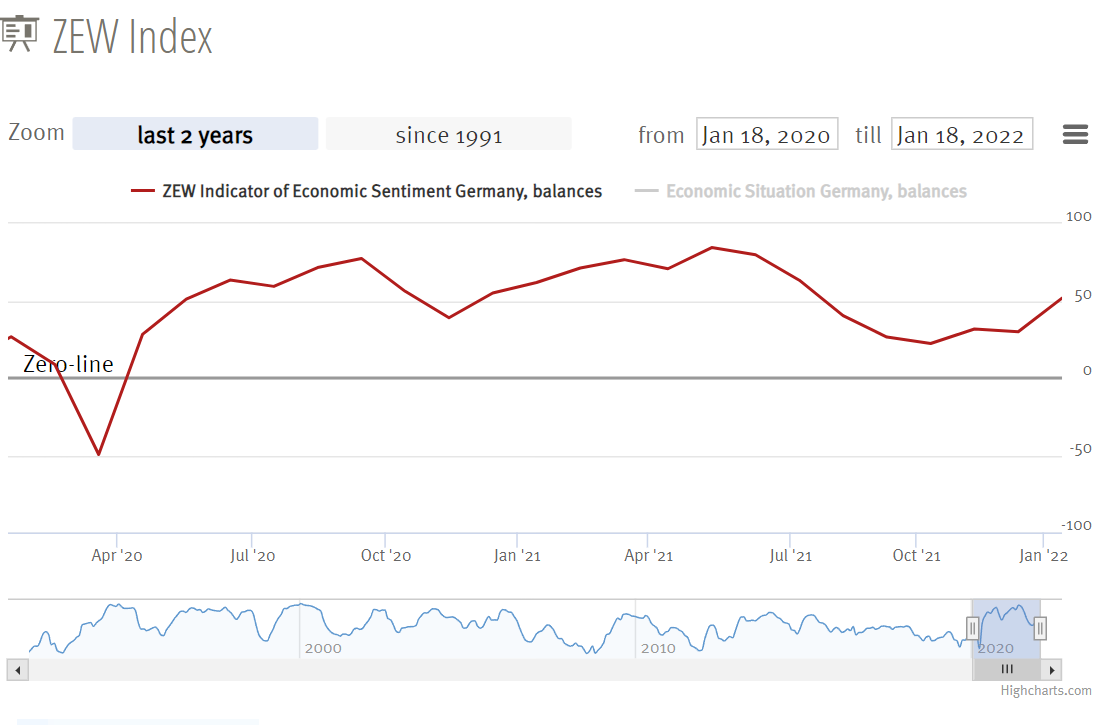

Den seneste ZEW-indikator for tysk økonomi peger på en klar forbedring i de kommende måneder, selv om indikatoren viser en negativ holdning til den aktuelle situation. Indikatoren bygger på opfattelsen fra finansielle økonomer, og de ser en forbedring af pandemien og en forbedring af forbruget samt eksporten i de kommende seks måneder. Indikatoren steg med 21,8 point til 51,7 point.

Significantly More Optimistic Outlook

The ZEW Indicator of Economic Sentiment Stands at 51.7 Points

The financial market experts’ sentiment concerning the economic development of the eurozone increased by 22.6 points in January and currently stands at 49.4 points. The situation indicator fell to a new level of minus 6.2 points, dropping 3.9 points compared to December 2021.

Inflation expectations for the eurozone continued to decline in the current survey. The indicator currently stands at minus 38.7 points, which corresponds to a decrease of 5.4 points compared with the December result. 58 per cent of the experts expect the inflation rate to decline in the next six months.