Uddrag fra Zerohedge: // ØU: Boligomkostningerne var med til at trække de seneste CPI-forbrugerpriser op, og prisfald på boligudgifter vil tage det opadgående prispres herfra ud af ligningen.

There was a remarkable moment during today’s Jay Powell post-FOMC presser, which revealed once again just how out of touch the Fed is when it comes to correctly evaluating the broader economy. Asked about the ongoing devastation in the housing market in general, and rent inflation in particular, Powell’s response was the following:

- *POWELL: POINT AT WHICH RENT INFLATION SLOWS IS STILL FAR AWAY

- *POWELL: AT SOME POINT YOU’LL SEE RENTS COMING DOW

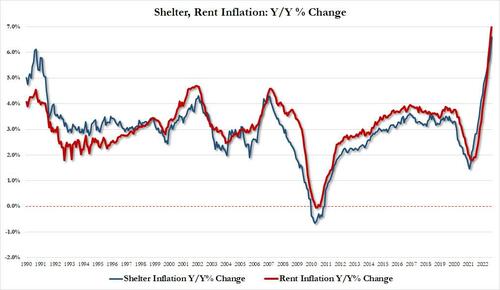

Here, Powell is doing two things; i) he is referring to the latest shelter/OER (owner equivalent rent) inflation data as reported by the CPI and which is indeed soaring…

… and ii) is dead wrong by making the exact same mistake that so many economists made last year when they did not realize just how high rent inflation will soar as it tracks real-time rental metrics, something we first explained last summer in “”What Rental Hyperinflation Looks Like: “Soaring Prices. Competition. Desperation“, when we showed – without a shadow of a doubt – why inflation was not transitory (we now know that was the correct interpretation).

The bottom line, as we explained in “With Krugman Humiliated, This Is What Goldman Thinks True Rent Inflation Is“, is that while the heavily-delayed CPI data is showing runaway inflation, what it is really showing is the state of the rental market 6-9 months ago.

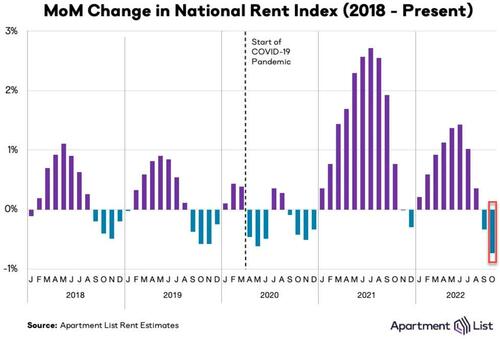

What about the actual state of rents? For the answer we go to the latest monthly report from Apartment List which we have used consistently since early 2021, and where we find something stunning: rents just tumbled by the most on record!

As the AL blog writes in its latest monthly note, “the national index fell by 0.7 percent over the course of October, marking the second straight month-over-month decline, and the largest single month dip in the history of our index, going back to 2017.”

More details:

These past two months have marked a rapid cooldown in the market, but the timing of that cooldown is consistent with a seasonal trend that was typical in pre-pandemic years. Going forward it is likely that rents will continue falling in the coming months as we enter the winter slow season for the rental market.

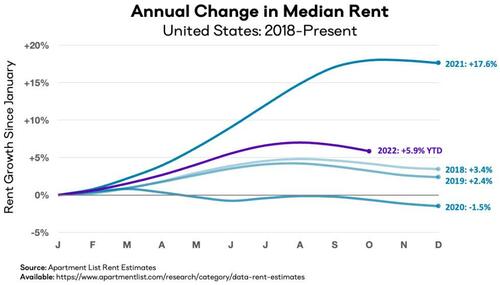

Despite the monthly decline, rent growth over the course of this year continues to outpace the pre-pandemic trend, even as it has slowed significantly from last year’s peaks. So far in 2022 rents are up by a total of 5.9 percent, compared to a record 18 percent at this point in 2021. Year-over-year growth has decelerated rapidly since the start of the year, but it’s still likely that 2022 will end up being the second fastest year of rent growth since the start of our estimates.

The cooldown in rent growth is being mirrored by continued easing on the supply side of the market. Our vacancy index now stands at 5.5 percent, after a full year of gradual increases from a low of 4.1 percent last fall. In the past two months, this easing of the vacancy rate has picked up steam again, after plateauing a bit over the summer. That said, today’s vacancy rate remains below the pre-pandemic norm.

The recent slowdown has been geographically widespread. Rents decreased this month in 89 of the nation’s 100 largest cities in October. Boise, ID – one of the first rental markets to explode in the early phases of the pandemic – saw the sharpest rent decline among the nation’s 100 largest cities this month (-3.5 percent). At the metro level, we are continuing to see an ongoing cooldown in many of the recently booming Sun Belt markets. Las Vegas, Phoenix, Jacksonville, and Riverside have all seen rent growth of more than 30 percent since March 2020, but none of these metros has seen rents increase by more than 2 percent over the past twelve months.

Summarizing the above, Apartment List writes that “the national median rent increased by a record-setting 17.6 percent over the course of 2021. This rapid growth in rent prices is a key contributor to overall inflation, which is currently rising at its fastest pace in 40 years.” Furthermore, now that virtually all economists – not just this website – refer to the Apartment list index, the consultance writes that “with inflation top-of-mind for policymakers and everyday Americans alike, Apartment List rent index is particularly relevant, since movements in market rents lead movements in average rents paid. As a result, our index can signal what is likely ahead for the housing component of the official inflation estimates produced by the Bureau of Labor Statistics.”

Thankfully, the Apartment List authords write, for the country’s renters, the national rent index has shown month-over-month growth decelerating quickly in recent months. “In fact, for the past two months, our index has actually been declining.”

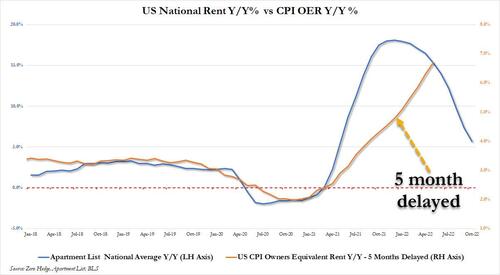

What does this mean for the CPI’s OER and, eventually, the Fed which continues to just watch this badly lagging index while ignoring real-time indicators? Here is the answer:

Translation: we are not only two months away from rents not only sliding a record-tying 4 months in a row, but we are also two months away from rent inflation turning flat (or negative) on the year. And the paradox: in two months is precisely when the (6-9 month delayed) OER inflation will peak and the Fed will be hiking with gusto and signaling that the market the terminal rate is 5% or more. This will happen just as the economy goes into freefall. A few months (or weeks) later the Fed will finally be scrambling to undo the biggest mistake it has ever done by pushing the US economy into a quasi-depression. Unfortunately, that particular U-turn won’t have a happy ending.