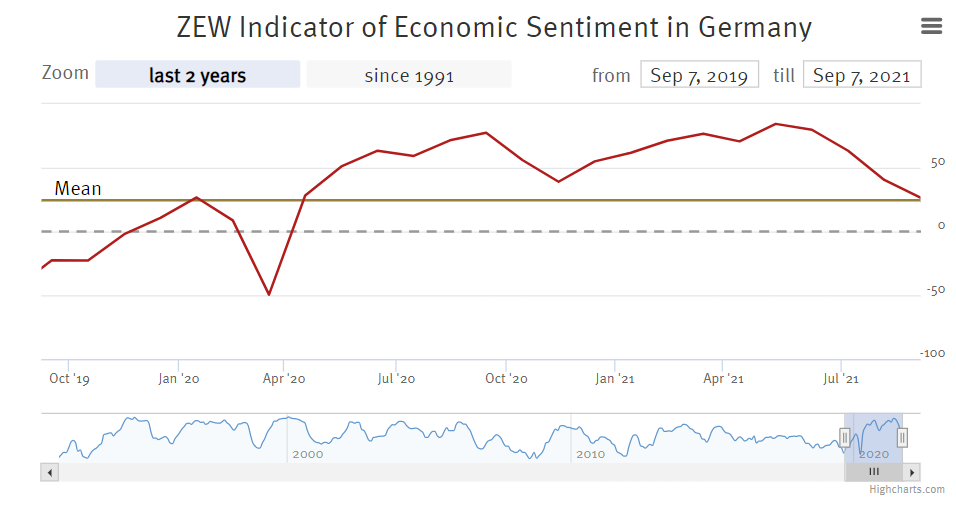

Den seneste ZEW-indikator for tysk økonomi viser, at forventningerne er faldet for fjerde måned i træk. Ganske vidst er der sket en stigning i vurderingen af situationen her og nu, men alt i alt tyder indekset på, at den tyske vækst kun vil stige ganske svagt i de kommende seks måneder. Det er globale forsyningsproblemer, der er den væsentligste årsag til de faldende forventninger.

Economic Expectations Fall, Assessment of Current Situation Improves

“Expectations fell markedly once more in September 2021. Although financial market experts expect further improvements of the economic situation over the next six months, the expected magnitude and the dynamics of the improvements have decreased considerably. Global chip shortage in the automobile sector and shortage of building material in the construction sector have caused a significant reduction in profit expectations for these sectors. This may have had a negative effect on economic expectations,” comments ZEW President Professor Achim Wambach.

The financial market experts’ sentiment concerning the economic development of the Eurozone also decreased for the fourth consecutive time in September 2021, bringing the indicator to a current level of 31.1 points. This is 11.6 points lower than in the previous month. The indicator for the current economic situation in the Eurozone climbed 7.9 points to a level of 22.5 points compared to August 2021.

Inflation expectations continue their decline. The inflation indicator for the Eurozone decreased by 22.1 points to a new reading of 20.1 points. The experts therefore expect inflation to decline over the next six months.