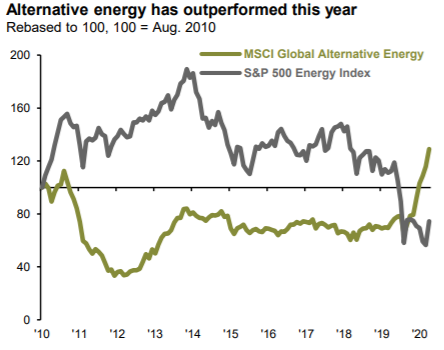

JPMorgan har analyseret energimarkedet. Mens energiaktierne som helhed har været under nedtur i flere år, så er der sket en dramatisk stigning i kursen på grønne aktier. De er steget med 69 pct. alene i år, mens de traditionelle energiaktier er faldet med 37 pct. En ny Paris-klimaaftale samt den nye EU-fond, hvor 30 pct. skal bruges på at fremme grønne investeringer, vil styrke de grønne aktier endnu mere. Men JPMorgan gør opmærksom på, at grønne virksomheder er en relativ ny sektor, og der er mange selskaber, der kan bryde sammen. Derfor er det vigtigt med stock-picking. Og så består 85 pct. af energimarkedet fortsat af fossible brændstoffer.

Thought of the week

Large technology stocks have led equity markets this year, prompting investors to look for future innovations to drive future returns.

After a year in which Tesla was added to the S&P 500 and Exxon was removed, investors ought to consider the shifts underway in the energy sector as one possibility.

As highlighted in this week’s chart, clean energy stocks have risen 69% year-to-date, while traditional energy stocks have fallen 37%.

This provides some powerful evidence for the ongoing debate on the alpha-generating potential of sustainability strategies.

This outperformance has a few catalysts. One, costs have come down considerably for renewables, increasing the viability of these options. Two, policy is coalescing around mitigating the impacts of climate change through cleaner energy.

President-elect Biden is likely to pursue energy re-regulation, rejoin the Paris Climate accord and advance clean energy through potential infrastructure spending.

Internationally, 30% of the EU’s EUR 750 billion COVID-19 recovery fund will be raised through green bonds. China has pledged to be carbon neutral by 2060.

Still, there are risks to a greener outlook. Renewables is still a burgeoning industry in which many companies may fail. Storage remains a key challenge.

Despite the rise of renewables, about 85% of energy still comes from fossil fuels. However, with challenged earnings and oil prices likely range-bound, investors may consider diversifying energy allocations, which will require careful stock selection in both traditional and alternative energy sectors.