Goldman Sachs Group Inc. er ved at komme godt ind på det hurtigt voksende marked for bæredygtig finansiering.

Den New York-baserede långiver planlægger at udstede flere miljømæssige, sociale og ledelsesmæssige (ESG) obligationer regelmæssigt som en del af planerne om at anvende 750 milliarder dollars i bæredygtig finansiering, investering og rådgivning inden 2030, oplyser Carey Halio, administrerende direktør af Goldman Sachs Bank USA, ifølge bnnbloomberg.

”Vi forventer at udstede en gang hver 12. til 18. måned med hensyn til benchmarkudstedelse, og vi har fleksibiliteten til at udføre andre former for forpligtelser i stedet for benchmarkobligationen,” sagde Halio i et interview. “Vi tror på, at det vil være en kerneelement i vores strategi fremover, ” sagde Hallo.

Uddrag fra artiklen:

Goldman said its sustainability bond was well received by investors from the U.S., Europe and Canada, in addition to other countries, including new investors. The order book reached well north of US$3 billion at the peak, with more than half of the deal going to ESG accounts. The demand helped it price 5 basis points inside of the bank’s normal credit curve for the tenor, Halio said.

“We do think the size of our ESG bonds will grow over time,” said Halio. “We think investors value the liquidity in the benchmark size issuance.”

The firm will also consider issuing in different currencies in the future, including in euros. David Solomon, chairman and chief executive at Goldman, said in a Friday statement that building a low-carbon and an inclusive economy is a “business imperative” and the lender is demonstrating its commitment by using the same financial toolkit the bank recommends to its clients.

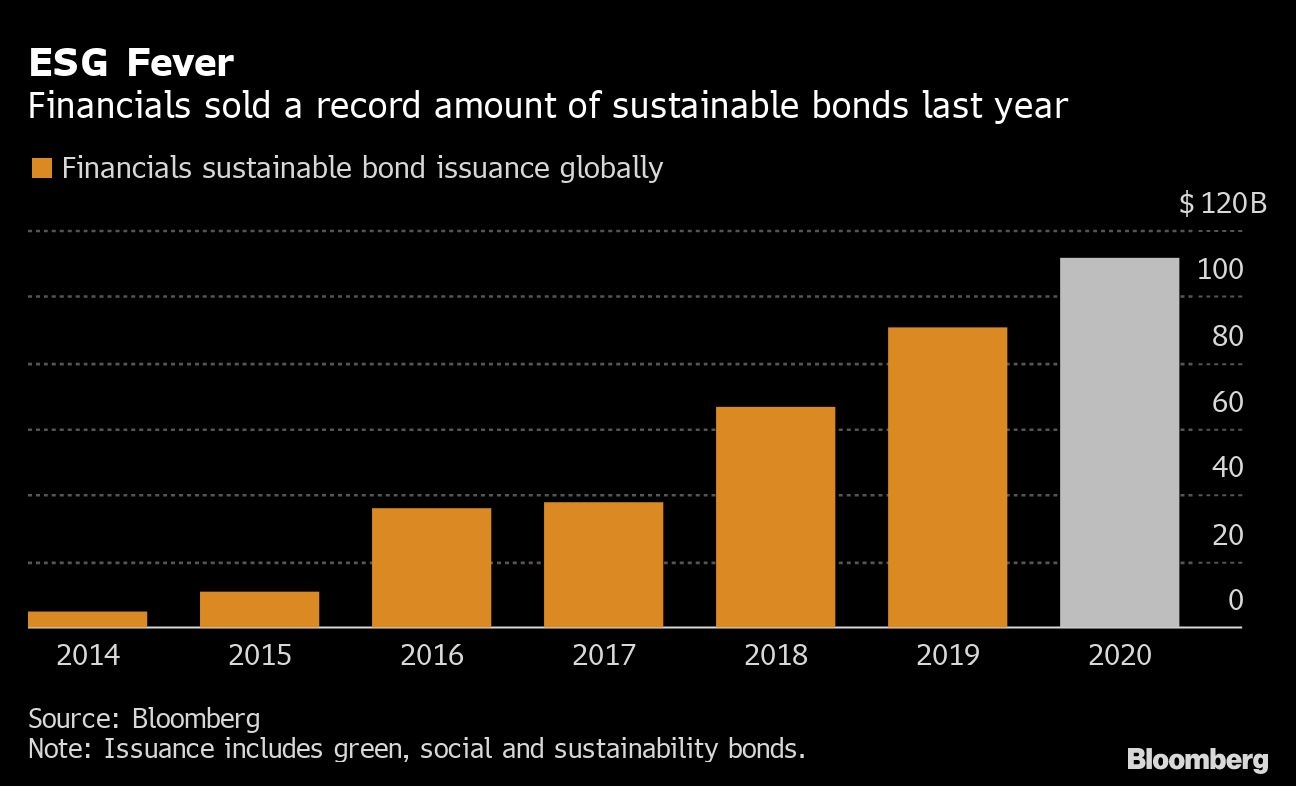

Financial firms globally have raised about US$25.5 billion pf ESG-linked debt this year, making the sector the biggest issuer of sustainable bonds after governments, according to data compiled by Bloomberg. The sector borrowed a record US$111.8 billion last year. That included deals from Bank of America Corp., Citigroup Inc. and Morgan Stanley.

Goldman is joining other top Wall Street banks that have been issuing ESG bonds amid pressure for the private sector to do more to promote ESG issues. JPMorgan Chase & Co., the biggest U.S. bank by assets, priced a US$1 billion social bond on Tuesday and raised a similar amount of green debt last year.

https://www.bnnbloomberg.ca/goldman-sachs-says-esg-finance-to-become-core-part-of-strategy-1.1563057