Den månedlige rapport fra den amerikanske centralbanks sidste møde i juli viser, at centralbanken mener, der er behov for mere regeringsstøtte, hvis man skal undgå en længerevarende og dybere nedtur efter den forværrede coronakrise. Men centralbanken sagde dog intet om, hvornår en ny støtteaktion bør finde sted og i hvilken form. Centralbanken frygter en ny bølge af konkurser, og at ledigheden vil falde mindre end ventet.

Uddrag fra Fidelity/Dow Jones:

Fed Resumed Deliberations Over Policy-Setting Revamp

Federal Reserve officials said at their meeting last month they expected the economy would require greater government support to recover from the coronavirus pandemic, though they didn’t signal at which of their coming meetings they would deploy those tools.

Minutes from the Fed’s July 28-29 meeting released Wednesday showed officials believed more government spending would be needed to prevent a longer or deeper downturn amid difficulties states have faced suppressing the virus.

A number of officials also believed more stimulus from the Fed could be required, the minutes said. With interest rates already cut to near zero, Fed officials could do this by providing more specifics about how long they will keep rates low — including by describing an inflation threshold and various labor market conditions that would warrant withdrawing any stimulus.

The minutes didn’t offer strong signals about the timing of such a move, saying only that a number of officials believe more explicit guidance would be “appropriate at some point.” That suggests central bank officials are keeping their options open as they look to forge agreement on how and when to sequence their next moves.

The Fed’s next meeting is scheduled for Sept. 15-16, and officials meet again in early November.

Officials didn’t announce new policy steps at the conclusion of their July meeting. The Fed responded aggressively to the pandemic shock in March and April, expanding its asset holdings by nearly $3 trillion to $7 trillion after slashing rates to near zero. It has launched an array of emergency lending programs to backstop markets, from corporate debt to short-term municipal bonds.

Officials have worried that difficulties containing the virus will lead to increased levels of business bankruptcy and a slower decline in joblessness.

With interest rates already at low levels, some presidents of regional Fed banks have indicated it would make more sense for the central bank to provide additional support once virus infections have declined to a point that allows more commercial activity to resume.

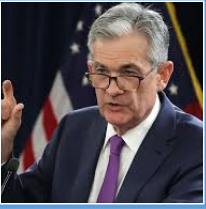

Fed Chairman Jerome Powell indicated at a news conference last month he preferred to maintain as much flexibility as possible about the central bank’s next moves. “I can’t give you a specific trigger,” he said. “It really just is when we think it would help.”

“They want to be a little bit tactical about these big announcements,” said James Sweeney, chief economist at Credit Suisse.

The minutes showed Fed officials moved closer last month toward formalizing changes to their long-term policy- setting framework designed to boost growth in times when interest rates can’t be lowered because they are already near zero.

Officials are preparing to wrap up a yearlong review by adopting an approach of making up for periods of low inflation by seeking subsequent periods of somewhat higher inflation. The practical effect is it will be a long time before they raise interest rates.

The primary vehicle for the Fed to formalize these changes would be to amend a statement of longer-run goals and policy strategy, which was first adopted in 2012 when the central bank established a 2% inflation goal. Inflation has generally run below the target, which has led officials to grow more concerned with periods of too little inflation.

The minutes indicated officials could complete their review by approving changes to the statement as soon as their next meeting. Next week’s central bank symposium, traditionally hosted in Jackson Hole, Wyo., by the Kansas City Fed and conducted virtually this year, could be a natural forum for Mr. Powell to preview those conclusions in more detail.

Those conclusions would inform how the central bank designs additional support this year, which could then be unveiled at the September or November meeting.