Uddrag fra Zerohedge:

Despite multiple signals that the labor market has slowed down dramatically over the past month, analysts expect the rate of monthly payroll additions to tick up ever so slightly in May to 180K, although remain far below recent averages. With the unemployment rate expected to remain unchanged, wage growth is seen accelerating fractionally on a monthly basis, but remaining unchanged on an YoY basis: as Newsquawk notes, analysts have noted that the Quits Rate in the most recent JOLTs data (for April) is consistent with a moderation in wage pressures ahead.

Other labor market proxies have been mixed in the month, with jobless claims little changed in the survey windows that coincide with the jobs report; elsewhere, the ADP’s gauge of payrolls disappointed to the downside, while ISM surveys both saw a modest tick up in the employment subindex, with the manufacturing sector’s gauge back into expansion territory. Meanwhile, the consumer view of the jobs market has improved in the month. The market reaction will be based on the combination of headline NFPs and the wage metrics; if both came in hot, analysts think it would pressure risk assets, and Treasury yields could rise; conversely, a miss on both may support Treasuries, but equities could succumb to the growth concerns narrative, although Goldman’s derivatives desk believes that dealer positioning would lead to a jump in risk prices in either case.

Let’s take a closer look at the expectations:

- Consensus expects 180k nonfarm payrolls in May, up from the April 175k print if below both the six- and 12-month averages, which are currently at 242k and 234k respectively.

- The range of Wall Street estimates is from 258K on the high side (from Regions Bank) down to 120K on the low end (courtesy of Santander Bank).

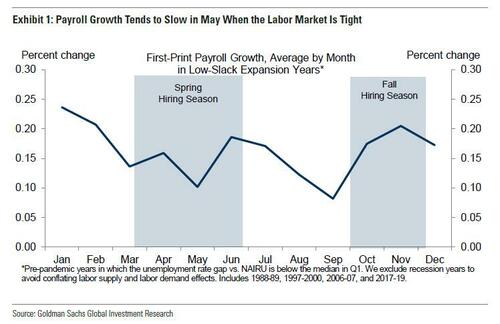

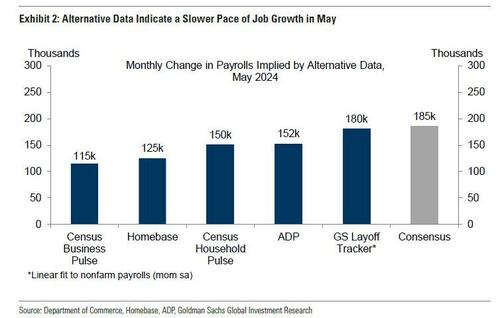

- Goldman, which had been relentlessly and overly optimistic in recent months, has had a change of tune, and now expects a subpar print, with nonfarm payrolls rising by only 160k, somewhat below consensus, because “when the labor market is tight, job growth tends to slow disproportionately during the spring hiring season and particularly in May—when the seasonal factors expect more hiring than is realistic with fewer workers available—and all five of the alternative measures of employment growth we track suggest a below-consensus report.” Then again, since Goldman has been wrong for several months in a row, this argues for a stronger than expected print.

- The unemployment rate is seen unchanged at 3.9%.

- The average hourly earnings rate is likely to pick up in the month, with analysts predicting +0.3% M/M (prev. +0.2%), though the annual rate of average earnings is seen unchanged at 3.9% Y /Y.

Some more details courtesy of Newqsuawk

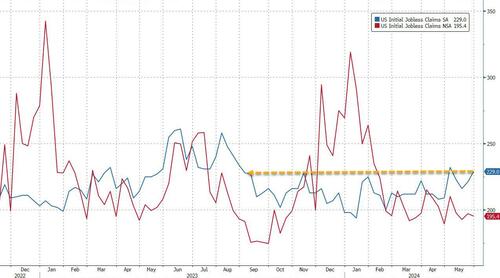

WEEKLY CLAIMS: Initial jobless claims data for the week that coincides with the jobs report’s survey period saw initial claims at 216k (vs 212k going into the April jobs data) while continuing claims ticked up from 1.774mln in the April period to 1.791mln in the May comparable window. “Initial claims for the May payroll reference period were broadly in line with April’s, suggesting that the May nonfarm employment numbers are likely to remain solid,” Oxford Economics said. “Job growth is likely to moderate further as the labor market rebalances, but we expect that will continue through a slowdown in hiring, not a notable pickup in layoffs.”

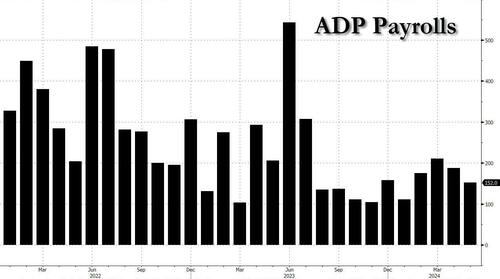

ADP DATA: The ADP’s gauge of private payrolls reported additions of only 152k jobs in the month, missing expectations of 175k, with the payrolls services provider stating that both job gains and pay growth are slowing going into the second half of the year. “The labour market is solid, but we’re monitoring notable pockets of weakness tied to both producers and consumers,” its chief economist said. Within the ADP report, the median change in annual pay for job stayers was unchanged at +5.0% Y/Y, while the measure for job changers declined to 7.8% Y/Y from 9.3% in April; ADP said pay growth was also slowing into H2 of 2024.

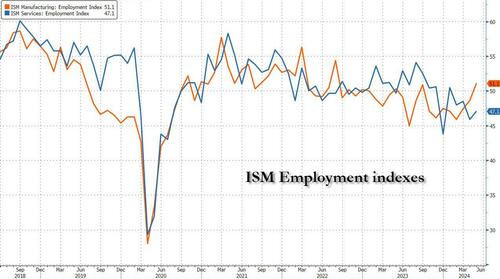

BUSINESS SURVEYS: In the May ISM Services PMI Data, the employment sub-index contracted for the fifth time in six months, though at a slower rate, printing 47.1 from 45.9 in April. ISM said that “employment challenges remain, primarily attributed to difficulties in backfilling positions and controlling labor expenses,” adding that “the majority of respondents indicate that inflation and the current interest rates are an impediment to improving business conditions.” Meanwhile, the Manufacturing ISM’s employment sub-index printed 51.1 in May from 48.6 in April, back above the 50 mark (which separates expansion and contraction) following seven straight months of being in contraction. ISM said that many respondents “are continuing to reduce head counts through layoffs (which accounted for 38% of reduction activity, down from 50% in April), attrition and hiring freezes.” Respondents indicated an increase in staff reductions compared to April. “The approximately 1-to-1 ratio of hiring versus reduction comments is consistent with activity from November 2023 through March,” ISM said.

CONSUMER SURVEYS: Within the Conference Board’s gauge of US consumer confidence, consumers’ overall assessment of the present situation was bolstered by the strong labor market. “Views of current labor market conditions improved in May, as fewer respondents said jobs were ‘hard to get,’ which outweighed a slight decline in the number who said jobs were ‘plentiful.’ Ahead, the Conference Board said that fewer consumers expected deterioration in future business conditions, job availability, and income.

FED: The Fed’s most recent Beige Book, released at the end of May, noted that employment rose at a slight pace overall. It went on to say that a majority of Districts noted better labour availability, though some shortages remained in select industries or areas. The report stated that multiple districts said employee turnover had decreased, and hiring plans were generally mixed among the districts. Meanwhile, wage growth remained mostly moderate, though some Districts reported more modest increases. Several Districts reported that wage growth was at pre-pandemic historical averages or was normalising toward those rates. Speaking in mid-May, Fed Chair Powell said that the US jobs market was very strong, with shortages still apparent in many industries, though it was coming back into better balance (he cited the JOLTs data, which has been cooling, the falling quits rate, surveys, as well as easing wage growth), with the job market now about as tight as it was pre-pandemic. While there was a gradual cooling in the labour market, Powell still expects it to remain strong while rebalancing. Powell has also previously said that if any unexpected weakening in the labour market was observed (he emphasised ‘unexpected’), then that could draw a policy response. At present, the Fed’s economic projections (which will be updated at the June 12th FOMC confab) see the jobless rate rising to 4.0% this year, and Powell has also suggested that a couple of tenths in the unemployment rate would probably not qualify as “unexpected weakening”.

ARGUING FOR A WEAKER-THAN-EXPECTED REPORT

- Labor supply constraints. When the labor market is tight, seasonally-adjusted job growth often slows disproportionately in the spring, when the seasonal factors expect more hiring than is realistic with fewer workers available. This effect is particularly pronounced in May, with average payroll gains ~90k below the full-year average. The arrival of the youth summer labor force tends to ease these constraints in June and July, consistent with a peak drag on job growth in the May report.

- Big Data. Alternative measures of employment growth indicate a solid but slowing pace of job growth in May, with a median pace of +150k across the five indicators Goldman tracks. This is somewhat below the +192k median of these measures in April

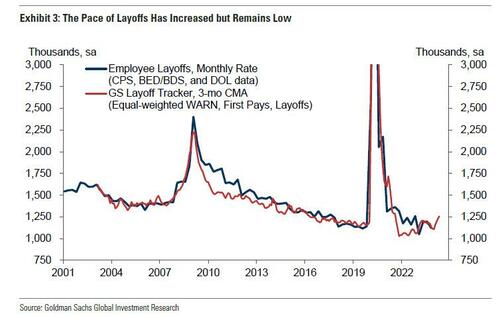

- Layoffs. Layoff activity increased from low levels in May, with the GS layoff tracker edging 0.1mn higher to 1.3mn. Initial jobless claims edged up to an average of 218k in the May payroll month from 215k in April but remained below the 223k average of 2023. The JOLTS layoff rate was unchanged at 1.0% in April. Announced layoffs reported by Challenger, Gray & Christmas decreased by 3k in May to 58k (SA by GS), compared to 54k on average in the second half of 2023. All that being said, the period of seasonally elevated layoffs at the turn of the year is now behind us, which implies that the pace of layoffs will be a less important determinant of net job gains in May.

ARGUING FOR A STRONGER-THAN-EXPECTED REPORT

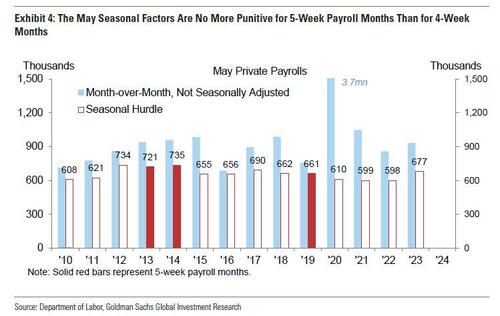

- A longer-than-usual May payroll month. Goldman expects a 50-80k boost from the longer-than-usual May payroll month. The May seasonal factors have been roughly unchanged over the last few years, with a month-over-month hurdle of 600-700k for most of the last decade (private payrolls). Importantly, the hurdles for 5-week payroll months (solid red bars in Exhibit 4) and the hurdles for 4-week payroll months (outlined red bars) are of similar magnitudes. While the seasonal factors in principle adjust for these effects, it appears they may have been distorted by a weak payrolls reading in May 2019, which was also 5 weeks long.

NEUTRAL FACTORS

- Job availability. JOLTS job openings declined 0.3mn to 8.1mn in April, and online measures have trended lower from high levels. While labor demand has fallen meaningfully over the last year, it remains elevated by 1mn relative to 2019 and represents a positive factor for job growth, in our view. The Conference Board labor differential—the difference between the percent of respondents saying jobs are plentiful and those saying jobs are hard to get—edged up by 1.1pt to +24.0 in May but remains below the +30.4 average level of Q1.

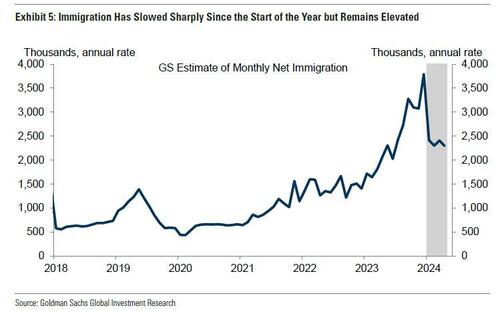

- Immigration. Elevated illegal immigration boosted labor supply by roughly 80k per month last year, relative to normal, with Goldman expecting a continued tailwind averaging 50k per month this year. While the next chart shows that the pace of immigration has slowed sharply since the start of the year, the still-elevated level of job openings and the ramp-up of the spring hiring season could contribute to a higher share of recent immigrants finding jobs during the May survey period.

- Employer surveys. The employment components of business surveys edged lower on net and remained at contractionary levels in May. The employment component of our manufacturing survey tracker decreased 0.2pt to 48.2 while the employment component of our services survey tracker decreased 0.4pt to 48.0. However, as we recently discussed here, the signal from soft data has been less useful—and at times misleading—during the post-pandemic period and thus has little bearing on our payrolls forecast.

Turning to market expectations, Goldman’s John Flood notes that the options market is pricing in a 80bps move for S&P through tomorrow’s close.

Answering the question that is on everyone’s lips, namely whether “bad payrolls news will be good news for the market” the Goldman trader writes that in his view, the set up into the print remains favorable for stocks (“I have goldilocks zone in the low 100s as stocks continue to cheer for a palatable slowdown”). Stripping out headline print (knowing the other factors are also key, especially AHE, stocks don’t want to see acceleration here) this is the framework he is using for S&P’s reaction function…

- <50k S&P + 50bps

- 50k – 100k S&P +75 – 100bps

- 100k – 150k S&P +100bps

- 150k – 200k S&P + / – 50bps

- 200k – 250k S&P -50bps

- 250k – 300k S&P -75bps

- >300k S&P sells off more than 100bps

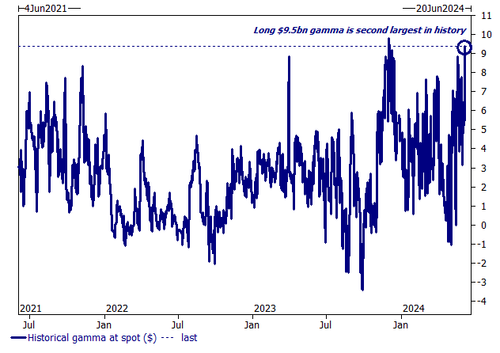

A more nuanced take comes from Goldman derivatives trader Brian Garrett who earlier wrote that tomorrow’s NFP is coming at a time when S&P index market makers are the longest of spot $ gamma in history, but net short the upside tail.

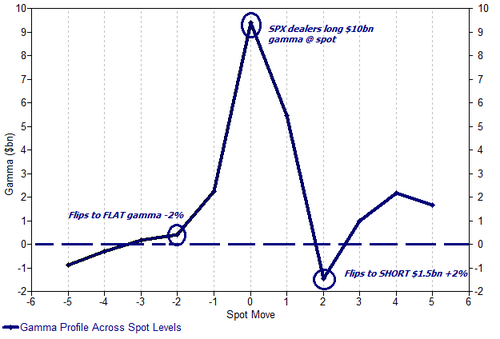

Garrett also notes that S&P 5350 is the magnetized strike, with ~$9.5 billion of gamma to trade per 100bps; dealers have to sell 35,000 eminis on a 1% rally, and buy 35,000 eminis on a 1% sell off (vol dampening).

So, “if” the number comes in softer than expected (Goldman expects 160k vs median consensus calls for 180K) and threads the “no recession” needle, there is a chance spx breaks to new highs. On the other hand, “if” S&P break out to new highs, it can spark a larger rally into the “wings” (+2% node) as dealers go from selling spoos to chasing spoos.

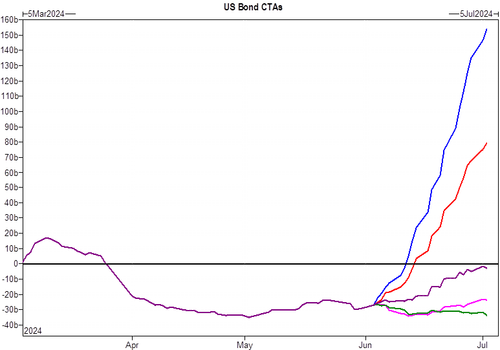

Furthermore, according to the Goldman MAPS FICC desk, “June kicked off with the strongest 3-day period for US duration since January month-end, suggesting market participants have pre-priced a weaker-than-consensus print. However, yields may have more room to rally in an miss-to-consensus print, given (1) Powell’s May FOMC reaction function (2) the broader narrative surrounding labor data (3) positioning/CTAs and (4) a more favorable macro backdrop post-OPEC.”

The implication here is that a further decline in yields will be favorable for risk assets, and could lead to a self-reinforcing meltup as CTAs cover their bond shorts.

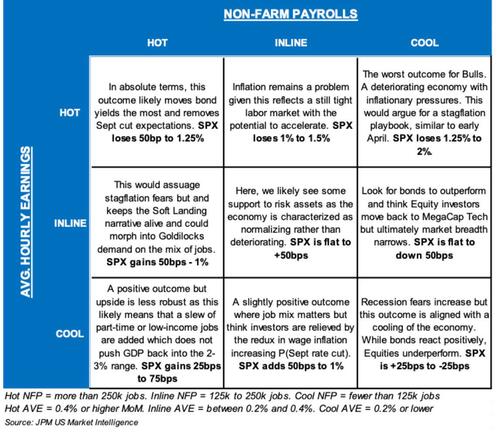

Finally, turning to that “other” bank, its chief economist Michael Feroli is even more downbeat thatn Goldman, and expects only 150k jobs being added, below the Street’s estimate of 180k. For average hourly earnings, he sees a MoM print of 0.3%, in line with the Street. As for the JPM trading desk, here is its scenario analysis for tomorrow’s number: