Uddrag fra Zerohedge:

After two weeks of relatively quiet flows, last week saw a massive $64BN inflow into money-market funds – the biggest inflows since the SVB crisis – to a new record high…

Source: Bloomberg

Both retail and institutional funds saw massive inflows last week…

Source: Bloomberg

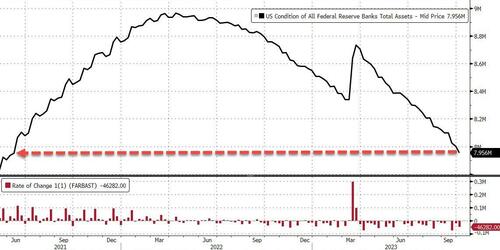

The Fed’s balance sheet continued to contract, down $46BN last week to its lowest since June 2021…

Source: Bloomberg

But banks’ usage of The Fed’s emergency funding facility remains at its record high around $108BN…

Source: Bloomberg

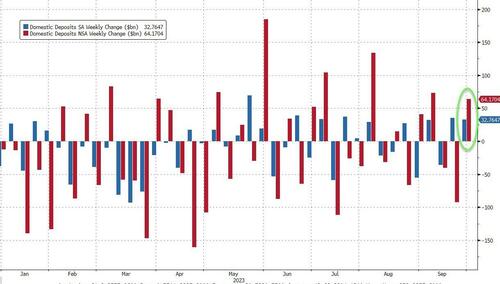

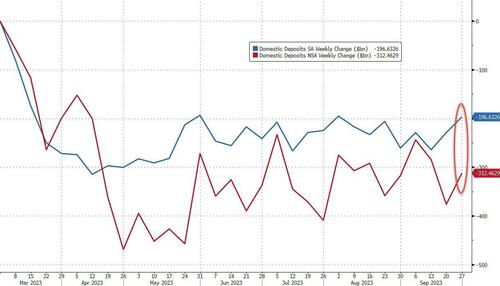

So with banks balance sheets being plugged – and after last week’s crazy divergence between SA and NSA deposit flows – we wait with baited breath for what The Fed has in store for us this week…

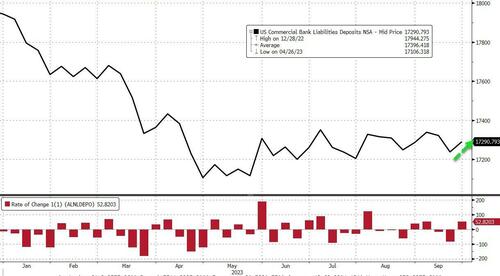

On a seasonally-adjusted basis, total deposits jumped $40BN last week (following the prior week’s $48BN SA inflow), back to its highest since the SVB crisis…

Source: Bloomberg

For once, non-seasonally-adjusted deposits went in the same direction, with a $52BN inflow – after last week’s $85BN outflow…

Source: Bloomberg

And removing foreign bank flows, domestic banks saw inflows on both an SA and NSA basis…

Source: Bloomberg

The gap between SA and NSA deposit outflows since SVB remain high (around $116BN)…

Source: Bloomberg

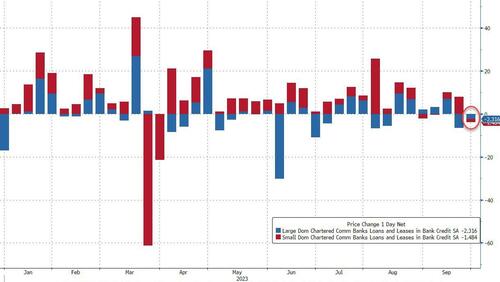

On the other side of the ledger, despite the big deposit inflows, both large and small banks saw loan volumes decline…

Source: Bloomberg

The key warning sign continues to trend lower (Small Banks’ reserve constraint), supported above the critical level by The Fed’s emergency funds (for now)…

After an ugly week (for bonds), following an ugly month and even uglier quarter…

…we sure hope these banks are making plans to fill the $108BN hole in their balance sheets they are filling with expensive Fed loans.