Fra Goldman/ Zerohedge:

The past few months can best be characterized as a period of unprecedented market optimism and sheer euphoria, and we have done just that with several recent articles…

- Dec 1: Market Euphoria Surpasses Dot Com Levels: What’s An Investor To Do?

- Dec 2: Citi Warns Most “Euphoric” Market Since Dot Com Bubble

- Dec 6: JPMorgan Warns Crowded Trades And Euphoric Consensus Are The Biggest Threats For Markets

- Dec 15: Record Wall Street Euphoria Triggers First BofA “Sell Signal” Since February 2020

- Dec 17: Euphoria Goes To 11: Futures, Global Markets, Bitcoin Soar As Dollar Collapse Continues

… and so on. But whereas in the recent past, the euphoria was always bounded by the upper limit reached during the insatiable buying spree of the dot com bubble, the first week of 2021 is when we went off the chart. Literally. As we showed last week, Citi’s latest Panic/Euphoria model hit a record reading of 1.83 versus an upwardly revised 1.69 in the prior week.

What does this mean? It’s simple: as Citi chief economist Tobias Levkovich wrote last Friday when looking at market returns following previous euphoria extremes, there is now a “100% historical probability of down markets in the next 12 months at current levels.”

Judging by the market action in the subsequent week which saw the S&P slide 1.5%, the Citi economist may be right, and the selloff is only just starting. Then again, the market has a tendency to do the opposite of what consensus expects it to do – and right now consensus among even the most bullish banks is that the next move in stocks will be lower – which is why the fact that Citi’s call for a selloff becoming consensus, make us wonder if the next move in stocks won’t be much higher instead.

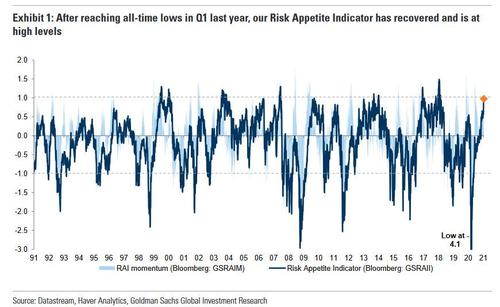

Case in point, in the latest Goldman Portfolio Research Strategy report, Christian Mueller-Glissman writes that Goldman’s Risk Appetite Indicator (RAI) reached a reading of 1 this week – the highest in 4 years and just shy of an all time high – after a large increase in risk appetite since Q4 last year.

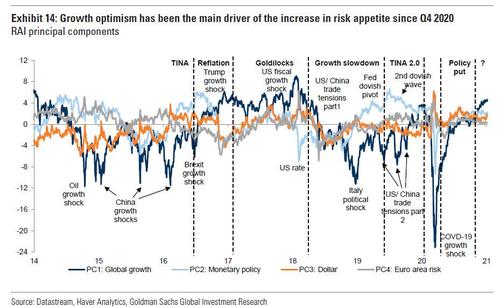

How did we get to such a high reading?

As Goldman explains, this was largely on the back of growth optimism in 2021, and while the bank expects monetary policy to remain supportive, “we see less potential for much more positive impulses from here. Following the news of a successful COVID-19 vaccine in November, growth optimism has broken out and shifted further into positive territory since Q4 as markets have become more optimistic on the prospects for reflation.” These various dynamics are shown below:

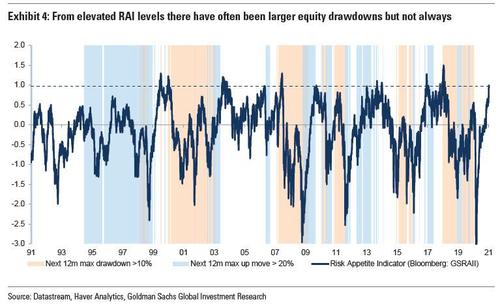

The Goldman strategist then notes that he has “seen a similar bullish shift in other sentiment and positioning indicators” and explains that while “sentiment and positioning alone are seldom a catalyst for a reversal, at extremes they increase that risk in the event of shocks.” Furthermore, “they are often a better contrarian signal on the way down as markets tend to overshoot faster during ‘risk off’ episodes – on the flipside risk appetite tends to build up slowly and can remain positive for a long time with a supportive macro backdrop.”

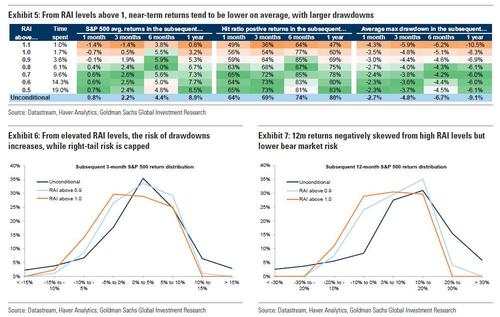

At this point, Goldman basically repeats what Citi said last week, warning that “from RAI levels close to 1 the asymmetry to add risk is worse: subsequent equity returns, especially in the near term, tend to be more negatively skewed and there is increased risk of drawdowns.”

Furthermore, at current RAI levels the market is more vulnerable to negative growth nor rate shocks in the near term, such as monetary and fiscal policy disappointments or more negative COVID-19 news. The key driver of risk appetite in the coming months is likely to be growth and reflation sentiment –we don’t expect more positive impulses from monetary policy.

That said, Goldman isn’t telling its clients to sell just yet because as Glissman writes, “risk appetite can stay at elevated levels for prolonged periods as long as the macro backdrop remains supportive” and explains further:

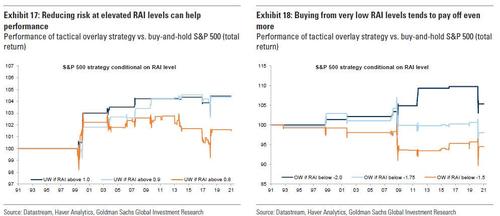

the RAI only tends to be at extremes for short periods of time: for example, the RAI has spent just 1.1% of the time below -2 and 1.7% of the time above 1. Still, adjusting equity allocations tactically based on RAI signals has enhanced returns: Exhibit 17 and Exhibit 18 show strategies that only invest 80% in the S&P 500 (the rest in T-Bills) if the RAI is high and 120% (with leverage) if it is very low. But the improved performance was captured only on a few days – for example, the RAI on average time spent only 6 consecutive days above 0.9.

On the other hand, “periods when the RAI declined back to zero from elevated levels have on average delivered positive, albeit slower, returns for risky assets.”

This is Goldman’s base case for the rest of 2021, and is why the bank remains pro-risk in its asset allocation, and expects the S&P to rise to 4,100 by the end of the year, and 4,400 in two years.

Which is odd, because Glissman also warns that a backtest of extreme RAI readings, shows that it is a good contrarian signal.

The problem is that while the right move here may well be to sell, the question is when: as Goldman explains, market timing with the RAI alone is difficult as it tends to spend little time at extremes. Still, not even Glissman can deny that what is coming won’t be pleasant – contrary to the recos from Goldman’s chief equity strategist David Kostin – and concludes that “when the RAI is above 0.9 and until it normalizes below 0.75, it has been a good time reduce risk tactically.”