Fra Vestas

Summary

Summary: For the first quarter of 2022, Vestas’ revenue amounted to EUR 2,485m with an EBIT margin before special items of (13.2) percent. Record high combined order backlog of EUR 48.9bn – an increase of 9.4 percent compared to same quarter last year. Full-year guidance updated. In the first quarter of 2022, Vestas generated revenue of EUR 2,485m – a increase of 27 percent compared to the year-earlier period. EBIT before special items decreased by EUR 251m to EUR (329)m. This resulted in an EBIT margin before special items of (13.2) percent, compared to (3.9) percent in the first quarter of 2021.

Adjusted for impairments and warranty provisions related to a review of the offshore activities, the EBIT margin before special items was (6.2) percent. Free cash flow* amounted to EUR (1,121)m compared to EUR (898)m in the first quarter of 2021. The quarterly intake of firm and unconditional wind turbine orders amounted to 2,948 MW. The value of the wind turbine order backlog was EUR 18.9bn as at 31 March 2022. In addition to the wind turbine order backlog, at the end of March 2022, Vestas had service agreements with expected contractual future revenue of EUR 30.0bn.

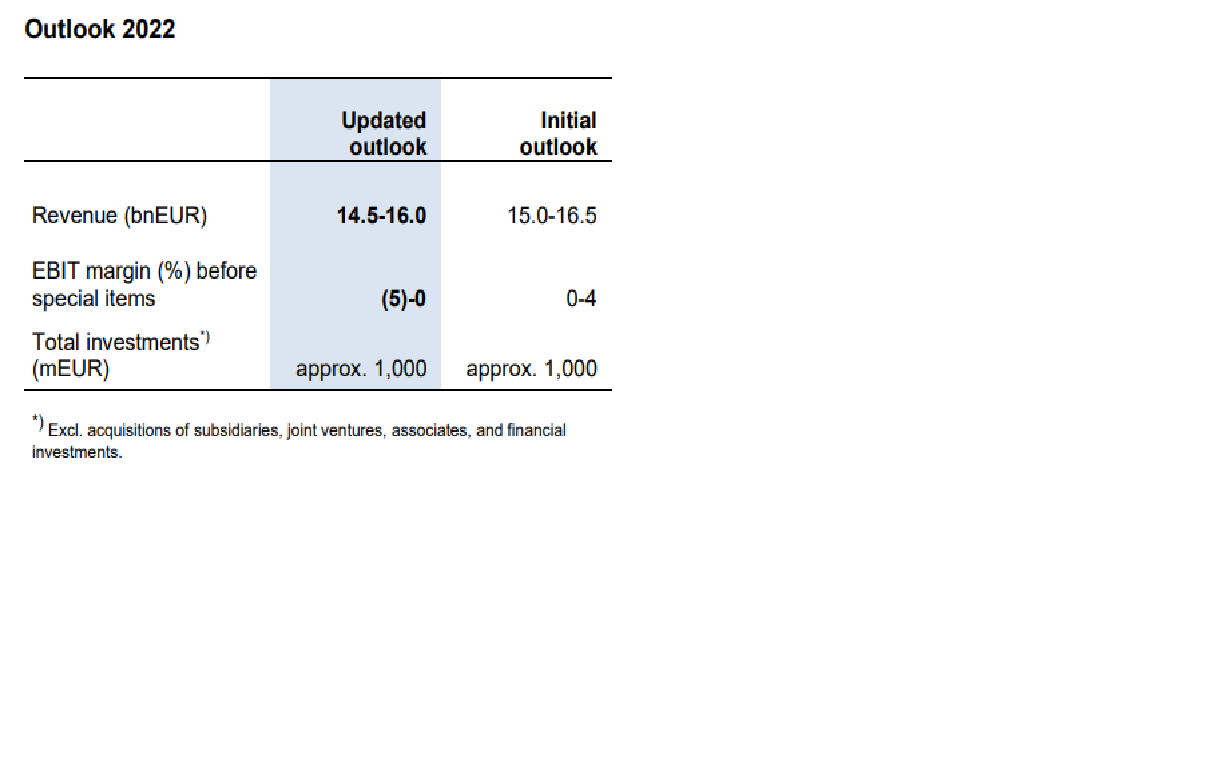

Thus, the value of the combined backlog of wind turbine orders and service agreements stood at EUR 48.9bn – an increase of EUR 4.2bn compared to the year-earlier period. As part of our decision to withdraw from Russia and to address the current business environment, we have made a strategic re-prioritisation of select markets while also making one-time write-downs related to legacy offshore activities. Based on these circumstances and the revenue and profits forfeited in Ukraine and Russia, Vestas is updating its outlook for 2022. Revenue for full year 2022 is now expected to range between EUR 14.5bn and 16.0bn (previously EUR 15.0- 16.5bn) including Service revenue which is now expected to grow min. 10 percent (previously approx. 5 percent). Vestas expects to achieve an EBIT margin before special items of (5)-0 percent (previously 0-4 percent) with a Service EBIT margin before special items of approx. 23 percent (previously approx. 25 percent). Total investments*) are still expected to amount to approx. EUR 1,000m in 2022.

Group President & CEO Henrik Andersen said: “In the first quarter of 2022, Vestas achieved a strong order intake and continued to increase prices in a very challenging business environment and unfolding energy crisis. Under these circumstances, our underlying performance was solid with revenue of EUR 2.5bn, a 27 percent increase year-over-year, as well as an average selling price of EUR 1.01m/MW and increased Service revenue and EBIT, but profitability was heavily impacted by highly disrupted supply chains and one-offs. In the quarter, we made one-time write-downs related to the Russian invasion of Ukraine and legacy offshore activities.

To address the current business environment, we also made a strategic re-prioritisation of select markets and plans to adjust our manufacturing footprint, which together with the write-downs on Russia, Ukraine, and Offshore impacted our results negatively. Based on these decisions and the uncertain business environment, we are adjusting our financial guidance for the full year. The growing energy crisis, however, also led to stronger political support for renewables to enhance energy independence and keep energy prices low, and we are strengthening our foundation to support governments and customers achieve these goals. Everyone at Vestas continues to do an outstanding job in executing on our strategic priorities in unprecedented and very unpredictable circumstances, and Executive Management wants to thank our customers, colleagues, and partners for their ongoing engagement and support.”

nedjusterer helårsforventning:

Consensus as at 25 April 2022

| Financials (mEUR) | Average | High | Low | # est. | Average | High | Low | # est. | Average | High | Low | # est. | Average | High | Low | # est. | ||||

| Q1 2022 | Q1 2022 | Q1 2022 | Q1 2022 | 2022 | 2022 | 2022 | 2022 | 2023 | 2023 | 2023 | 2023 | 2024 | 2024 | 2024 | 2024 | |||||

| Total Revenue | 2,251 | 2,527 | 1,934 | 20 | 15,528 | 16,096 | 15,035 | 20 | 16,330 | 18,292 | 14,624 | 20 | 17,388 | 21,299 | 13,701 | 20 | ||||

| Revenue, Power solutions | 1,475 | 1,815 | 888 | 18 | 11,011 | 13,004 | 9,725 | 20 | 12,117 | 13,813 | 10,287 | 20 | 13,003 | 16,932 | 10,024 | 20 | ||||

| Revenue, Offshore | 257 | 600 | 72 | 15 | 1,979 | 2,700 | 1,500 | 19 | 1,445 | 2,334 | 872 | 19 | 1,387 | 2,486 | 565 | 19 | ||||

| Revenue, Service | 578 | 628 | 550 | 18 | 2,637 | 2,710 | 2,415 | 20 | 2,840 | 3,005 | 2,620 | 20 | 3,067 | 3,289 | 2,837 | 20 | ||||

| Gross profit | 178 | 304 | 108 | 18 | 1,417 | 1,895 | 1,172 | 18 | 2,098 | 2,820 | 1,647 | 18 | 2,495 | 3,593 | 1,839 | 18 | ||||

| EBITDA before special items | 104 | 251 | -101 | 16 | 1,195 | 1,345 | 1,006 | 19 | 1,835 | 2,127 | 1,536 | 19 | 2,269 | 2,802 | 1,751 | 19 | ||||

| EBIT before special items | -91 | 36 | -202 | 20 | 258 | 420 | 72 | 20 | 859 | 1,269 | 564 | 20 | 1,264 | 1,850 | 761 | 20 | ||||

| EBIT, WTG | -153 | -24 | -269 | 18 | -108 | 99 | -255 | 19 | 431 | 899 | 175 | 18 | 770 | 1,446 | 298 | 18 | ||||

| EBIT, Service | 139 | 157 | 126 | 19 | 652 | 677 | 613 | 20 | 704 | 745 | 653 | 19 | 764 | 826 | 683 | 19 | ||||

| Not allocated | -78 | -56 | -100 | 17 | -304 | -205 | -336 | 18 | -309 | -204 | -368 | 17 | -318 | -206 | -430 | 17 | ||||

| Special items | -93 | 3 | -93 | 3 | ||||||||||||||||

| Income from JV and associates | 9 | 15 | 1 | 19 | 37 | 60 | 5 | 19 | 40 | 70 | 6 | 19 | 44 | 86 | 6 | 19 | ||||

| Net financials | -18 | -3 | -26 | 20 | -74 | -20 | -104 | 20 | -73 | -20 | -108 | 20 | -71 | -20 | -105 | 20 | ||||

| Profit before tax | -113 | 16 | -422 | 20 | 204 | 367 | -75 | 20 | 825 | 1,340 | 499 | 20 | 1,232 | 1,934 | 701 | 20 | ||||

| Net profit | -89 | 12 | -319 | 20 | 152 | 266 | -56 | 20 | 618 | 1,041 | 374 | 20 | 922 | 1,498 | 526 | 20 | ||||

| Free Cash Flow | 14 | 495 | -585 | 19 | 767 | 1,577 | 166 | 19 | 868 | 1,930 | 400 | 19 | ||||||||

| Dividend per share | 0.08 | 0.29 | 0.01 | 19 | 0.28 | 0.87 | 0.11 | 20 | 0.42 | 1.20 | 0.18 | 20 | ||||||||

| Onshore deliveries (MW) | 1,925 | 2,471 | 1,298 | 18 | 14,142 | 16,522 | 12,837 | 20 | 14,772 | 16,759 | 12,451 | 19 | 15,914 | 18,970 | 12,078 | 19 | ||||

| Onshore order intake (MW) | 2,384 | 2,879 | 1,900 | 19 | 14,053 | 15,831 | 11,720 | 18 | 15,484 | 18,205 | 12,697 | 16 | 16,402 | 20,026 | 12,874 | 16 | ||||

| Onshore order intake (mEUR) | 2,029 | 2,418 | 1,494 | 18 | 12,059 | 13,500 | 9,669 | 17 | 12,936 | 15,493 | 10,423 | 15 | 13,322 | 15,493 | 9,012 | 15 | ||||

| Offshore deliveries (MW) | 229 | 500 | 60 | 17 | 1,693 | 2,250 | 1,250 | 17 | 1,234 | 1,667 | 789 | 16 | 1,303 | 2,250 | 500 | 16 | ||||

| Offshore order intake (MW) | 583 | 620 | 325 | 16 | 1,820 | 3,020 | 679 | 14 | 2,482 | 5,000 | 520 | 13 | 3,106 | 5,000 | 1,500 | 13 | ||||

| Offshore order intake (mEUR) | 680 | 806 | 359 | 14 | 2,236 | 3,579 | 767 | 12 | 2,866 | 5,850 | 513 | 11 | 3,491 | 5,775 | 2,000 | 11 |

Disclaimer: The Consensus is based on the earnings projections made by analysts covering Vestas Wind Systems A/S and are theirs alone and do not represent opinions, forecasts or predictions of Vestas Wind Systems A/S. By disclosing the consensus information Vestas does not imply its endorsement of or concurrence with such information.