Uddrag fra

Having slowed for two straight months, whisper numbers predicted a slightly hotter than expected September CPI (edging up to 5.4% YoY, slightly above the consensus of 5.3%) on the back of a re-intensification of supply-chain bottlenecks due to a combination of natural disasters and COVID disruptions in the US and Asia kept pressure on manufactured goods in September.

Headline CPI did indeed come hotter than expected (+0.4% MoM vs +0.3% exp) with the YoY spike edging back up to +5.4%…

That is equal to its highest since July 2008.

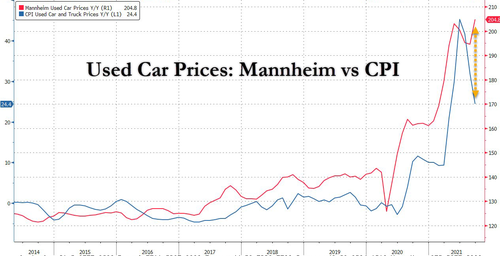

Fuel Oil and Gas Utility prices dominated the MoM gains with Used Car prices actually dropping modestly (which is odd given that Manheim used car prices are at record highs)…

Dear Bureau of Labor Statistics, explain this!!

Let us guess – hedonics? Or we would need a PhD to really understand?

Core CPI’s recent slowing picked up in September with a 0.2% MoM jump (vs +0.1% exp) leaving YoY flat around +4.0%.

Source: Bloomberg

Housing inflation is really ramping up with the shelter index increased over the month, rising 0.4 percent. The index for rent rose 0.5 percent in September, while the index for owners’ equivalent rent rose 0.4 percent over the month.

- Shelter inflation jumped 3.14% Y/Y vs 2.84% in August, highest since Feb 2020

- Rent inflation was up to 2.43% from 2.12% in August, highest since Nov 2020

Finally, we note that the index for airline fares continued to fall sharply, decreasing 6.4 percent over the month after falling 9.1 percent in August. The apparel index also decreased in September, declining 1.1 percent over the month after rising 0.4 percent in the previous month. The index for used cars and trucks fell 0.7 percent this month, continuing to decline after it decreased 1.5 percent in August.