Verdens største centralbanker mødes i dag i Washington – på et virtuelt møde – for at drøfte, om der er behov for nye gigantiske finanspakker. De erkender, at det er umuligt at genskabe væksten fuldtud, så længe coronavirussen hærger. Centralbankerne er også bekymrede for den enorme gæld, der er skabt for at undgå et økonomisk sammenbrud. Men centralbankerne erkender også, at de mest effektive metoder er finanspolitisk indgreb for at sikre beskæftigelsen. Centralbankpenge og lave renter er ikke nok.

Mid-recovery, coronavirus spreading, global central bankers take stock

The world’s top central bankers have opened the taps with trillions of dollars in promised credit to prevent a global pandemic from causing a global economic depression.

On Tuesday they will update their plans in presentations that could begin to signal just how much more they feel they can do in response to a once-in-a-century economic shock triggered by the spread of the coronavirus.

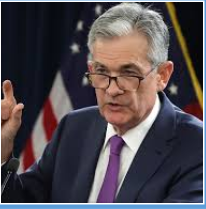

Despite the efforts made so far, the global economy is not out of the woods given the unique risks posed by the health crisis, and top officials from the Federal Reserve, European Central Bank and Bank of Japan are likely to acknowledge as much when they speak Tuesday at a virtual meeting of the National Association for Business Economics.

“We know monetary policy is pedal to the metal,” Chris Varvares, co-head of U.S. economics for IHS Markit’s Macroeconomic Advisers, said at a NABE panel on the global economy on Monday.

But “the disease is the boss…We are really having trouble tamping this down to low levels that will allow the economy to fully recover.”

For all three, their remarks will be framed by separate debates underway among elected leaders in the United States, Europe and Japan over the need for more stimulus.

With interest rates already at zero – and global demand still weak, millions unemployed and private incomes falling – central bankers and economists say the most effective response would be from fiscal authorities able through unemployment insurance or other existing programs to send money directly to households.

“This is a natural role (for fiscal policy)…when there is not enough aggregate demand,” Chicago Federal Reserve President Charles Evans said in remarks Monday.

Even the more optimistic forecasts see the global economy shrinking by perhaps 4% this year.

Still, all three major central banks face decisions in coming weeks over their next crisis-fighting steps, generally around whether and how to expand the amounts and types of assets they are buying each month.

AT AN INFLECTION POINT

All three banks took unprecedented steps in the spring as the pandemic shut down commerce throughout the developed world and caused major financial markets to stumble.

Since the 2007 to 2009 financial crisis they have already extended the borders of whom they could lend to and on what terms. The pandemic required them to draw a new map altogether – be it the Fed opening its lending to small businesses, the BOJ paying banks to lend to companies, or the ECB more freely buying Greek government bonds.

Those programs and others helped the initial phase of the economic recovery off to a faster-than-expected start.

But the pace of improvement has slowed, the virus continues to spread, and some analysts fear a financial crisis lies ahead. With the easy employment gains already booked, they worry the remaining unemployed will fall behind on loans and mortgages and rents, and begin to dent the financial strength of banks who will then reduce lending and, perhaps, undercut the recovery altogether.

“The first six months of this Great Coronavirus Depression is only the tip of the iceberg,” High Frequency Economics Chief Economist Carl Weinberg wrote, arguing that over time debts that have been postponed will eventually have to be acknowledged by financial firms as non-performing – eating into the capital stock of banks and other lenders and possibly triggering a fresh economic downturn.

“No one can predict either the magnitude of losses or the capacity of lenders,” Weinberg wrote, noting that an early jump in global credit growth, spurred on by central banks, had begun to slow.

Many of the central bank programs put in place in the spring were meant to ensure that sort of follow-on financial crisis would not develop, and Fed officials have said one bright spot in the current crisis is that banks have remained healthy so far.

The recovery, meanwhile, seems to have hit a pause – not regressing, but not yet reliably sustainable.

“We are at this inflection point where there are doubts about the future of the recovery,” said Oxford Economics Chief U.S. Economist Gregory Daco, with his clients, he said, “increasingly fearful of an L-shaped recovery” with a permanent blow to the world’s economic prospects.