Uddrag fra Goldman Sachs:

As 2026 gets going, Goldman Sachs Global Economics Research team use 10 of their favorite charts to illustrate the key global themes that stood out this past year and are likely to shape the year ahead.

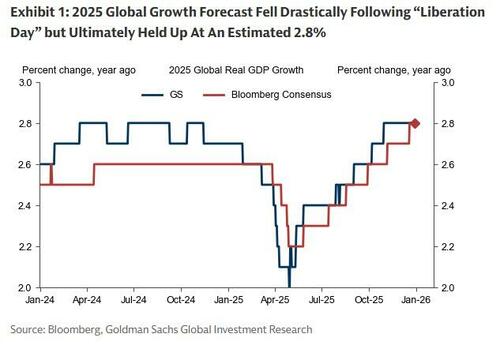

Global growth held up well in 2025.

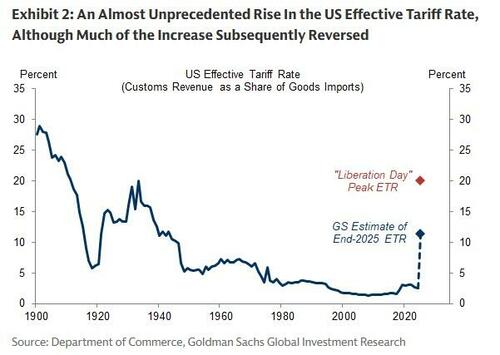

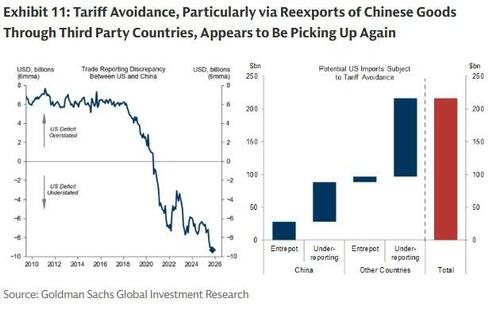

While a larger than expected increase in US tariffs led to a sharp downgrade to our GDP forecasts in April, the growth outlook improved due to a rollback in tariffs and resilient activity (particularly in China and Europe).

As a result, our 2.8% global GDP growth estimate for 2025 stands a touch above the 2.7% we predicted a year ago.

We are again optimistic on the global growth outlook for 2026 (2.8% GS vs. 2.5% consensus).

We expect the US will outperform (2.6% vs. 2.0%) because of reduced tariff drag, tax cuts, and easier financial conditions.

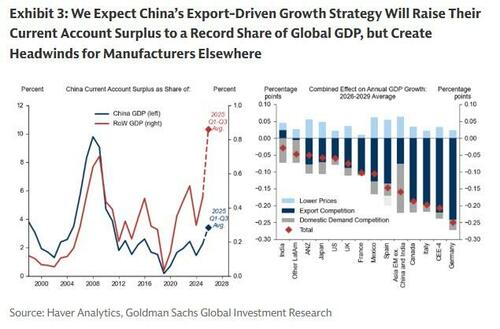

We expect China will outperform (4.8% vs. 4.5%) due to strong export growth, although increased Chinese supply will likely create headwinds for foreign manufacturers.

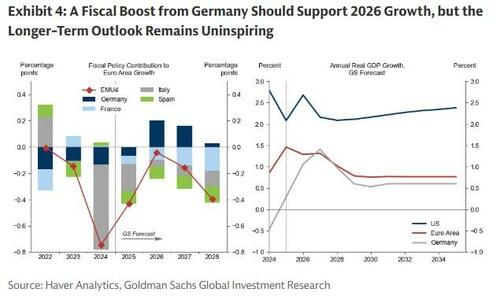

And our Euro area growth forecast is also slightly above consensus (1.3% vs. 1.2%), largely due to our expectations for fiscal stimulus in Germany.

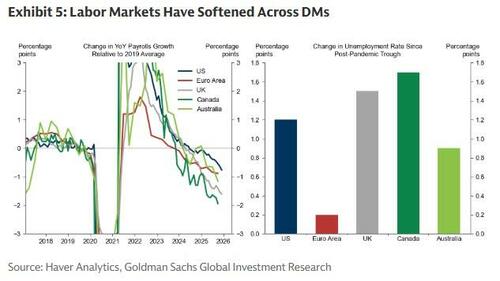

Despite our positive growth forecasts, softer labor markets…

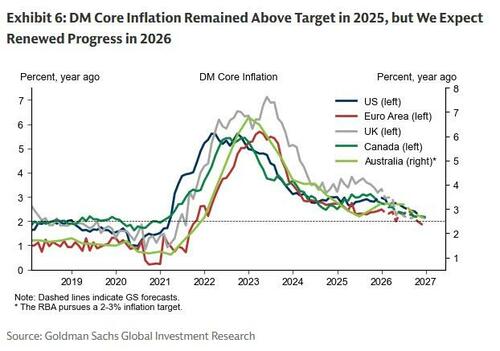

…and renewed inflation progress…

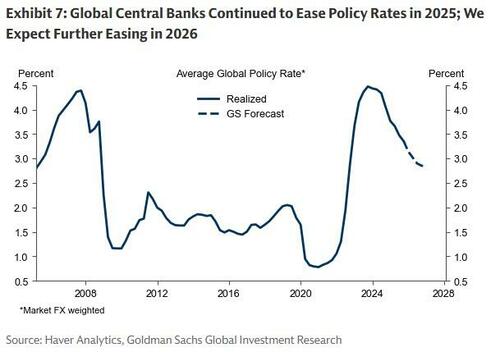

…set the stage for further central bank policy easing, particularly in the US, UK, Norway, Brazil, and CEEMEA.

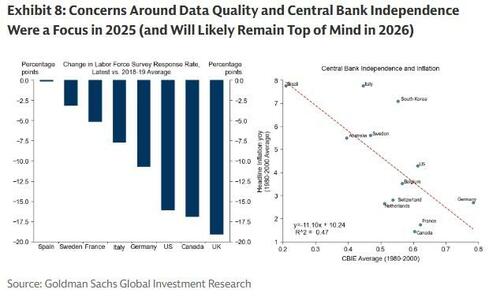

In the US, we expect that concerns around central bank independence will extend into 2026, and see the upcoming change in Fed leadership as one of several reasons why risks around our Fed funds rate forecast skew dovish.

The economic impact of AI was a top story in 2025 and will remain so in 2026.

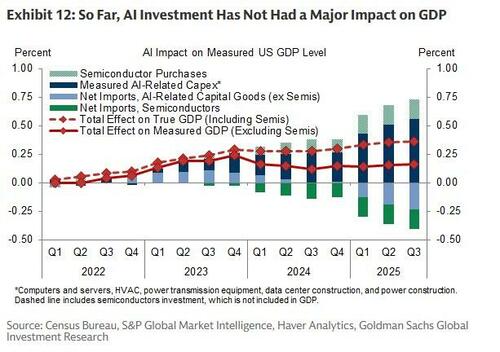

While AI-related capex has clearly surged, the impact on GDP has been minimal – since semiconductor purchases are not recorded as investment and imported equipment is netted out of overall GDP…

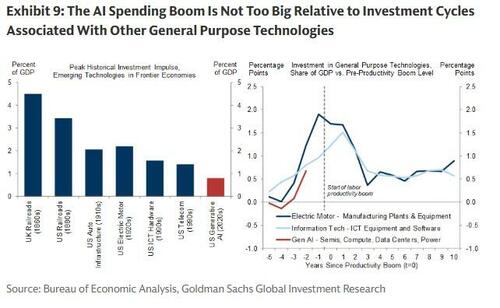

…and the AI spending boom does not look particularly large when appropriately benchmarked against investment cycles associated with other general-purpose technologies.

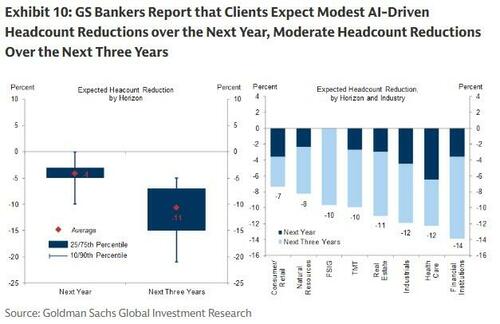

The labor market impacts from AI appear limited so far, but we expect hiring headwinds to emerge going forward, consistent with surveyed expectations of GS investment bankers.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her