Uddrag fra Bank of America/ZH

Courtesy of BofA, here are some key quotes from reporting companies:

- Fastenal (Industrials) – “The tone of business activity from regional leadership is best characterized as steady at weak levels. We are encouraged by the forward-looking PMI moving above 50 in March for the first time since October 2022. However, current conditions remain better defined by the string of sub-50 readings that prevailed in the latter part of ’23 and at the start of 2024.”

- Delta Air Lines (Industrials) – “Demand continues to be strong and we see a record spring and summer travel season with our 11 highest sales days in our history all occurring this calendar year.” “90% of companies in our recent survey intend to maintain or increase travel volumes in 2Q, putting us back on track to deliver record corporate revenues in the back half of this year.”

- Paychex (Industrials) – “The macroeconomic and labor market remains challenging for small and mid-sized businesses […] Our small business employment watch continues to show moderation in both job growth and wage inflation.”

- Lamb Weston (Staples) – “Restaurant traffic trends in the U.S. have been generally flat to slightly down during the past six to nine months.”

- JPMorgan Chase (Financials) – “While cash buffers have largely normalized, balances are still above pre-pandemic levels and wages are keeping pace with inflation.”

FWIW, the JPM trading desk, admits that even soggy earnings will not change its stubbornly bull case (unlike the uber bearish case of Marko Kolanovic). As a reason why they state that “with the economy growing in or above trends, the health of US consumer and corporate margins should continue to support corporate earnings. That said, while near-term pushback from management team may be a headwind for stocks, robust growth trend still remain in place and supports the bull case.”

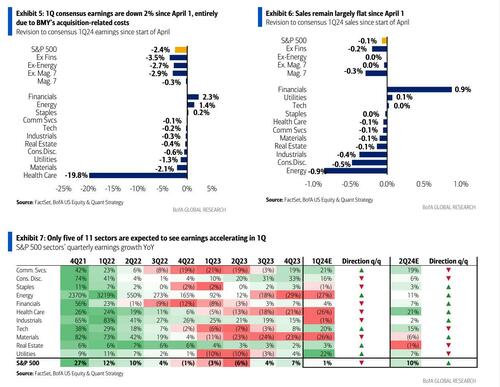

Taking a step back to look at the big picture, we see a slightly gloomier perspective: according to FactSet, Q1 earnings are expected to grow 3.6% YoY – revised down from 5.8% as of December 31 – which indicates a 2.5% decline in EPS estimates during the quarter. According to JPM, this represents a smaller cut than average to the EPS estimates: in the past 10 years, the average decline in the bottom-up EPS has been 3.4%. The smaller decline indicates more confidence in analysts on the broad economic growth and fewer concerns over recession risks.

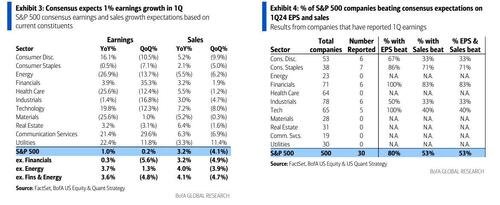

Next, BofA chimes in that with 30 S&P500 companies (or 10% of index earnings), reporting so far, the reported EPS beat is 6%, driven by Financials (+0.7% ex. Fins) and 80% beat on EPS vs. 67% post-Week 1 average. But, as noted above, Q1 consensus EPS is down 2% since April 1. As shown below, consensus now expects just 1% EPS growth (vs +8% YoY in 4Q) despite easier comps (BofA, which is also very bullish, expects a 4% beat vs consensus as of April 1, or +7% YoY).

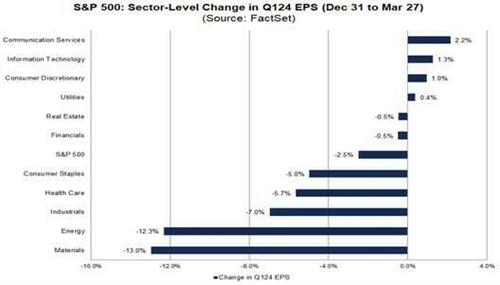

Looking at the sector level, data from FactSet suggests that the majority of the decline was driven by Materials (-13.0%), Energy (-12.3%), Industrials (-7.0%) and HealthCare (-5.7%), while we are actually seeing EPS upgrade in Cyclicals: Comm Services (+2.2%), Tech (+1.3%), Discretionary (+1.0%). Particularly, earnings revisions from Mag 7 and Semis are among the highest, per FactSet: NVDA (from $4.74 to $5.54), MU (from $-0.28 to +$0.42), MSFT (from $2.63 to $2.81), AMZN (from $0.68 to $0.83). That said, revisions from bottom-up analysts support the view that economic growth has been driving earnings growth.

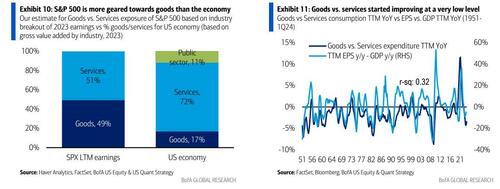

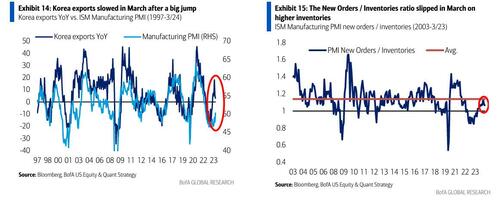

One interesting tangent here is the breakdown between goods and services EPS: as BofA notes, while goods/manufacturing represents half of earnings for the S&P 500, it accounts for less than 20% for the US economy (via GDP). The post-COVID shift from goods to services was a major culprit of the earnings recession in 1H22 despite a strong economy. Here, BofA is seeing signs that the goods/manufacturing economy is coming out of a long recession. The ISM Manufacturing PMI topped 50 for the first time in 17 months (third longest downturn in history) and leading indicators generally point to an uptrend (although some weakened in March). The improving trend for goods vs services from a very low level suggests EPS should outpace GDP, especially with operating leverage.

Yet even the rabidly cheerful BofA admits that the outlook is not without risks and cautions that the risk to its bullish earnings outlook is weaker demand. While the trend remains favorable, a few leading indicators that had suggested a manufacturing recovery are starting to roll over (e.g. Korea exports and PMI New Orders vs Inventories). The BofA Trucker survey also indicates that we are not out of the elongated freight recession.

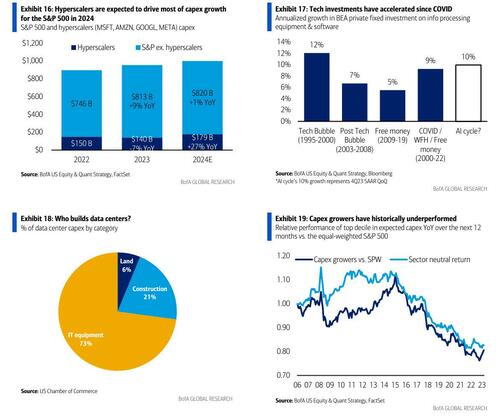

Earnings aside, what about capex? Here there are no surprises – it is all AI driven, and hyperscalers (MSFT, AMZN, GOOGL, META) are expected to spend $180BN on capex in 2024E, a whopping +27% YoY. The $38B YoY increase in capex represents nearly 80% of their expected increase in earnings YoY – i.e., they’re entering a reinvestment cycle. That’s not a good thing since history suggests companies in reinvestment cycles underperform, although the always cheerful BofA counters by saying that it sees a potential virtuous cycle forming from AI investments, with semis and networking are the most obvious beneficiaries, but increased power usage from AI and the physical build out of data centers will also lead to more demand for electrification, utilities, commodities, .

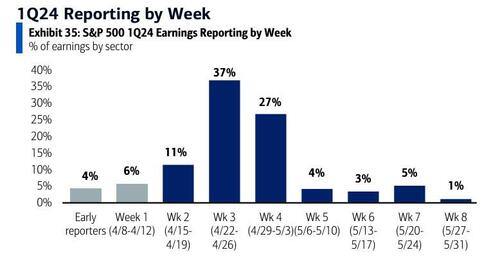

Finally, up next: 41 companies from nine sectors are reporting this week as the market’s focus is increasingly shifting from macro to earnings now (and geopolitics).

Earnings season peaks next next week, however, when the bulk of the S&P by earnings reports: