Uddrag fra Zerohedge:

The July employment report was solid all around:

- Nonfarm payrolls growth came in at 943k, beating market expectations and there was a +119k 2-month net revision, adding further to the total (however on a seasonally unadjusted basis, payrolls actually declined by 133K for those who care about such details).

- The unemployment rate dropped 50bps to 5.4% from 5.9%,the lowest figure seen since the pandemic.

- Average hourly earnings grew by another strong 0.4% mom (4.0% yoy) with broad based wage growth across most sectors.

- The labor force participation rate ticked up to 61.7% from 61.6% and the average duration of unemployment dropped to 29.5 weeks from 31.6 weeks which taken together suggests more workers are returning to the labor force and finding jobs more quickly.

Overall, the report was a solid read on the labor market that is making further progress toward full recovery and in fact there are now more job openings than there are unemployed workers. While there is still more work to be done to bringing people back in the workforce, Bank of America continues to see progress being made which helps to facilitate strong job growth which according to the bank “should set the Fed up very nicely for taper announcement later this year” (for selected reactions from Wall Street economists click here).

Also, public schools saw outsized employment gains in July. State and local education payrolls increased by 230k as school districts retained more teachers and staff over the summer to meet the strong summer school enrollment across the country. The strong hiring seen over the summer suggests that there may be less demand in the fall, limiting the upside risk in employment activity in this sector. Private education added another 40,000 teachers.

This means that almost two-thirds of all job gains (650K) came from bartenders/waiters and from teachers; and with the recent surge, it means that the shortfall to pre-covid levels in the hard- hit leisure and hospitality sector has narrowed to 10%.

To be sure, there is a favorable way to spin this surge in low-wage jobs: as Bloomberg notes, “low-wage leisure and hospitality positions, along with food services, once again made a big contribution to monthly payrolls gains. Increases in those sorts of jobs seem unlikely to trigger out-of-control inflation or to force a faster-than-expected taper from the Fed.”

That said, not everyone was euphoric, and as BBG Intelligence economist Carl Ricadonna said, the jobs report is “sturdy, but not as strong as it looks.” In addition to the modest fade in the pace of private-sector hiring (703,000 in July vs. 769,000 in June), much of the July gain occurred in the tenuous leisure and hospitality sector — and that could easily reverse due to Covid-19. This already appears to be evident in deteriorating metrics such as OpenTable bookings. “So if we look at private-sector hiring outside of leisure and hospitality, today’s reported gain was 323,000, a bit slower than the prior month’s 375,000. This tells us that underlying economic momentum is steady-state, not accelerating.”

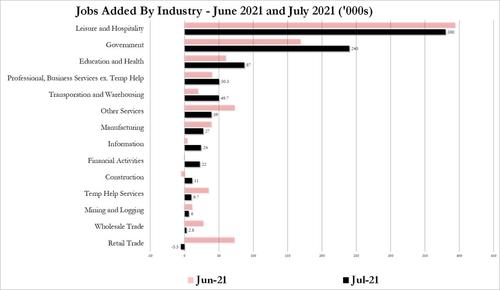

A full breakdown of the various sectors is below:

- Employment in leisure and hospitality increased by 380,000. Two-thirds of the job gain was in food services and drinking places (+253,000). Employment also continued to increase in accommodation (+74,000) and in arts, entertainment, and recreation (+53,000).

- Employment in local government education rose by 221,000 by 40,000 in private education. Staffing fluctuations in education due to the pandemic have distorted the normal seasonal buildup and layoff patterns, likely contributing to the job gains in July.

- Employment in professional and business services rose by 60,000 in July. Within the industry, employment in the professional and technical services component rose by 43,000 over the month and is 121,000 above its February 2020 level. By contrast, employment in the administrative and waste services component (which includes temporary help services) changed little over the month (+20,000) and is 577,000 lower than in February 2020.

- Transportation and warehousing added 50,000 jobs in July. Job growth occurred in transit and ground passenger transportation (+19,000), warehousing and storage (+11,000), and couriers and messengers (+8,000). Employment in transportation and warehousing has grown by 534,000 since April 2020; the industry has recovered 92.9 percent of the jobs lost during the February-April 2020 recession (-575,000).

- The other services industry added 39,000 jobs in July, with gains in membership associations and organizations (+17,000) and in personal and laundry services (+15,000).

- Health care added 37,000 jobs in July. Job gains in ambulatory health care services (+32,000) and hospitals (+18,000) more than offset a loss of 13,000 jobs in nursing and residential care facilities.

- Employment in manufacturing increased by 27,000 in July, largely in durable goods manufacturing. Within durable goods, job gains occurred in machinery (+7,000) and miscellaneous durable goods manufacturing (+6,000).

- Employment in information increased by 24,000 over the month, with three-quarters of the gain in motion picture and sound recording industries (+18,000).

- Employment in financial activities rose by 22,000 over the month, largely in real estate and rental and leasing (+18,000).

- Employment in mining increased by 7,000 in July, reflecting a gain in support activities for mining (+6,000).

- Employment in retail trade changed little in July (-6,000), following large increases in the prior 2 months. In July, job gains in gasoline stations (+14,000), miscellaneous store retailers (+7,000), and nonstore retailers (+5,000) were more than offset by a loss in building material and garden supply stores (-34,000).

And visually: