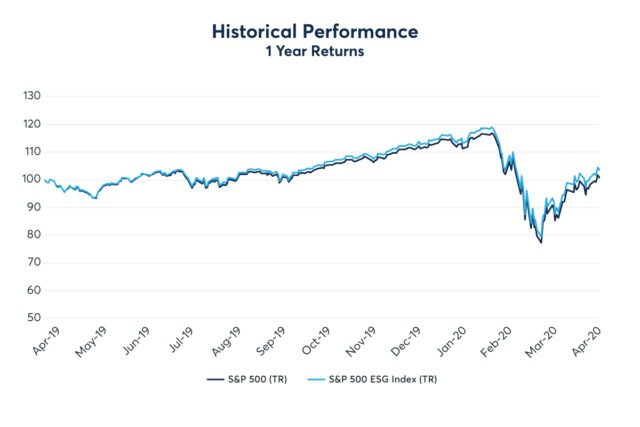

I løbet af det sidste år har S&P 500 ESG-indeks afkast ligget næsten 3% over benchmarket S&P 500. Dette er imponerende i betragtning af at målet med ESG-indekset ikke er at overgå benchmark. I stedet kan det tilbyde et bæredygtigt alternativ til den bredt baserede S&P 500 med lignende risiko og afkast, skriver benzinga.com.

The Coronavirus pandemic is strengthening the hand of ESG investors. Sustainability-themed funds saw record Q1 inflows in the United States, while the rest of the market saw record outflows. Globally, investments in ETFs tracking ESG indices more than doubled, going from $22.1 billion in 2018 to $56.8 billion by the end of 2019, according to S&P Dow Jones estimates. The pandemic has only reinforced fund managers’ belief in ESG, with investors focusing on environmental, social and governance themes.

Rebalancing Act

The S&P 500 ESG Index is designed to be a broad-based benchmark. The screening criteria states that companies are excluded if they have a low ESG score relative to industry peers, are involved in controversial weapons or tobacco, are not closely adhering to the UN Global Compact, or are involved in severe controversies.

Growing regulatory importance makes those firms who are included in the ESG Index perhaps more relevant now than ever before. The need to integrate investors’ values in ESG is now also a key consideration for money managers.

ESG Driving Performance

An ESG lens teases out all sorts of risks that are not necessarily apparent in conventional financial analysis. This screening may be the reason that the S&P ESG 500 index has outperformed its parent index in the recent sell-off.

Many observers believe that strong ESG performance indicates better management, and that screening for companies with high ESG scores is simply a way to find good executive teams, which translates into stronger long-term returns. The idea being that management teams that do a good job of minimizing their environmental footprint; promote good employee relations, contingency plan, enforce employee sick leave policies and are prepared for disasters, create resilient governance structures. These types of management teams are more likely to be adept at running all other aspects of a company’s business and should be better equipped to ride out a downturn.

ESG analysis regularly focuses on supply-chain transparency. These challenges often occur many steps up a supply chain, and when companies struggle to address them, it’s often because they don’t know much about where their raw materials are coming from.

For example, as the Coronavirus pandemic started to disrupt supply chains from China and authorities began to shut down economic activity, many companies were caught by surprise when their own products or services were affected leading to stock price shocks.

What Drove the Outperformance?

Of the newly rebalanced ESG index, the index weighting by GICS sector breakdown for the S&P 500 ESG Index as compared to the S&P 500 Index is shown below. Consumer Discretionary, Information Technology, Communication Services and Real Estate all have a higher weighting in the ESG version than the parent index.

The main drivers of the outperformance was a combination of allocation effect (+0.46%) together with selection effect (+2.23%).

In particular, the higher weight allocated to the Technology Sector saw those constituents performing better than those in the parent S&P 500 Index and so contributed to +1.3% outperformance of the S&P 500 ESG than the S&P 500. Outperformance was also driven by better stock selection in the Consumer Discretionary (+0.47%), Consumer Staples (+0.21%), Industrials (+0.35%), and Materials sector (+0.2%).