting for the overall US-euro area nominal GDP growth differential of 2.3pp between 4Q19 to 4Q20.

■ The US-euro area growth differential can be broken down into a component that is due to the differences in industry weights (for example, “financial and insurance” accounted for 4.4.% of euro area output pre-pandemic, less than the 7.8% for the US), and a component that is due to differences in industry growth rates (for example, “financial and insurance” output fell 1.7% yoy in 4Q20 in the euro area, whereas in the US it expanded 6.1% yoy in 4Q20).

We calculate that the differences in industry weights account for only 0.2pp of the total US-euro area nominal growth differential of 2.3pp, while differences in industry growth rates explain the remaining 2.1pp.

■ It seems likely that the less sweeping and less stringent lockdowns in the US compared to in the euro area, along with voluntary social distancing, largely explains the US outperformance of “trade, travel, accommodation and food services”, which has been one of the industries most exposed to the effects of the pandemic and, in particular, social distancing. The stronger direct fiscal response in the US compared to the euro area last year is also likely part of the explanation.

■ The US-euro area growth differential is likely to widen in 1Q21. Many US states have eased restrictions while several euro area member states have extended and tightened restrictions. The COVID-19 vaccination program has been progressing rapidly in the US but more slowly in the euro area. And additional support from fiscal policy in the US far exceeds that in the euro area.