Exxon Mobil Corp har for første gang offentliggjort data om sine drivhusgasemissioner. Det er en god start men stadig langt fra hvad den store oliegigant skal gøre for at overbevise aktionærerne om engagementet i energiomstillingen, vurdere analytikere ifølge S&P Global.

I sin “2021 Energirapportering, der blev frigivet den 5. januar, rapporterede Exxon scope 3-drivhusgasemissioner fra sin upstream-sektor til sandsynligvis at være på i alt 570 millioner tons CO2-ækvivalent i 2019.

I en gennemgang skriver S&P Global:

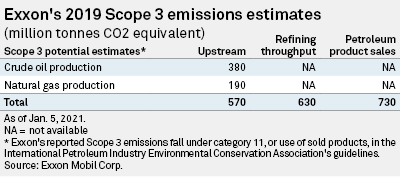

In its “2021 Energy and Carbon Summary” released Jan. 5, Exxon reported Scope 3 greenhouse gas emissions from its upstream sector likely totaled 570 million tonnes of CO2 equivalent in 2019. In addition, Scope 3 emissions, which include those across its supply chain right down to end-user emissions, totaled 630 million tonnes of CO2 equivalent from its refining throughput and 730 million tonnes of CO2 equivalent from the petroleum products it sells.

By comparison, Exxon’s 2019 Scope 1 and 2 emissions were pegged at around 120 million tonnes of CO2 equivalent.

“The Scope 3 emissions just tell you how big the company is,” RBC Capital Markets analyst Biraj Borkhataria said in a Jan. 7 email.

As the world’s largest refiner and one of the top five chemical companies, “By definition, [Exxon] sells massive amounts of oil and gas products to end-users,” Raymond James analyst Pavel Molchanov said in a Jan. 7 email. “The 2019 figure of 730 million tonnes equates to 2% of global CO2 emissio

|

Investors and environmental groups have expressed a growing interest in major oil and gas companies’ Scope 3 emissions. These types of emissions can account for 85% or more of integrated companies’ total emissions.

In the last year, U.S. energy companies have tried to be more transparent about their climate change efforts to avoid losing billions of dollars in investor capital.

Borkhataria and AJ Bell Investment Director Russ Mould said Exxon must outline not just its yearly emissions figures but also the specific steps the company is taking to reduce them and prepare for a carbon-neutral world by 2050.

“The onus is now on the company to outline its vision for the future — how its operations and its business mix are to change, how it will fund this change and how long it will take,” Mould said in a Jan. 6 email.

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/exxon-needs-less-talk-more-action-on-climate-change-analysts-say-62020197?mkt_tok=eyJpIjoiWmpFM00yVTNORFV3TVRRNCIsInQiOiJRSGpFalY2cjVGam1UbThDcmw4M2U5YW5MVVhMb3NxVWtzd0hzeENpaXpIdjRUNzdXejdHdzZPdkRFRzhmaTFSbHBPZElBT3lZYWtQZWUzMFpyMGNcL1JUcStIczE2emw2Z0N0MVJWRVh3Q05EWEp5VEhld0JNYmhsYTAxQWxhT0kifQ%3D%3D