Uddrag fra Zerohedge:

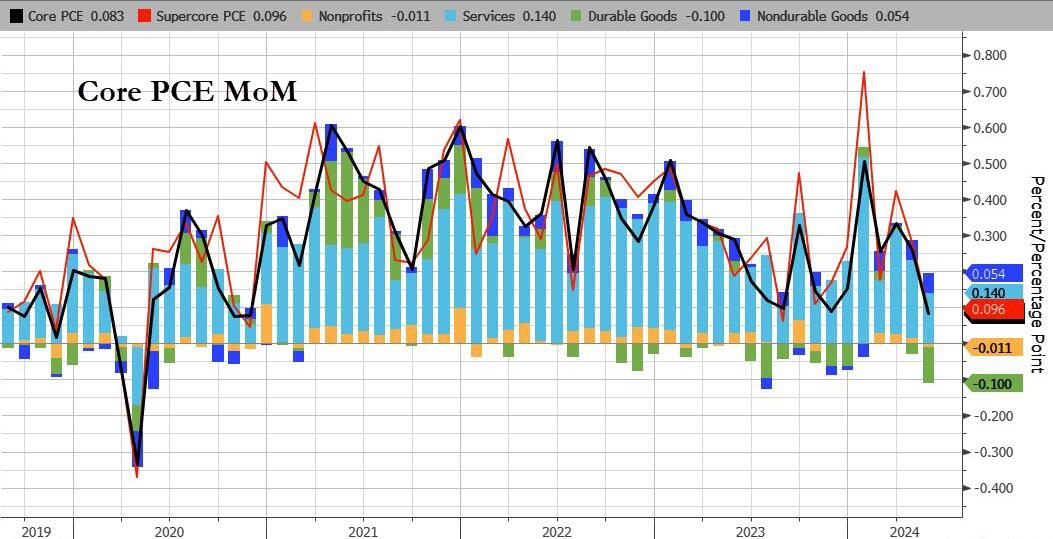

The Fed’s favorite inflation indicator – Core PCE – instead came in slightly hotter than expected, rising 2.6% YoY (vs +2.5% YoY exp). The headline PCE dipped to +2.5%...

Source: Bloomberg

Under the hood, durable goods deflation continues to drag Core PCE lower while Services costs continue to rise…

Source: Bloomberg

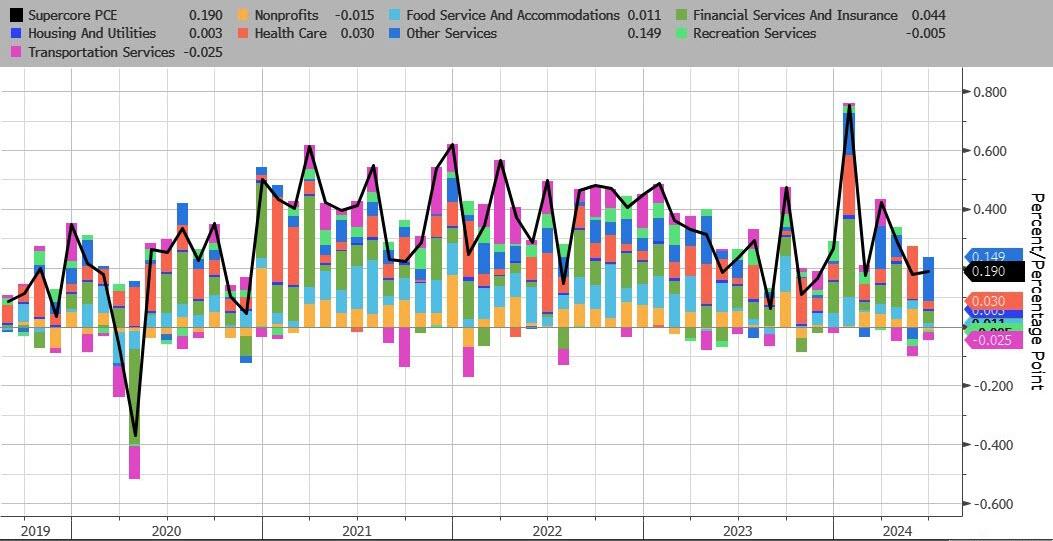

Even more notably, the so-called SuperCore PCE rose 0.2% MoM, which saw YoY rise to 3.43%… which is awkwardly stagnant at elevated levels…

Source: Bloomberg

That is the 50th straight monthly rise in SuperCore prices with Healthcare costs soaring…

Source: Bloomberg

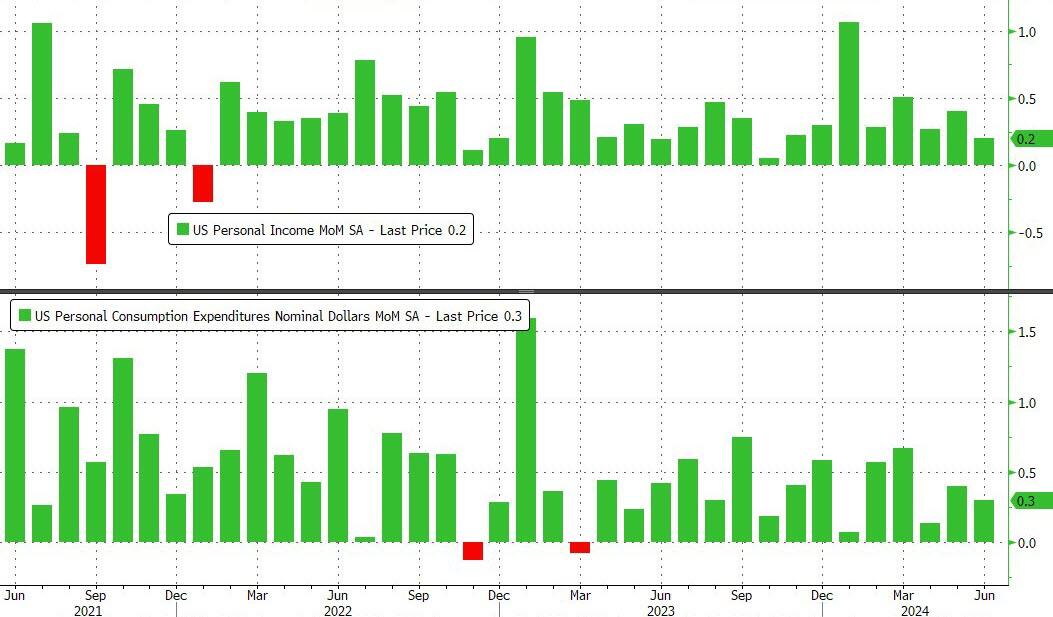

On A MoM basis, income growth was weaker than expected (+0.2% vs +0.4% exp), while spending was +0.3% as expected…

Source: Bloomberg

On a YoY basis, spending continues to outpace incomes…

Source: Bloomberg

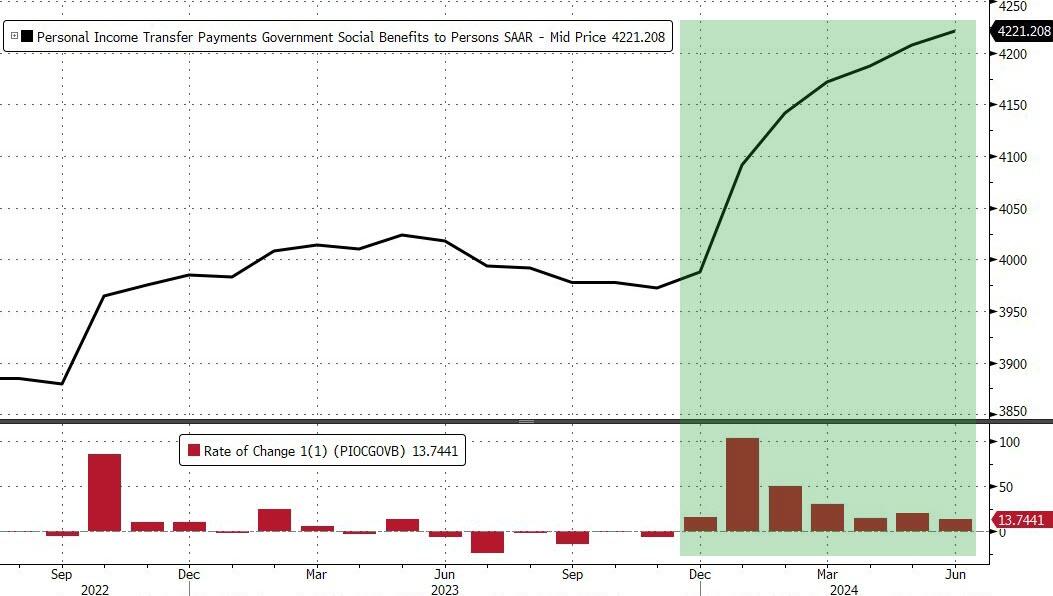

Which dragged the savings rate down further…

Source: Bloomberg

All of which takes place against a background of the seventh straight month of rising government handouts (well it is an election year after all)… (which means the savings rate would have puked even more without it)

Source: Bloomberg