Fra Zerohedge:

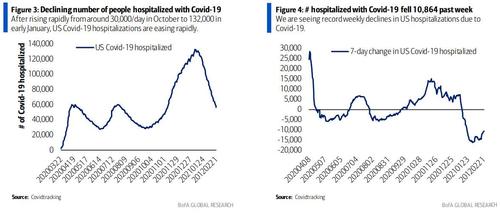

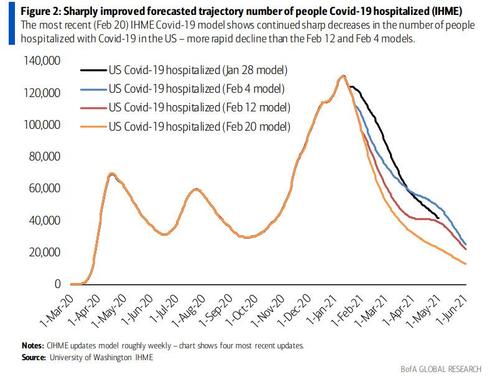

Amid a constant barrage of good news on the covid front which mysteriously started around the time Joe Biden was inaugurated, including a plunge in the number of people hospitalized with Covid-19 which has tumbled to 56,159, or 76,315, down 58% off the peak which occurred on January 5th…

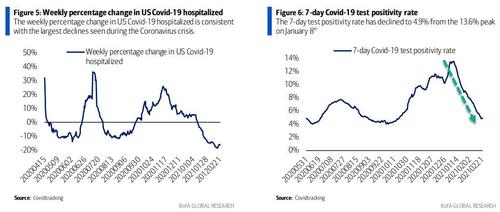

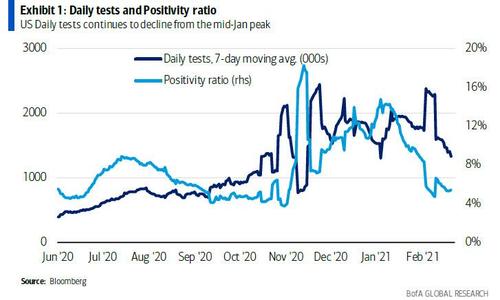

… coupled with a dramatic drop in the 7-day test positivity rate which has declined to 4.9% from the 13.6% peak on January 8th…

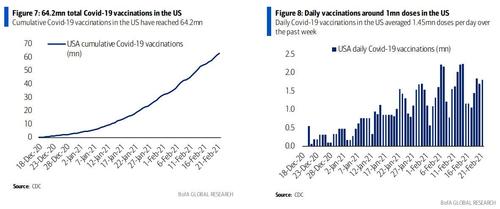

…. as daily vaccinations in the US averaged 1.45mn doses per day over the past week and reached a cumulative 64.2mn…

… despite the fact that there has been far less testing in recent weeks which explains the collapse in new cases…

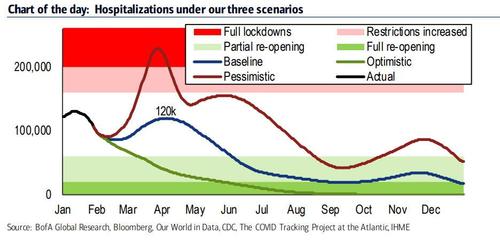

… one bank – Bank of America – threw up all over the covid optimism as BofA economist Aditya Bhave warned at the start of the month that the worst may be yet to come as he remains “concerned about the new, more contagious virus strains out of the UK, South Africa and Brazil.”

Why? Because according to BofA simulations, even a very optimistic pace of vaccination cannot fully offset their impact the mutations they become dominant. Therefore the bank’s base case as of early February was that cases and hospitalizations would actually return to their post-holiday peaks in the early spring.

Well, not any more.

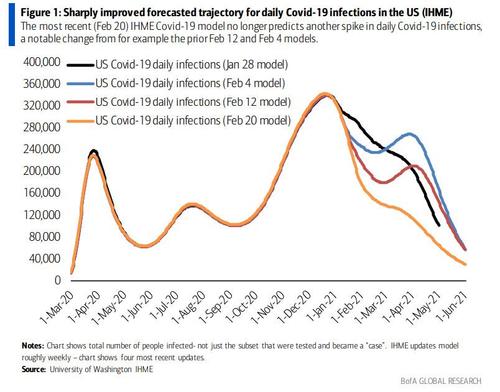

According to BofA chief credit strategist, the latest update to University of Washington’s IHME Covid-19 model shows a dramatic improvement in the trajectory for the US Covid-19 situation between now and the summer.

In the most striking development, the “scientific” model no longer predicts another spring spike in daily infections due to the more infectious mutated variants and instead all that remains is a bump – i.e. a March slowdown in the rate of decline in daily infections.

The news is even better in terms of the number of people hospitalized with Covid-19 – as we first predicted back in December and as “models” now confirm, due to vaccinations, there is now barely any impact of the bump in infections as the weekly rate of decline ranges from 7% to 14% through June 1st.

In short: even with new mutant versions, thanks to vaccinations and the ascent of herd immunity, Covid may be a distant memory by the summer. Which will be a problem for the authoritarian leaders of the US who will soon need to find another “crisis” to use a smokescreen for trillions in stimulus. In fact, if the Biden $1.9 trillion stimulus isn’t passed very soon, it may never pass once it becomes readily known that covid is now on its way out.