| AI’s not the problem. Euphoria is | | No, this isn’t a “we hate AI” note. It’s a trading technical read on a market that’s gone full parabolic. For the first time in over a year, every indicator we track in Mag7 is flashing red contrarian sell. The indicators don’t care about narratives. This isn’t a fundamental hit piece. It’s a derivatives trade – with the main focus on the complacency we see in the options markets. The Mag7 trade has become the most crowded bet on Earth, and the last time sentiment looked this one-sided, drawdowns weren’t polite. The signals are clear unfortunately — the timing never is – but we are betting it is sometime between now and January. |

|

| Drawdowns do happen | | This chart shows Mag-7 versus S&P500. Point here is that the outperformance has been insane AND drawdowns do actually happen. We are not asking for a 22-style event but why not a mid-24 or early 25? |  Bloomberg Bloomberg |

|

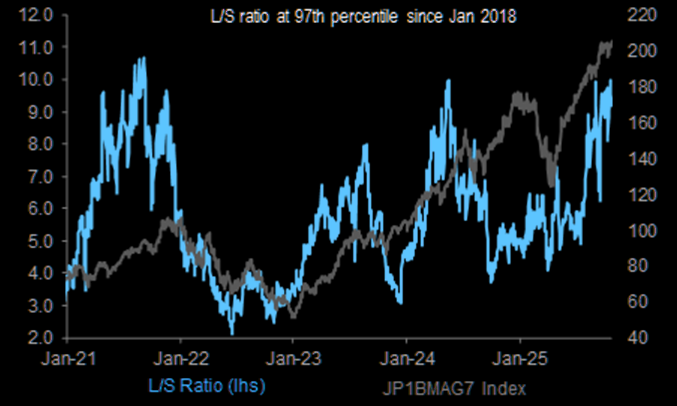

| Hedge funds love Mag7 | | Hedge funds are very bullish Mag7 stocks. |  JPM PI JPM PI |

|

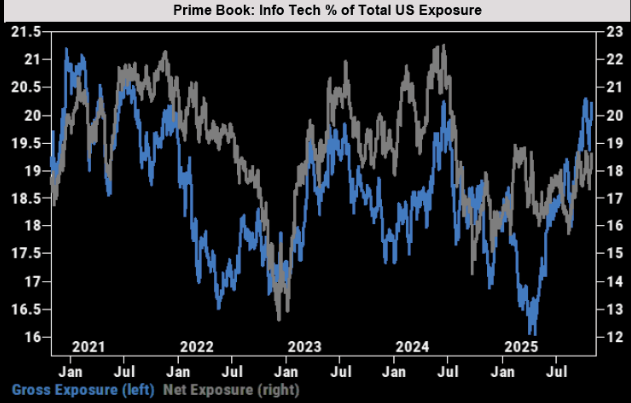

| Most net bought | | “Info Tech was the most net bought US sector last week. The notional short covering in the sector was the largest in 4 months.” (GS PB) |  GS GS |

|

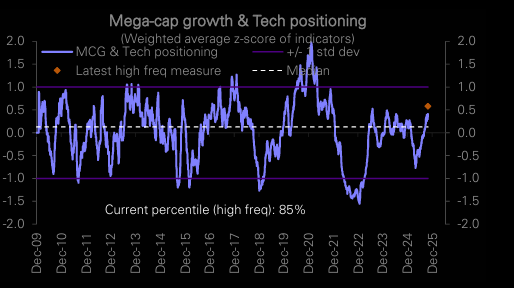

| More on positioning | | This chart from Deutsche Bank tracks overall positioning in “Mega-cap growth & Tech”. It is not as high as in 2022 but still, the latest jump (the dot) is taking us to a multi-year high. |  Deutsche Bank Deutsche Bank |

|

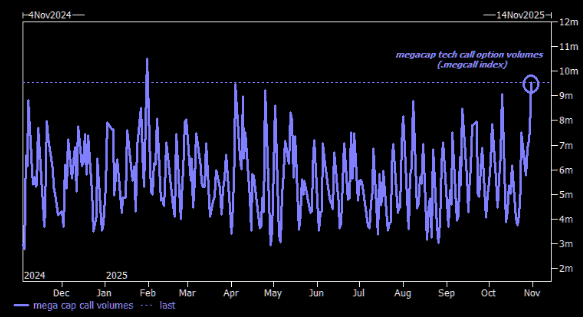

| The view from the options markets | | MAG7 options call volumes exploding to the upside. The only fear is FOMO to the upside. |  GS GS |

|

| Downside is not in fashion | | The crowd has been busy resetting skew lower over the past weeks. The panic NOT have downside hedges is not sound. |  LSEG Workspace LSEG Workspace |

|

| Extinct | | Shorts in NVDA have been on a steady decline. Chart shows % shares outstanding. |  LSEG Workspace LSEG Workspace |

|

| Lone wolf | | There is only one analyst with a sell on NVDA. It did not use to be that extreme during most part of the rally. Furthermore, the average target price does now have >15% upside vs. current share price. It also did not use to be like that during most part of the rally. Analysts were behind the curve. Not anymore. They are all caught up in the euphoria. |

|

| When NVDA looks “poor” | | Some of the high flying names in Asia have really left NVDA behind. From the top: SK Hynix, Advantest, Samsung electronics, NVDA (% YTD). How does this fit into the “sell narrative”? It is at the very last innings of a bull that the peripheral 2nd derivative proxies go crazy and make even the “core” look normal. |  LSEG Workspace LSEG Workspace |

|

| Bro signals downside | | NVDA and BTC have traded in close tandem for a long time. Driven by the same market psychology? The latest gap has our attention. |  LSEG Workspace LSEG Workspace |

|

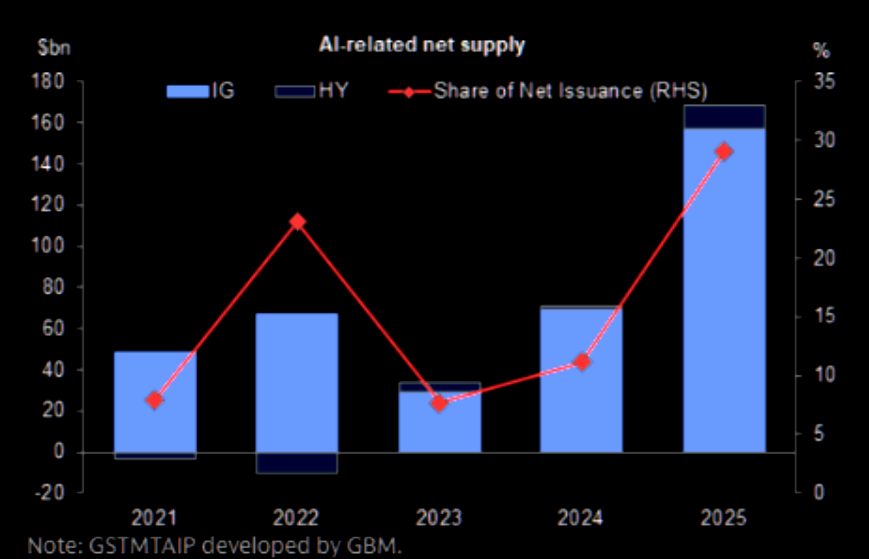

| LQD signals downside | | LQD vs. SPX gap at rather short term wide levels (note LQD went ex div yesterday, but the gap is still worth watching). The sell off in LQD is not due to credit being weaker… this is massive AI supply that needs to be absorbed. |  LSEG Workspace LSEG Workspace |  GS GS |

|

| Need a pause | | MAG has come a long way. Note we are trading close to the upper trend line. Channel lows and the 50 day are way lower… not to mention the 200 day. At the peak of the 2024 melt-up, MAG sat about 28% above its 200-day. We’re right back there again. |  LSEG Workspace LSEG Workspace |

|

| How to play it via options | | QQQ has traded inside the perfect trend channel since May. We have left the lower part of the channel and the 50 day behind. A 5% pullback and we would still trade just above the 50 day. One way to play a possible move lower is via put spreads. Chart 2 shows the QQQ Jan26 620/590 put spread, around 4.6x max. |  LSEG Workspace LSEG Workspace |  LSEG Workspace LSEG Workspace |

|