Uddrag fra Goldman og Zerohedge:

The pace of payroll growth is expected to ease again in December after November’s unexpected surge, in keeping with the latest ADP print as well as the Fed’s view that it is “cooling gradually”. The jobless rate is expected to be unchanged at 4.2%, while the rate of average hourly earnings is seen cooling a little in the month, but maintaining its brisk annual pace.

According to Goldman, labor market proxies have been mixed; weekly initial jobless claims data ticked up a touch in the December reference period (even if it tumbled just after), while continuing claims were unchanged; and even though the ADP’s private payrolls print disappointed expectations to the downside, the JOLTS job openings (for November) soared even as the hiring and quits rates fell; and while consumers became more confident in the labor market in December, their six-month outlook worsened a little; finally, business surveys were mixed, with the services sector performance remaining in expansion, though the manufacturing sectors performance has been contracting for months. All that said, besides a brief kneejerk move in the subsequent minutes, don’t expect a big market repricing tomorrow: that’s because Fed policymakers do not appear to be concerned about the labor market, noting that it is strong, has been cooling gradually, and with downside risks diminishing; crucially, policymakers do not think that the labor market is a source of inflation pressures.

Here are the details of what Wall Street expects from Friday’s numbers:

- The median analyst consensus expect the US economy will have added 165k payrolls to the economy in December (range of forecasts: 100-268k), slowing from the 227k added in November (which included 110k of those impacted by Hurricanes and Boeing strikes in October).

- If consensus is accurate, payrolls growth will slow relative to the three-month average (of 173k) and the 12-month average (of 190k), but rise relative to the six-month average rate (of 143k)

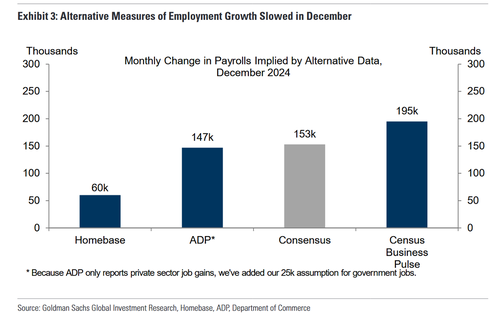

- While their track record has been very spotty of late, Goldman is taking the under – way under – and estimates payrolls rose by only 125k in December, far below consensus, as alternative measures of employment growth generally indicated a sequentially slower pace of job creation, with Goldman also estimating a seasonal headwind of roughly 50k

- Average hourly earnings are expected to rise 0.3% MoM in December, down from 0.4% in November; this would translate into a 4.0% YoY growth, the same as last month.

- As a basis of comparison, within the ADP national employment data for December, the Y/Y median change in annual pay for job-stayers fell to 4.6% (prev. 4.8%) and fell to 7.1% for job-changers (prev. 7.2%).

- The November data’s wage figures surprised to the upside, and analysts will be watching to see if this continues, or normalizes; another above-consensus wage metric could fuel concerns about accelerating pay growth, which could limit the Fed’s scope to continuing cutting rates ahead, some suggest, despite Fed officials arguing that the current labor market is not a source of inflation pressures.

- The unemployment rate is expected to be unchanged at 4.2% (range: 4.1-4.4%)

- The most recent Fed economic projections see the unemployment rate rising to 4.3% by the end of 2025 but maintained its longer-run view of 4.2%. That said, analysts note that officials have premised their views on different assumptions regarding the policies of the incoming Trump administration, and that suggests that as new policies are enacted, the Fed’s view is likely to change in the months ahead.

- Here, too, Goldman is more pessimistic than consensus and estimates that the unemployment rate edged up to 4.3%, a forecast which “reflects a rebound in the labor force participation rate and middling household employment growth amid more challenging job finding prospects.”

INITIAL JOBLESS CLAIMS: Weekly initial jobless claims data for the week that coincides with the BLS survey window for the jobs report printed 220k in December (vs 215k in November), while continuing claims data for the corresponding week 1.897mln (unchanged vs November).

ADP PAYROLLS: ADP’s gauge of national employment printed 122k in December, beneath the expected 140k, and the prior 146k. ADP’s chief economist said “the labour market downshifted to a more modest pace of growth in the final month of 2024, with a slowdown in both hiring and pay gains,” and on sectors, noted that “healthcare stood out in the second half of the year, creating more jobs than any other.” It is worth noting, that analysts continue to caution about the ADP’s predictive power for the official jobs data; Pantheon Macroeconomics writes “the recent track record of ADP’s data has been very poor,” and “since ADP overhauled its methodology in August 2022, the average absolute error of its estimate of initial private payrolls has been 88K, with a massive range, from -337K to +348K.”

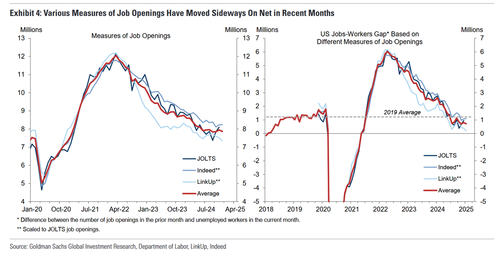

JOLTS: The November JOLTS data (the most recent release, but note that we are due to get the December jobs report this week), a measure said to be looked at closely by Fed officials, showed Job Openings rising to 8.098mln from 7.839mln, with the Vacancy Rate increasing to 4.8% from 4.7%, and the Quits Rate falling to 1.9% from 2.1%. Oxford Economics says that the data painted a familiar picture of the labour market, with the pace of layoffs keeping net job growth positive despite a slow pace of hiring. It added that “the report is unlikely to alter that Fed’s conviction that a slower pace of normalising interest rates in 2025 is appropriate,” noting that “the low quits rate is consistent with the slower pace of hiring and signals further deceleration in wage growth,” while “the ratio of openings to unemployed workers is still below pre-pandemic levels, and therefore doesn’t signal a renewed tightening in the labour market.”

CONSUMER SENTIMENT: The Conference Board’s measure of consumer confidence in December saw consumers’ appraisals of the labour market improve: 37% said jobs were “plentiful,” up from 33.6% in November, while 14.8 of consumers said jobs were “hard to get,” down from 15.2%. However, expectations for six-months ahead returned to being pessimistic, with 19.1% expecting more jobs to be available, down from 22.8% in November, and 21.3% see fewer jobs, up from 17.9%. Additionally, consumers’ assessments of their income prospects were less optimistic in the month, with 17.2% expecting their incomes to increase, down from 20.7% in November, and 14.3% expecting their incomes to decrease, up from 12.1% in November.

BUSINESS SURVEYS: The employment sub-index in the ISM Services PMI has been in expansionary territory for the fifth time in six months, though the index level eased a little, to 51.4 from 51.5; the report noted that respondents’ comments included: “staging for future growth” and “hiring freeze.” Elsewhere, the Manufacturing ISM’s employment sub-index fell to 45.3 from 48.1, and has now contracted for a seventh consecutive month, and the 14th out of the last 15 months.

SEASONAL REVISIONS: Friday’s report will be accompanied by the annual revision to the household survey, with scope for revisions to the last 5 years of seasonally adjusted household data. These revisions are typically minor, often producing small changes to the month-to-month profile of the unemployment rate, although just like the August revision showed, it is possible that there will be an especially large (downward) revision this time.

ARGUING FOR A STRONGER THAN EXPECTED REPORT:

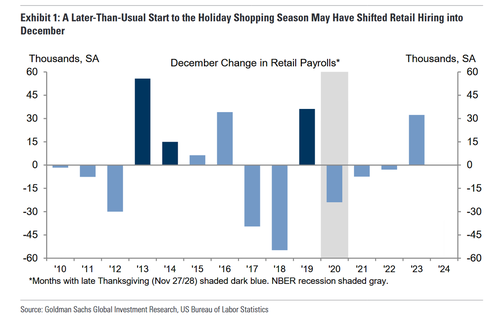

- Retail hiring shifting to December. Thanksgiving—and thus Black Friday and then start of the holiday shopping season—was relatively late this year (November 28th), which likely contributed to weak holiday retail hiring in November. We expect payback in this month’s reading as a greater share of holiday retail hiring is captured in the December survey period. Exhibit 1 shows that December retail job growth tends to be strong in years with similar calendar configurations, increasing by an average of 35k in the last three instances.

ARGUING FOR A WEAKER THAN EXPECTED REPORT:

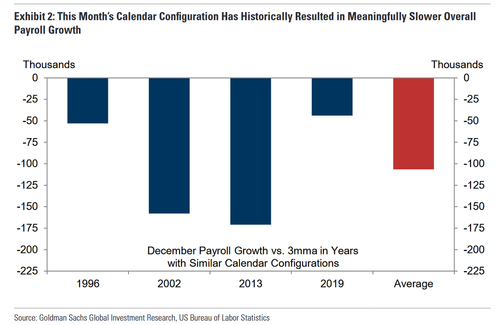

- Seasonal effects. While the later-than-usual Thanksgiving is likely to boost retail hiring, this December’s calendar configuration has historically resulted in meaningfully slower seasonally-adjusted payroll growth on net (Exhibit 2). Goldman expects deceleration in job growth in non-retail sectors, particularly professional services and construction, to more than offset stronger retail hiring this month. Taken together, seasonal distortions pose a 50k headwind to payroll growth.

- Big data. Alternative measures of employment growth decelerated on net in December, indicating an average pace of +136k across the indicators we track (vs. +182k in November).

NEUTRAL FACTORS:

- Employer surveys. Our manufacturing survey employment component tracker increased by 0.6pt to 49.1 while our services survey employment component tracker decreased by 0.2pt to 50.0. However, the signal from survey data has been less useful—and at times misleading—during the post-pandemic period and thus has little bearing on our payrolls forecast.

- Layoffs. Initial jobless claims increased to an average of 225k in the December payroll month from 220k in November. The JOLTS layoff rate was unchanged at 1.1% in November. Announced layoffs reported by Challenger, Gray & Christmas decreased by 19k in December to 39k (SA by GS), compared to 66k on average over the rest of 2024.

- Job availability. JOLTS job openings increased 0.3MM to 8.1MM in November after moving sideways-to-lower on net in recent months. The Conference Board labor differential—the difference between the percentage of respondents saying jobs are plentiful and those saying jobs are hard to get—increased by 3.8pt to +22.2 in December but remained noticeably below the +30.4 average level of Q1 and the 2019 average of +33.2.

FED POLICY: The Fed seems comfortable with the state of the labor market, which is cooling gradually, and its attention seems to be on bringing inflation under control. Chair Powell himself said that the labor market was cooling in a way that was not raising concerns; Fed’s Hammack said the strong jobs market allows the Fed to focus on lowering inflation; Fed’s Daly noted that firms were saying that they can find workers, and workers are saying they can find jobs, and the Fed does not want that to break; Fed’s Barkin was optimistic, stating that the labor market was likely to break towards more hiring rather than towards layoffs; Fed’s Waller said that there was nothing to suggest that the labor market will waken dramatically in the coming months. In terms of the implications for interest rate policy, Powell has said that as long as the labor market and economy are solid, the Fed can be cautious as it considers further rate cuts, but offered his familiar caveat that the central bank can ease more quickly if the labor market weakens unexpectedly or inflation falls more quickly – he also reiterated that downside risks to the labour market have diminished, and it was not a source of inflation pressures. At the time of writing, money markets are not expecting the FOMC to cut rates at its January 29th policy meeting, and are discounting around 40bps of rate cuts through 2025 (implying that one cut is fully priced, with a 60% probability of a second cut this year); by the end of this year, the Fed median projection suggests the FFR could be cut to between 3.75-4.00% from the current 4.25-4.50%.

Turning to the market reaction, where the vol market is pricing in a 1.2% market move on Friday, JPMorgan’s Market Intel desk is, as always, out with its matrix analysis:

- Above 220k. This tail risk may bring renewed fears of inflation especially if hourly earnings print above expectations. Currently, the Fed view is that that the labor market is not a driver of inflation. The risk is that a hotter NFP print pushes the market back to dual-sided risks, repricing the yield curve higher. Should this ignite a sell-off in bonds, the key level in the 10Y is 5%, the cycle high; stocks have reacted negatively on a multi-week or multi-month basis when the 10Y yield has made new highs, during this cycle. SPX loses 50bps – 1%; Probability 5%

- Between 180k – 220k. In the November NFIB report, the net percent of firms planning to increase employment spiked to the highest level in 12 months; these NFIB prints typically precede actual hiring by 3 – 5 months. If we see this print, it may be the first step in an inflection higher in hiring which would have positive impacts on both GDP and earnings. SPX adds 25bps – 75bps; Probability 25%

- Between 140k – 180k. This is the base case with payrolls printing in line with 3mo (173k), 6mo (143k) and 12mo (190k) averages. This print supports the consensus view of above-trend growth in the US and continues to position the Fed to skip changes to policy at the January meeting. SPX adds 25bps – 50bps; probability 40%.

- Between 100k – 140k. A miss in NFP along with an uptick in Unemployment Rate would lead to renewed growth fears; if combined with stronger hourly earnings could return the market to the stagflation narrative, though that will likely require CPI to print materially hotter than consensus, which current shows Headline YoY printing 2.8% vs. 2.7% prior and Core YoY printing 3.3% vs. 3.3% prior. SPX loses 25bps – 75bps; probability 25%.

- Below 100k. The other tail risk is this scenario of NFP printing below 100k jobs. While we have seen two of these prints recently, one was a revision to lower the print below 100k and the other was weather-related. In both cases, the market did not react strongly. On this occasion, a sub-100k print is likely to elicit a stronger, negative response as the market would take it this a part of a slowing that eventually leads to recession, though the more immediate risk is a stagflationary environment. SPX loses 75bps – 1.5%; probability 5%

Turning to Goldman, as noted above the bank’s economists is looking for a headline number of +125k (vs +160k consensus and +227k prior), although according to trader John Flood, the sweet spot for stocks is 100k – 125k: “Too hot and rates will climb higher (which the stock market clearly doesn’t want) and too cold will quickly shift worries from rates to growth.” Here is Flood’s S&P’s reaction function to the headline print:

- >200k: S&P sells off at least 100bps

- 175k – 200k: S&P sells off 50 – 100bps

- 150k – 175: S&P +/- 50bps

- 125k – 150k: S&P rallies 0 – 50bps

- 100k – 125k: S&P rallies 50 – 100bps

- <100k: S&P sells off 0 – 50bps

And here are some thoughts from around the Goldman trading desk:

Adam Crook, FX – Asymmetry to a stronger USD on BEAT.

“On a beat: Likely HF’s feel under-positioned, Real Money accelerate EURUSD selling strategies they started 2nd Jan + US Corporates accelerate hedging programmes –> USD breaking to new cycle highs vs G10, with negative impact for EMFX;

On a miss: Any immediate reaction of weaker USD / stronger EMFX likely to be short-lived: USD-demand returned within 30 mins of the last 2-3 Payroll prints; the market has reduced a lot of USD-length in the last couple of days; and long-USD remains one of the few high conviction market-themes for Q1. We think a retest of the week’s lows in the USD (EURUSD 1.0450, DXY 107.85, USDCNH 7.3150, USDZAR 18.4500, USDMXN 20.2500) will be seen as an opportunity to re-engage/add to core USD-length for post-Inauguration + Q1. (Brauten-Smith, Stewart).

FX Gamma looks fairly priced, we favour Mon-Tues GBPUSD Calls to hedge core USD-length; -) Rates: 2025 FOMC-pricing should be the most reactive to Friday’s Unemployment Rate. Worth noting the Dec SEP distribution of 2025 UER projections: 3 participants revised 2025 year-end forecasts down from the 4.4-4.5 range to 4.2-4.3, with 13 dot plot submitters in the 4.2-4.3 camp; and 14 in the 2-or-fewer-cuts camp. Any 4.4% UER print over the coming months (even on a rounded basis) could quickly result in the market extrapolating December’s information set to a 3-cut baseline (Bingham). Equities: Most +ve reaction for Equities from a print around GS forecasts; Risk to equities is anything that pushes us back to the higher for longer camp. “

Ronnie Walker (US Economist):

“We expect seasonal distortions to weigh on payroll growth and the unemployment rate in Friday’s report. On payrolls, seasonally-adjusted December job growth has slowed both sequentially and relative to trend in each of the last four matching calendar configurations (chart below). With the caveat of a small sample size, this calendar configuration typically sees an acceleration in retail hiring—it follows a late Thanksgiving and thus start to the holiday shopping season, shifting hiring from November into December—that is more than offset by deceleration in other sectors (professional services, construction). Taken in combination with mixed-to-sequentially-weaker signals from the alternative measures of job growth that we track, we’re looking for a below-consensus 125k increase in nonfarm payrolls (consensus 163k, last 227k).

On the unemployment rate, this month’s employment report will be accompanied by the annual seasonal factor revisions to the household survey, with potential revisions to the last 5 years of seasonally adjusted household data. These revisions are typically minor, often producing small changes to the month-to-month profile of the unemployment rate. But because seasonal adjustment tends to smooth outliers, these revisions argue for a modest amount of downward pressure on the high points of the unemployment rate this year (i.e., July, August, Q4). However, despite that headwind, we’re looking for the unemployment rate to round up to 4.3% in this month’s report—a low hurdle from an unrounded 4.246% in the prior month. While the above-normal contribution to labor supply growth from elevated immigration should be moderating on the back of slowing immigration, it’s still likely elevated, and job searchers have faced more challenging job finding prospects in recent months.”

Mike Cahill (Senior FX Strategist):

“I’ve been a bit surprised that the market was so concerned about the labor market last summer and is now seemingly nonplussed, even though the picture looks very similar (and further advanced). I still think the unemployment rate will be the best summary indicator, for two reasons. First, the household survey has been weaker than the establishment survey, and last month was essentially a return to that trend. Second, it’s the indicator that is most directly aligned with the Fed’s mandate of maximum employment. This matters for the market because much of the repricing in rates and FX has been in forward policy expectations, ie the neutral rate. That is essentially a view that the economy can be resilient to policy rates around here, and the labor market has been the clearest counter to that view. And remember that next month’s report looks like another challenging one given the weather impact that probably will linger into the survey week next week. We still think the recent repricing should be durable, but this is the clearest fundamental downside risk to that view and so warrants close scrutiny.”

Kristian Brauten-Smith (G10 FX Spot Trading):

“As things currently stand, the asymmetry in G10 FX is to a beat on Fridays Payrolls print. Something around say 200k with UER at 4.1% would expose the vulnerable side of a market, one who has just spent the best part of 3 sessions reducing Dollar length. EURUSD back through 1.0330/45 would complicate investors decision processes with HFs feeling under-positioned and real money accelerating the EURUSD selling strategies they begun to implement January 2nd. US corporates have started to express an interest to hedge, and a combination of these factors likely accelerates any EURUSD decline on a beat, and dampens the intensity of any rally on a miss ahead of 1.0460. Cable is bucketed in with EURUSD for now after the 200 pip recovery from last Thursday’s sell-off. With Gilts selling off and the OBR updated projections due in the same Quarter (late March) there will be increased scrutiny over how the October budget will ultimately be funded and books balanced. Expect cable to feature in the top 2/3 trades for investors should the Dollar regain its footing. A miss to Payrolls is likely to allow a short term Dollar sell-off and depending on the severity perhaps a more sustained one in something like USDJPY, but we remain conscious of the price action after the last 2 or three readings. Dollar demand seems to come through within 30min of the release either way, and with the markets card prompters for 2025 still reading “long USD” it would take quite a severe miss to counter this pre-inauguration.”

Biran Bingham (Short Macro Trading):

“Relative to the past 5 NFP prints – highlighted by the Aug ’24 miss that catalyzed a 50bp rally in 2024 pricing and opened the door to the Fed delivering 50bps at the subsequent September meeting – focus on Friday’s headline number is comparatively low, given the unique combination of minimal focus on the front meeting vs. a breathtakingly wide distribution of mid-year STIR pricing in advance of Trump’s inauguration. January FOMC pricing is down to a cycle low of just 1.5bps, reflecting the market’s near-certainty that December’s dot plot confirmed a January pause, thereby reducing the convexity of near-term pricing to a single data point. While we believe the sticker-shock of a deviation from the 160k consensus will be short lived, as traders quickly look past q4 hurricane/strike-related impacts (and based on the view that, in absence of a negative headline number, a Jan cut will remain off the table), 2025 FOMC pricing should be most reactive to Friday’s Unemployment Rate, which narrowly avoided ticking up to 4.3% last month. An interesting – and perhaps underappreciated – data point from the Dec SEP was the distribution of 2025 UER projections, which saw 3 participants revise 2025 year-end forecasts down from the 4.4-4.5 range to 4.2-4.3. With 13 dot plot submitters in the 4.2-4.3 camp and 14 in the 2-or-fewer-cuts camp, any 4.4% UER print over the coming months (even on a rounded basis) could quickly result in the market extrapolating December’s information set to a 3-cut baseline. We see asymmetry in optionalized longs as a play for this outcome, either via 2025 FOMC flatteners (June/Sep from -9bps) or receiver spreads on z5 dates.“

Rich Privorotsky (Head of EMEA Cash Equity Trading):

“Think the hopefulness is that we get a NFP somewhere close to the GIR below consensus forecasts. Think the risk to equities, which have been a in a rather choppy trajectory since the Dec FOMC, is anything that pushes us back to the higher for longer camp. The Fed has put a clear preference for inflation relative to growth post Dec and I think data that confirms soft landing will be somewhat of a relief…especially if we see continued moderation in AHE without any material prick up in unemployment. Seasonal distortions are probably less likely to get as much of a pass given the Fed’s focus. An NFP close to the GIR number and I expect to see continued outperformance in duration+ tech and perhaps some moderation in the dollar supporting emerging market equities. On a strong number I would expect to see largely the opposite with credit sensitive/balance sheet sensitive/most short pockets of the market underperforming while duration struggles in a backup in yields. Think equities locally supported this week by low sentiment/mark down in positioning into year end but rates will be somewhat deterministic and if bonds down I would think equities down too.”

Alan Stewart (Head of EMEA EMFX One-Delta Trading):

“My read into Friday’s payrolls is that there is a locational asymmetry that would result in a larger immediate reaction weaker in the USD / stronger in EMFX to a notable miss in the data but that this would be somewhat short lived, whereas the overall macro backdrop as well as the imminent arrival of the new US administration and the market vulnerabilities that this entails, mean that the more sustained reaction would be to any material beat in the data which would likely see the USD break to new cycle highs with obviously negative impact on the broader EMFX space. We do not expect the market to give up on this theme prior to Trump’s inauguration, thus expect any weakness in Friday’s employment report to provide only temporary relief to EM currencies. January FOMC looks likely to deliver a “skip”, which could ultimately prove to be the beginning of a longer pause, and Friday’s data is unlikely to challenge that outlook. Additionally, given the rapid position purge in popular USD length on Monday and Tuesday (that took us back to mid December levels in most crosses), our read is that the market has given up a lot of its positioning in what remains one of the few high conviction market themes for this quarter. Thus a miss on Friday could see a retest of the week’s lows in the USD (EURUSD 1.0450, DXY 107.85, USDCNH 7.3150, USDZAR 18.4500, USDMXN 20.2500) but I would expect these levels to be used as an opportunity to re-engage/add to core USD length. Within the EM space, Asian currencies will likely continue to benefit from smoothing operations which have seen renminbi Cfets basket move to its strongest level in fifteen months – something which strikes us as unsustainable but requiring patience, whilst the CE3 currencies continue to strike us as most vulnerable led by HUF.”

Prateek Mookerjee (G10 FX Option Trading):

“Gamma in FX over payrolls is pretty well priced in our opinion, in the 50-65bp breakeven range for most of G10. Given USD positioning in general is still held long, we feel the harsher gamma moves could be in the USD lower direction although will likely be worth fading as a structural view. With JPY a bit trapped and EUR gamma having been marked up on spreads (gap there higher than USDJPY which is quite rare) we’re going to be playing it via GBP longs even after today’s move higher – positioning there much cleaner, lack of any stops preventing long dealer gamma and the gap being flat to EURUSD feels like an easy hold for GBPUSD here. We’d stick to very short dated expiries for gamma, ideally Mon-Tues slight GBP calls.”

Mike Mitchell (Head of US Government Trading):

“The bond market has traded poorly amidst heavy sovereign and corporate supply to begin this year, and feels a bit on edge as we approach the most important data point of the month. Softer payroll growth or (perhaps more importantly) an unwelcomed further tick higher in the unemployment rate could catalyze a re-richening of whites and reds, while a robust payroll report could challenge existing long positioning at a moment which feels a little precarious in the bond market already. Overall, we think the market is cheap, with very little in the way of further cuts priced into the front end.”

Richard Chambers (Global Head of Repo Trading and Co-Head of Short Term Macro Trading)

“The US market looks cheap and positioning in USD rates remains broadly short. The counter to our thesis is how poorly duration trades in Europe and in gilts adding an extra edge to a potential bond market sell-off on a strong print. There’s much uncertainty on the outcome of rates early this year. Most VaR continues to be deployed in spreads and FX from the macro community until we get a clearer picture. It’s hard to see a the Fed hike into the teeth of strong data in 2025, however the market can move the trough in rates from H6 to late 2025 with March leading the selloff on a strong print tomorrow.”

Arvind Giridhar (Head of US Volex Trading)

Tomorrow’s breakeven on TY is roughly 8.5bps, which continues the trend of recent event vol premia being on the lower side as the market is more focused on the policy outlook & uncertainty. Trump has indicated his view on rates being too high while simultaneously pushing for tax cuts & has emphasized tariffs over spending cuts as an offset. This is a curve steeper impulse, but given the curve has already steepened materially and supply is behind us we prefer to wait for better entry points on the curve. On the front-end, the Fed minutes yesterday seemed to confirm that some on the committee adjusted up their inflation forecasts based not on recent data but on trade policy expectations. Combined with the committee’s reluctance to ease policy in the near term, the front end has rationally reduced the premium for cuts further.