In a comprehensive new study of the climate targets of 28 major companies, most of which have their targets validated by the Science Based Targets initiative (SBTi), the majority fail miserably. The report reveals, among other things, that SBTi has approved climate targets that actually entail annual CO2 reductions of less than half a percent. SBTi has declined to comment on the report. According to Bill Baue, a former member of SBTi’s technical advisory board and one of the organization’s sharpest critics, the high failure rate reveals a significant lack of scientific rigor in SBTi’s criteria.

This is an AI-generated translation of the original Danish article

On April 9th of this year, the New Climate Institute and Carbon Market Watch released the Corporate Climate Responsibility Monitor 2024 report, in which the two non-profit organizations evaluate the climate targets of 28 of the world’s largest companies, most of which have their targets validated by the Science Based Targets initiative (SBTi) – this includes targets set by companies such as BMW, Nestlé, and Walmart.

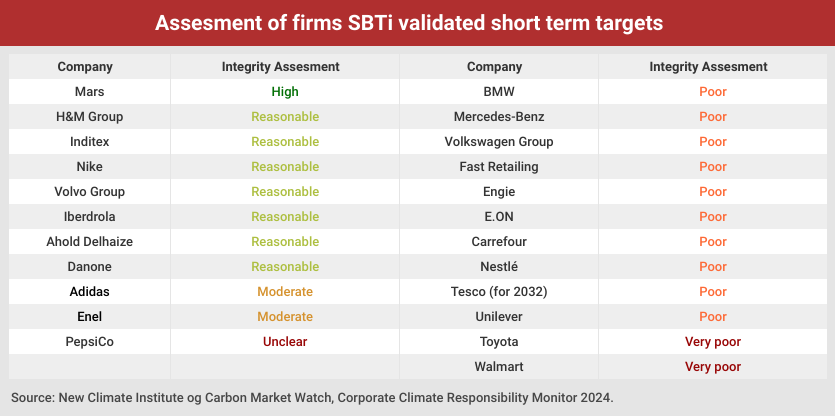

In particular, the short-term SBTi targets are heavily criticized in the report, where over half of the 23 examined SBTi validated 2030 targets are assessed to have low or very low integrity. The report concludes: “Most of these companies prominently highlight their SBTi validations in their climate-related communications to promote targets that are in many cases insufficient in the context of the latest available science.”*

For example, Walmart’s short-term target fails completely. The retail giant aims to reduce its climate footprint from its own operations (scope 1 and 2) by 65 percent by 2030, using 2019 as the baseline – which initially sounds quite reasonable. However, the problem is that Walmart’s 2030 target only covers a very limited part of the company’s total climate footprint. If the company’s footprint from the value chain (scope 3) is included, then according to the report, the target only amounts to a 5 percent reduction over the period – thus, an annual reduction target of less than half a percent.

As shown in the table below, only one of the 23 examined SBTi validated 2030 targets is assessed to have high integrity. That company is Mars, which stands out positively. The chocolate giant has an ambition to reduce the company’s total climate footprint, including the value chain, by 50 percent by 2030 – with 2019 as the baseline and without the use of offsetting.

Økonomisk Ugebrev requested SBTi to comment on several conclusions of the report, including the fact that only one out of the 23 examined short-term SBTi validated targets is assessed to have high integrity. SBTi has not responded to our inquiry.

According to Bill Baue, one of the initiators of SBTi and a former long-standing member of SBTi’s technical advisory board, the high failure rate of SBTi validated targets reveals a significant lack of scientific rigor in SBTi’s target-setting criteria – it’s simply too easy for companies to get insufficient climate targets approved.**

In addition to failing the majority of short-term targets, the report also highlights several problems associated with SBTi’s methodology and practices. This includes inadequate reduction targets for companies’ scope 3 emissions and a lack of transparency regarding methodology and data foundation in the approval of companies’ climate targets.

Bill Baue points out to Økonomisk Ugebrev that the report is not alone in its criticism. For example, a team of researchers led by Danish Anders Bjørn recently criticized SBTi’s lack of transparency: “Scientific assessment has already identified SBTi’s insufficient transparency in methodology and data. Anders Bjorn and colleagues published the critical analysis in a highly-regarded peer-reviewed scientific journal,” says Bill Baue.

According to the report, it is crucial that SBTi takes action to address these problems: “Without the initial improvement listed above, however, existing SBTi validations for 2030 targets continue to lend credibility to some companies whose targets are highly insufficient.”

However, the report is not very optimistic about SBTi’s ability to solve the methodological and practical problems: “The SBTi might face multiple challenges to implement such timely improvements. As a voluntary and mostly third-party funded initiative, the SBTi depends on the voluntary participation of companies and needs to accommodate the perspectives of different stakeholders when developing its validation methodologies.”

Bill Baue agrees and refers to the composition of SBTi’s board in this regard: “One indication of an organization’s primary stakeholders is to assess the constituencies its Board represents — it is telling that SBTi’s Board does not include a single representative of the scientific community, while the corporate and investment communities are amply represented.”

Moreover, according to Bill Baue, it is worth noting that SBTi’s business model relies on grants from corporate-affiliated foundations such as the IKEA Foundation and Bezos Earth Fund (founded by Amazon founder Jeff Bezos) as well as the fees that companies pay to have their climate targets approved by SBTi.

He adds: “A slightly contextualized version of the Upton Sinclair quote comes to mind: ‘It is difficult to get [an institution] to understand something when [its revenue] depends on [its] not understanding it.'”

* The report repeatedly refers to 22 out of the 28 examined companies having short-term SBTi validated targets. However, a table in the report indicates that there are 23 companies with short-term SBTi validated targets – hence, our reference to the number 23 instead of 22 above.

** Bill Baue is Senior Director at the not-for-profit platform r3.0 and one of the sharpest critics of SBTi.