Uddrag fra Wall Street Journal og Zerohedge:

This morning, with a few short hours until Trump’s swearing in, The Wall Street Journal reports that Trump is planning to issue a broad memorandum Monday that directs federal agencies to study trade policies and evaluate U.S. trade relationships with China and America’s continental neighbors – but stops short of imposing new tariffs on his first day in office, as many trading partners feared.

The Wall Street Journal reviewed a summary of the memo and spoke to Trump’s advisers about it.

A senior Trump policy adviser described the memo as an effort to lay out a vision for Trump’s trade agenda “in a measured way,” suggesting that the incoming president is, at least for now, taking a more deliberative approach to the issue that animated his political campaign.

The memo provides a blueprint for further executive action that Trump may take on trade, the adviser said.

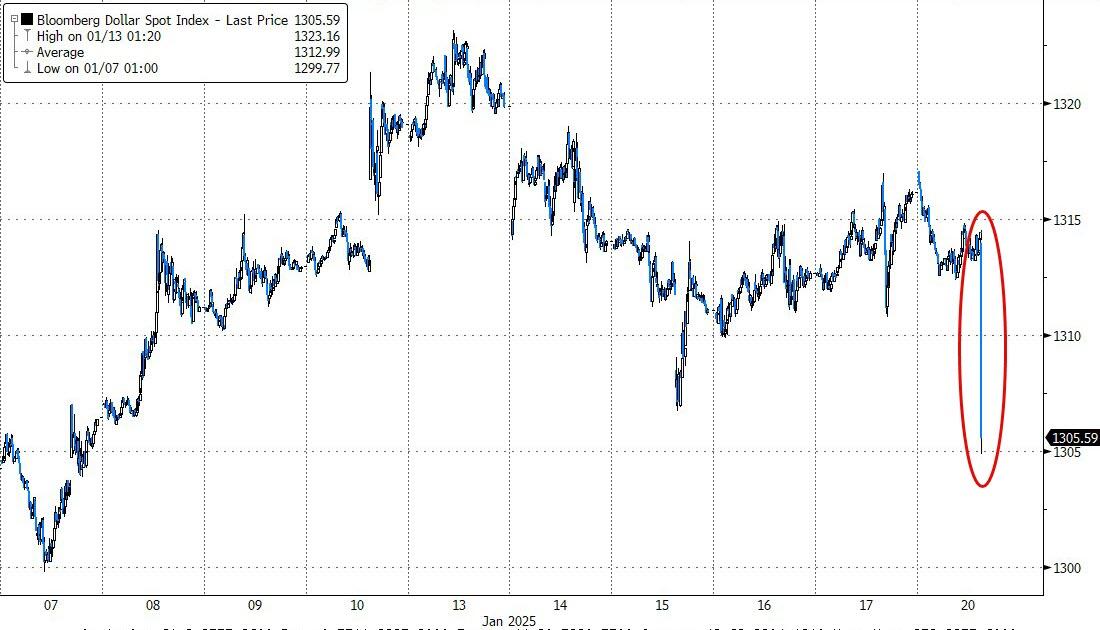

The immediate reaction was a collapse in the dollar…

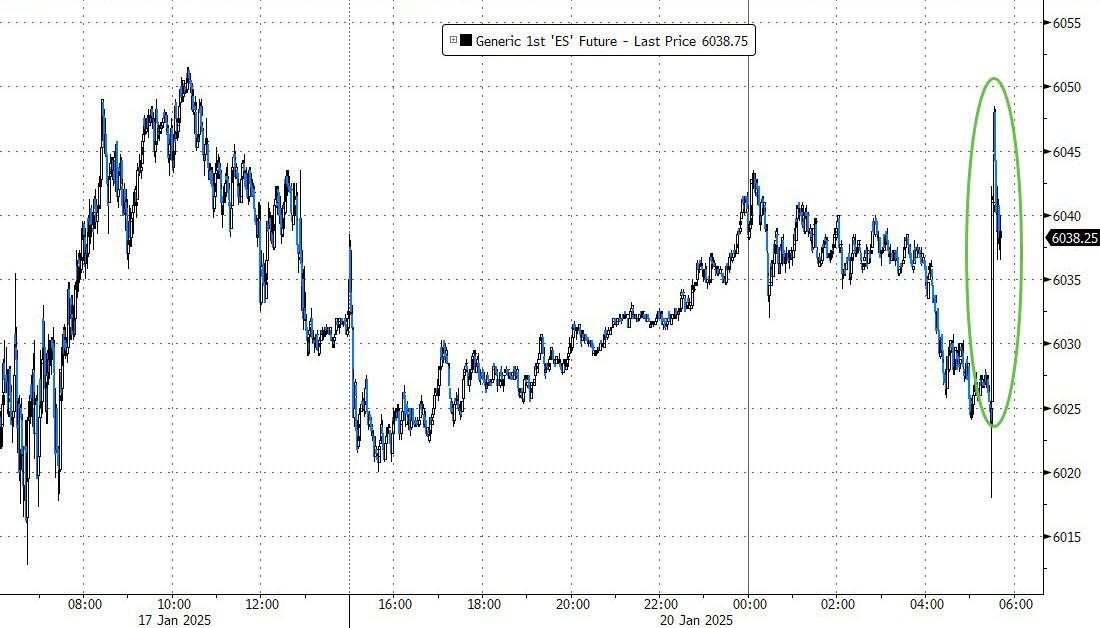

And a spike higher in S&P futs…

Additionally, the memo directs economic agencies to focus on a few specific trade themes, such as reducing persistent trade deficits – countries that consistently export more to the U.S. than they import from it. And it directs a focus on currency manipulation, which Trump singled out China and Vietnam for during his first term, as well as combating counterfeit products.

Finally, the memo asks agencies to evaluate the feasibility of an “External Revenue Service” – a new federal agency Trump has floated to collect tariff revenue. Exactly how that agency would differ from U.S. Customs and Border Protection, which has held that responsibility for decades, hasn’t been spelled out.