Den amerikanske centralbank har efter et todages møde erklæret, at der ikke bliver en hurtig genoplivning af økonomien – ingen V-kurve. Der er behov for en større indsats, også fra politisk hold. Genoplivningen bliver langstrakt.

Uddrag fra Nordea:

Fed Review: No V-shaped recovery – “more is needed”

While the Fed did not deliver any further easing measures at tonight’s FOMC meeting, Powell did make a fairly strong commitment to deliver more in the near future given a gloomy economic outlook. More credit purchases are on its way.

After firing several bazookas, the Fed decided to take a breather at tonight’s FOMC meeting, keeping both rates and the open-ended QE programme unchanged. This was in line with our expectations as well as most market participants.

The statement’s forward guidance was also left unchanged saying that

“The Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals”.

Hence, those calling for a more explicit forward guidance rule ala the 2012 “Evans Rule” – which stated that rates would be kept low until unemployment or inflation reached certain levels – were left disappointed.

The Fed did though include one new line:

“The ongoing public health crisis will weigh heavily on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term”.

In our view, this a pseudo forward guidance. Thus, this indicates that the Fed’s base case is not a V-shaped recovery, why rates in turn will stay unchanged in the medium term. This was confirmed by Powell in the press conference as he said that the Fed will wait raising rates until it is “quite confident” that the economy is well on its way to recovery. This underpins our expectations of unchanged rates throughout our forecast horizon (ultimo 2021).

Otherwise, the statement did not offer much news. It was, however, striking how vivid the words generally were (such as “tremendous”, heavily”, etc). While one could easily draw a parallel to the Donald, this was probably just the Fed’s way of saying that the economic impact is unprecedented.

Not a V-shaped recovery

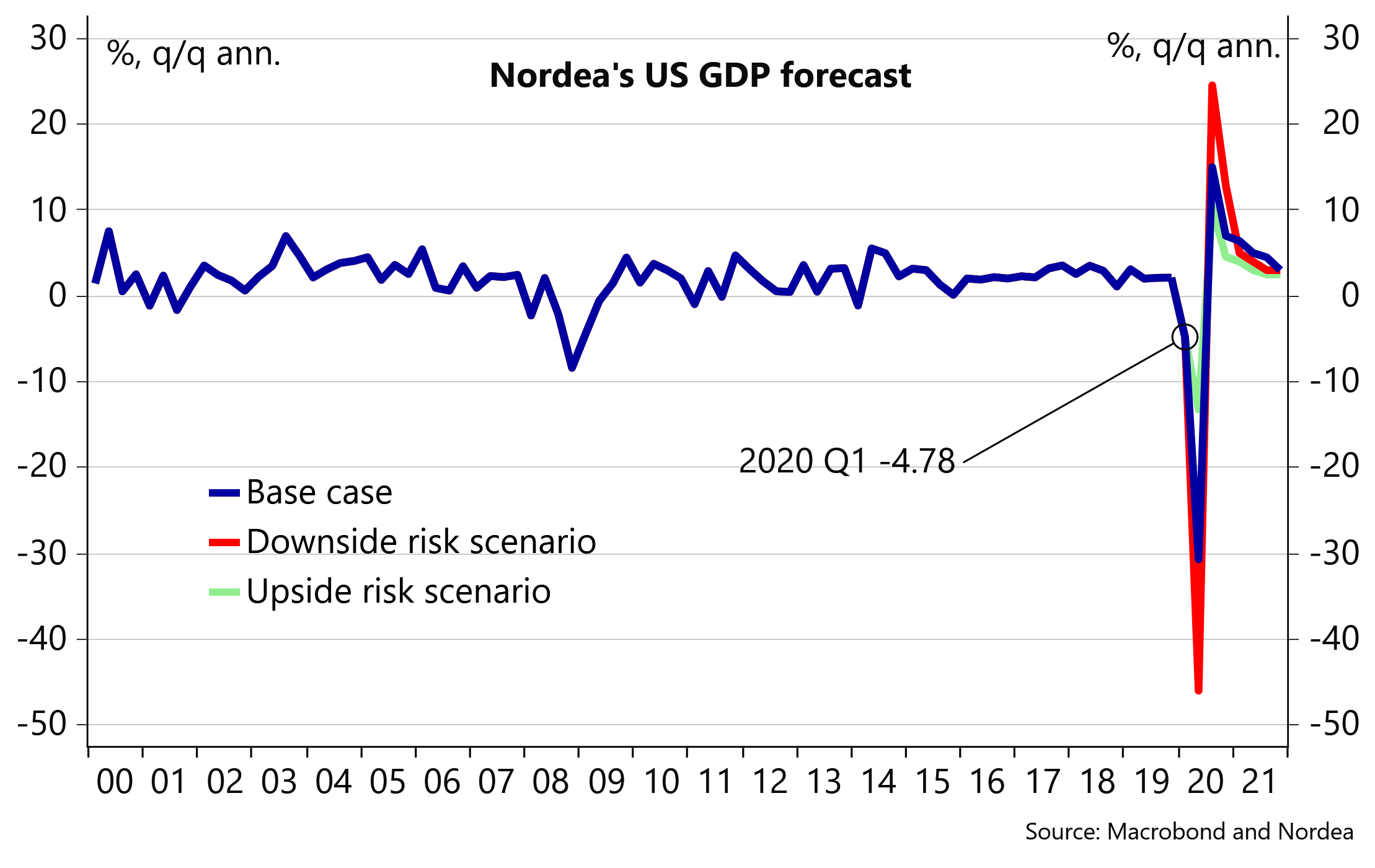

In the press conference, Chair Powell again stressed the severity of the economic consequences stemming from the coronavirus. Although Powell would not give a precise forecast on the deepness of the downturn nor his anticipation of how fast/slow the recovery will be, he did say that “we are going to see economic data for the second quarter which are worse than anything seen”. A view, which we share, as we expect Q2 GDP at -31% q/q ann. (US Macro: Biggest decline in GDP growth since 2008, but it will get much worse).

Chart 1. GDP growth declined by -4.8% in Q1, but it will be much worse in Q2

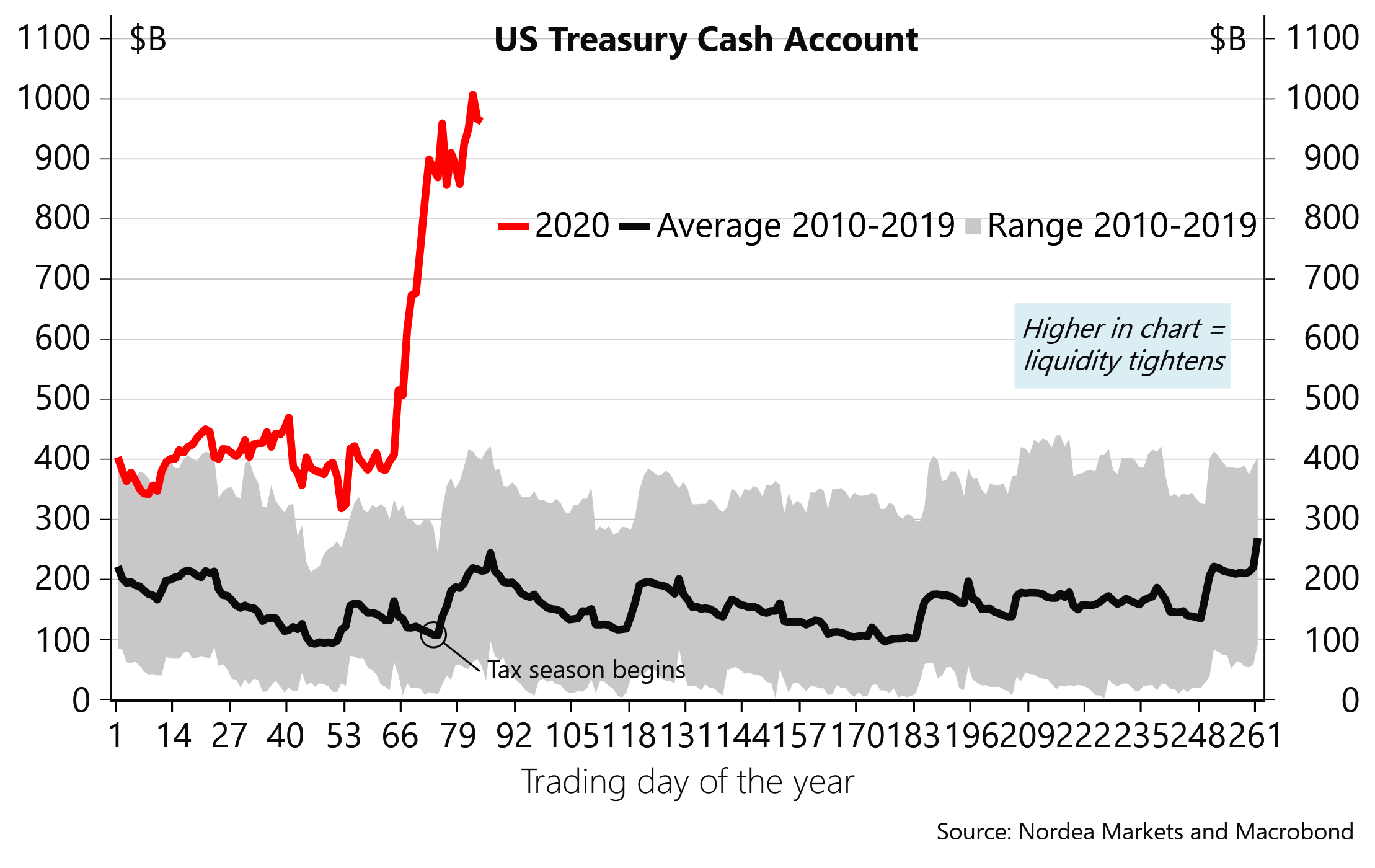

Furthermore in regards to the economic outlook, Powell highlighted the historical uncertainty – especially, since factors such as a potential vaccine as well as the length of lockdowns are somewhat unknown. He did though stress that the recovery depends on securing a fast and smooth implementation of both monetary and fiscal measures. Regarding the latter, Powell hence indirectly tried to put some pressure on politicians in order to get things done more quickly. This is, in our view, indeed also needed as a recent survey showed that only 15% of businesses most hurt by the coronavirus have received funding during the first PPP round.

Chart 2. Cash is piling up at the Treasury cash account instead of being paid out

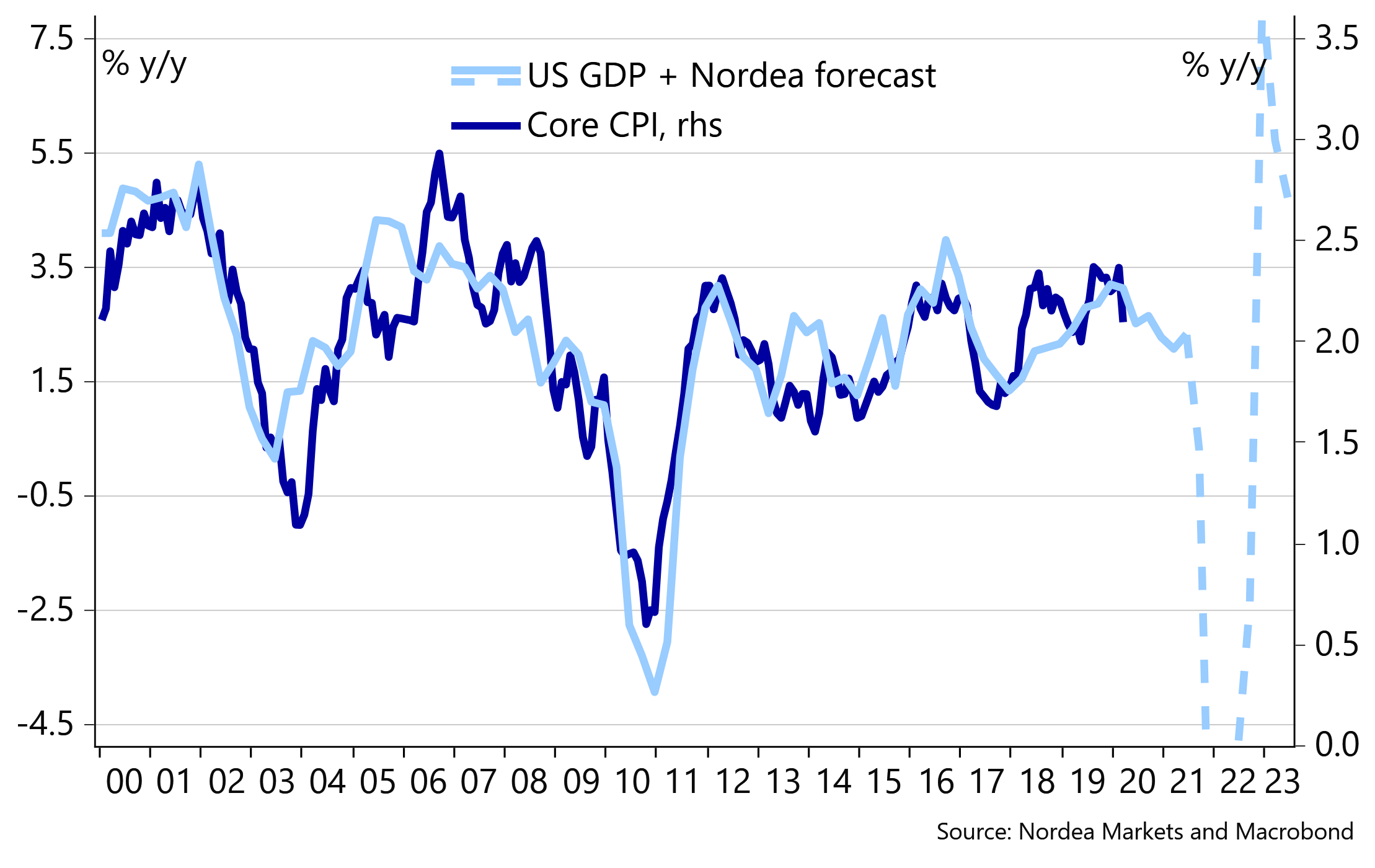

On inflation, Powell said that it was not the Fed’s top priority at the moment, but obviously still something to look out for. Moreover, he argued that “as long as inflation expectations remain anchored, then we shouldn’t see deflation”. While falling oil prices would be a negative drag on headline inflation, the Fed does not anticipate deflation per se – a view, we disagree on, see chart 3 (we do though agree that it is crucial to keep inflation expectations anchored).

Chart 3. No deflation you say?

Keep Federal Reserve Great

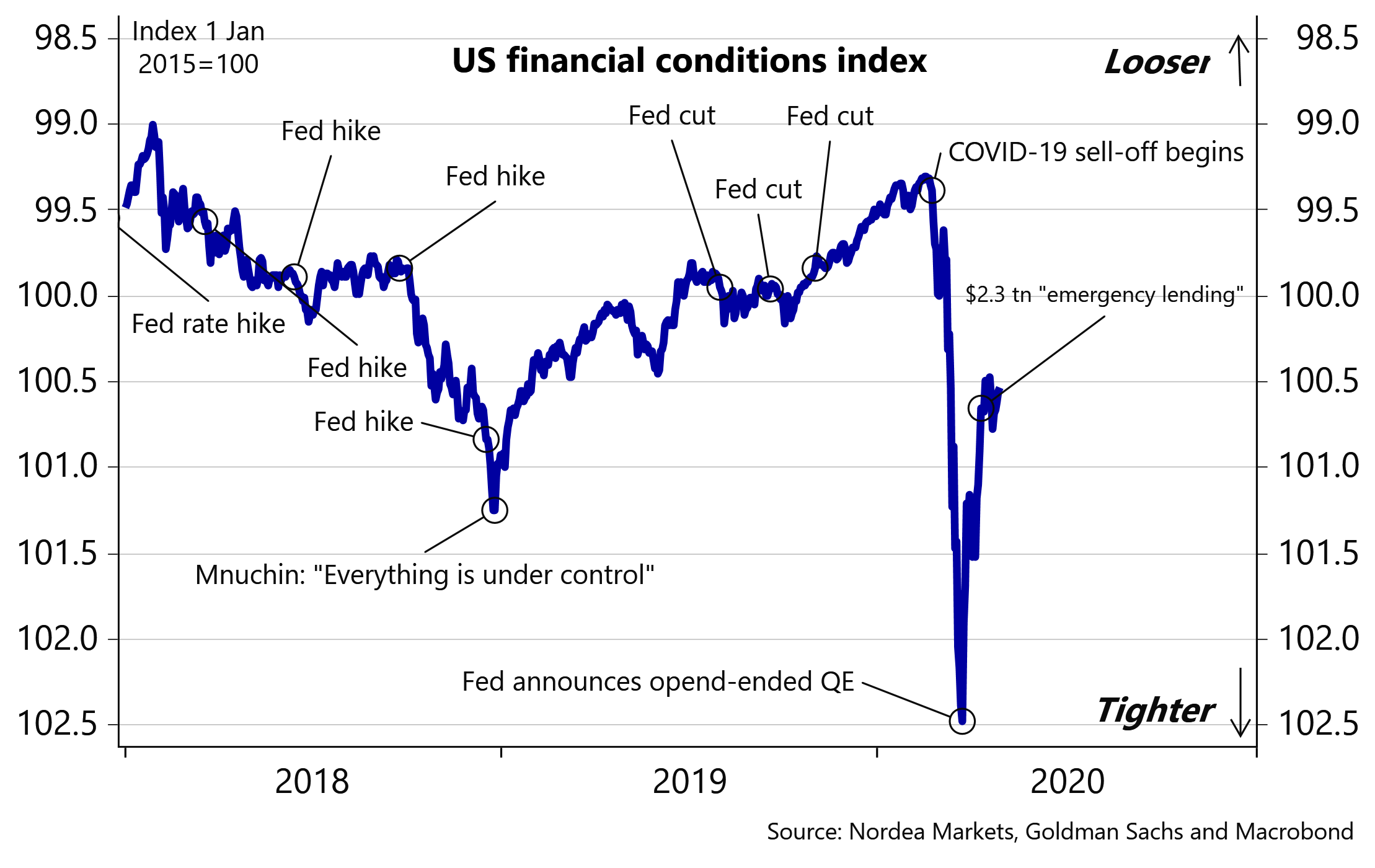

In an evaluation of the cascade of easing measures, Powell praised himself and the Fed in an almost Trump-ish way for reacting quickly in response to the coronavirus, as liquidity and credit facilities have been implemented in weeks rather than months in contrast to the GFC. And yes, the Fed does deserve some credit. The reaction has been impressive and these measures have indeed served their purposes of securing market functioning (absolute first priority), providing liquidity/credit and stabilising inflation expectations.

On the other hand, we have also been part of the somewhat sceptical choir, highlighting the possibly long-term negative consequences such as moral hazard, hysteresis and an unknown exit plan. In response to this, Powell said that the credit facilities are “loans, not grants” and “this is not the time to be concerned about debt”. In other words, these issues are not on the top of the Fed’s priority list at the moment. For now it is about saving Corporate America.

Chart 4. Fed has been THE driver behind financial conditions having eased and securing market functioning. Well done, Fed!

“More is needed and credit facilities are wide open”

Powell also received a bunch of questions on the topic of “what comes next”. Here Powell was pretty clear that the Fed has plenty of opportunities, highlighting that only $195 bn out of the $454 bn emergency backstop lending allocated by Congress have been used. He specifically said that this “Treasury equity” will be used and that more (easing) is needed. Quite a rare statement from a Fed chair.

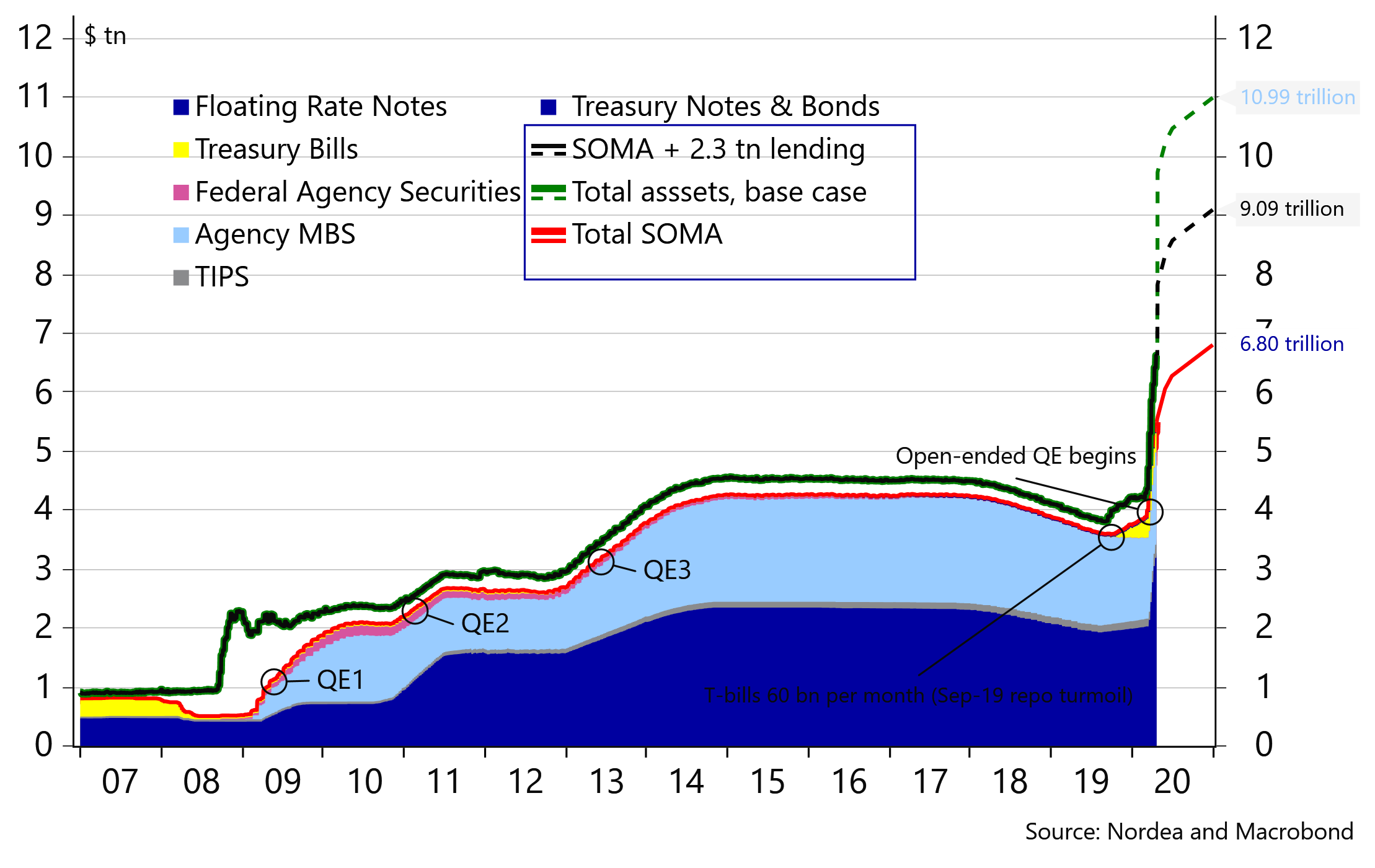

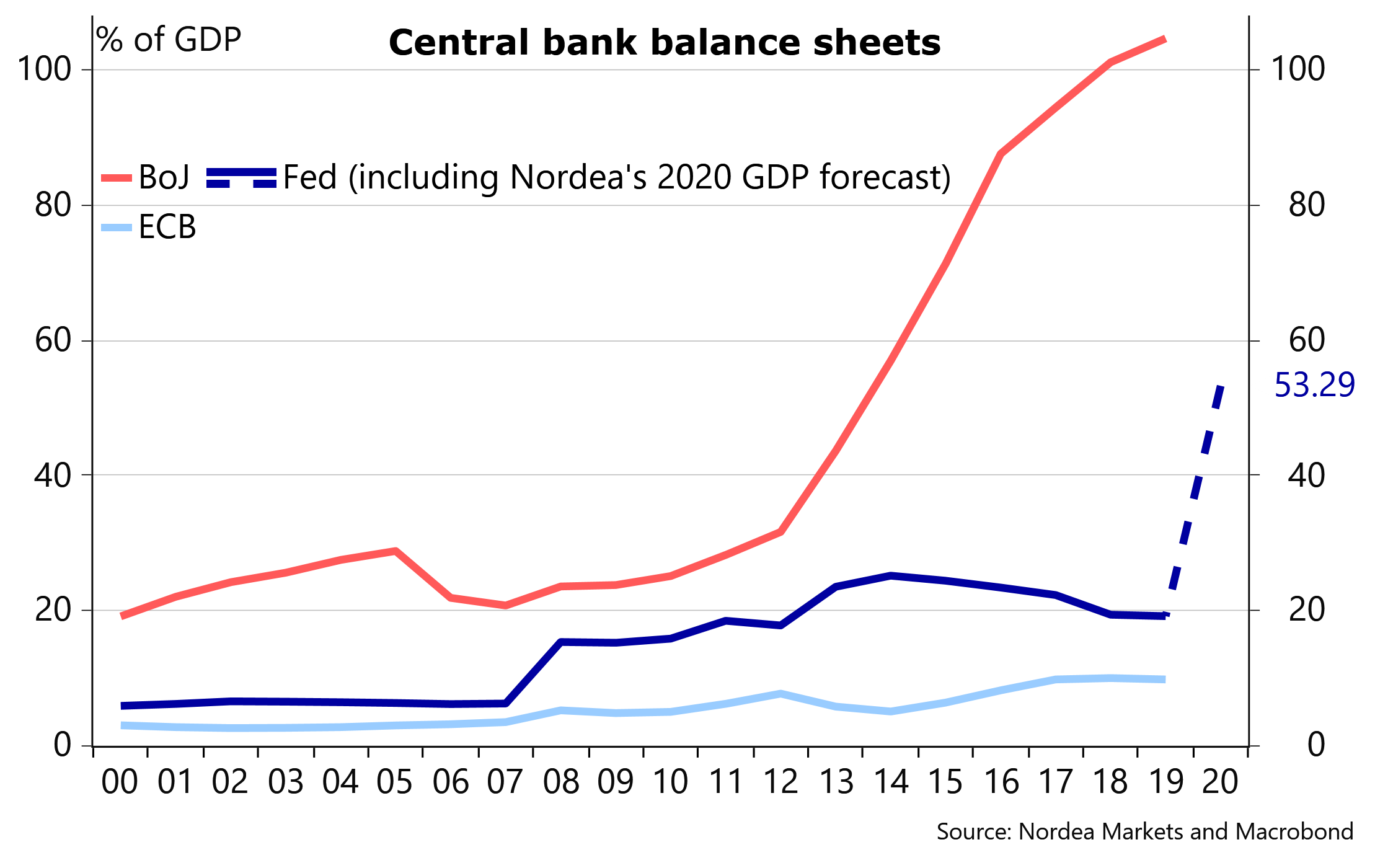

In terms of what they would buy, Powell said it will likely include more credit purchases and that the “credit facilities are wide open”. There is no limits when it comes to this. Overall, Powell’s rhetoric and guidance of “more is needed” was in line with our expectations of a ballooning balance sheet (see more on the topic here: Fed Watch: Forecasting balance sheet bananas and yield curve control).

Powell was not challenged on the prospects of purchasing equity ETF, introducing yield curve control or NIRP (Powell reiterated that rates are at its “effective lower bound”). Some market participants had also speculated that Powell could receive some questions about the suffering oil companies on the back of the WTI price collapsing. While no questions were made to Powell on this, do note that the Energy Secretary at another press conference said that it will be decided within days, whether financial aid will come to the oil and gas industry (read: fiscal help will come).

Finally on the outlook for asset purchases, Powell did not offer any news. The Fed will simply continue its de facto yield curve control and purchase as many bonds as they see fit to “secure market functioning” and keeping rates low. Hence, continue to expect tapering announcements of daily Treasury and Agency MBS being sneaked in through the back door at NY Fed’s website each week.