Uddrag fra Zerohedge:

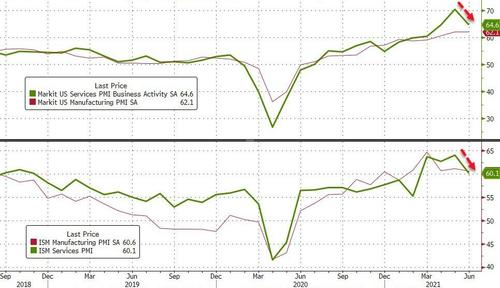

After a mixed picture in Manufacturing surveys in June (PMI marginally higher, ISM marginally lower), and serially down-trending ‘hard’ data, this morning’s Services surveys show a serious and coordinated disappointment as ISM Servceis tumbled from 64.0 to 60.1 and Markit’s PMI dropped from 70.4 to 64.6…

Source: Bloomberg

Is it time to catch down to reality?

Source: Bloomberg

Most ISM components plunged.

The IHS Markit U.S. Composite PMI Output Index posted 63.7 in June, down from May’s recent high of 68.7. The overall upturn eased following slower output expansions across both the manufacturing and service sectors. Nonetheless, the rate of growth in activity was substantial and the second-fastest on record.

Contributing to the softer upturn in output was a slight moderation in the rate of new business growth during June.

At the same time, cost pressures remained marked in June. Further raw material shortages and hikes in supplier and fuel costs reportedly pushed input prices higher, according to panellists. The rate of cost inflation was the second-quickest on record. Firms passed on greater costs to clients via the secondsharpest increase in average selling prices for goods and services since data collection began in 2009.

Commenting on the latest survey results, Chris Williamson, Chief Business Economist at IHS Markit, said:

“June saw another month of impressive output growth across the manufacturing and services sectors of the US economy, rounding off the strongest quarterly expansion since data were first available in 2009.

“The rate of growth cooled compared to May’s record high, however, adding to signs that the economy’s recovery bounce peaked in the second quarter.

“Some of the easing in the rate of expansion reflects payback after especially strong expansions in prior months as the economy opened up from pandemic-related restrictions, especially in consumer-facing companies. However, many firms reported that business activity had been constrained either by shortages of supplies or difficulties filling vacancies. Backlogs of uncompleted orders are consequently rising at a rate unprecedented in the survey’s history, underscoring how demand is outstripping supply of both goods and services.

“These capacity constraints are not only stifling growth, but also driving prices sharply higher. June saw the second-steepest rise in average prices charged for goods and services in the survey’s 12-year history, though some encouragement can be gleaned from the rate of inflation easing in the service sector compared to May.”

All of which turns the “Stagflation” anxiety dial up to 11…