Resume af teksten:

I en nylig opdatering forventes EUR/USD-kursen at ramme 1,20+ gennem 2026, drevet af Federal Reserves potentielle rentenedsættelser og en stabil global økonomisk baggrund. Den amerikanske dollar står over for pres på grund af en svagere jobrapport og lav forbrugertillid, mens Fed-rentenedsættelser kan fremkalde flere sikringsstrømme, der holder dollaren svag. Investorer viser fortsat interesse for eurozonens aktiver, med stærke køb af obligationer og aktier. På trods af potentielle risici som høj inflation i USA eller geopolitiske udfordringer i Europa, anser prognosen, at en vækst i Tyskland på 2% vil styrke EUR/USD-kursen, hvilket kan føre til en stigning mod 1,22/25 i 2026.

Fra ING:

Earlier in August, we published our monthly FX update . That was centred around the view that the last line of defence for the dollar – a resilient jobs market – had started to capitulate with large payrolls revisions. In this note, we discuss our latest thinking and why we are looking for 1.20+ levels through 2026

Fed easing and a benign global backdrop makes the case for 1.20+ EUR/USD levels through 2026

ING’s EUR/USD forecasts

Source: ING forecasts

Powell ready to turn dovish?

We’re writing this note two days ahead of the Jackson Hole Symposium, which we generally see as a neutral/dovish event risk for the dollar. But even if Federal Reserve Chair Jerome Powell emphasises muted unemployment over sharply revised payrolls, that would be a hard sell to both the White House and a market that is pricing in 21bp for September. We see the dollar staying offered around this event risk.

The deterioration in the jobs market is notable, with consumer sentiment even weaker than official data suggests. Our economists now expect the tariff-driven inflation spike to be milder and short-lived. As they discuss here , our new base case is 25bp cuts in September, October and December, followed by 50bp of easing in 2026 and a terminal rate of 3.25%, in line with market pricing.

Rate differentials have been more relevant for EUR/USD recently

Source: Refinitiv, ING

Cheaper dollar to sell

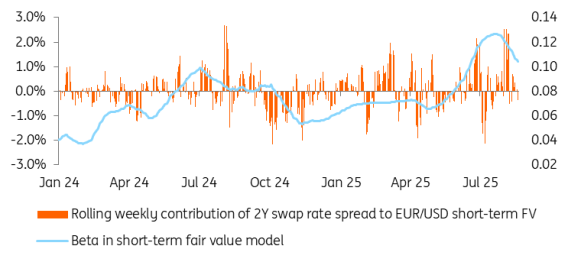

There’s a roughly 20bp gap between Fed funds futures pricing for December (-55bp) and our call (-75bp). While the beta on the EUR/USD short-term rate differential isn’t exceptionally high in our fair value model, it remains elevated relative to the past 18 months. A dovish repricing by year-end supports our bullish EUR/USD view, though markets may resist pushing front-end USD rates much lower if terminal rate expectations prove sticky.

However, we believe the Fed’s impact on the dollar extends beyond direct rate effects. USD hedging flows have played a significant role in recent months, helping to prevent a dollar rebound despite a strong US asset performance. Fed interest rate cuts cheapen the cost of selling dollars, which we expect will trigger a new wave of hedging flows – keeping the dollar under pressure. Add in the prospect of a new Fed chair next May and seasonal dollar weakness in December, and 1.20 looks to be the target for year-end.

Investors seem to like the euro story

There has not been too much follow-through to the ‘Sell America’ story seen in April, and the US Treasury yield to dollar correlation has returned to its traditional positive setting. Yet it seems like international investors are still keen on the theme of asset rotation, and the eurozone remains in demand. The European Central Bank’s Balance of Payments data shows continued strong interest for eurozone debt and equity products in May and June, with foreigners buying a combined €236bn of eurozone assets over that two-month period.

Our macro team haven’t completely ruled out one final ECB rate cut this year – but even so, the late 2025 and 2026 story should be a benign one, with the Fed playing catch-up with the ECB in a move to neutral monetary policy – and all of this occurring without the need for a US recession. Lower core interest rates and steady growth should be positive for growth-sensitive currencies like the euro.

Through 2026, our baseline view is that a fiscally-driven German expansion toward growth rates of 2% will be a source of continued EUR/USD gains through the year. 2% growth in Germany is worth so much more than 2% growth in the US in terms of impact for EUR/USD. Our call is that this will prompt the ECB to tighten in early 2027 – well before the Fed. That’s why we think EUR/USD could be trading towards the 1.22/25 area by late 2026.

Foreign demand for eurozone debt and equity continues

Source: ECB, ING

Risks to our scenario

Our EUR/USD view is quite US-centric, and the major risks to our baseline scenario also stem from US macro. The biggest is that US inflation proves too high and/or too persistent to hinder the Fed’s cutting plans. It would remain to be seen whether political pressure would still force unorthodox cuts (a very USD-negative scenario), but, assuming a more canonical FOMC response function, that is a big upside risk for the dollar. On the jobs market, we might see unemployment staying stubbornly low and payrolls still showing some resilience, ultimately removing a key argument for cuts.

On the European side, the largest black swan risk remains a new escalation in geopolitical risks – with peace talks collapsing and military threats rising. The probability of this has declined after recent summits. A more tangible risk is that markets have underestimated the implications of US tariffs on the EU. The impact of that should be more limited than any major Fed re-pricing, but could take some steam out of the EUR rally, with markets looking outside of Europe to play the dollar decline.

Another wild card is European politics, where the French government is facing another budget showdown this autumn. French 10-year government bond yields are now closing in on those of the (albeit well-supported) Italian BTPs. More sustained pressure on French debt could also take the shine off the euro.

Hurtige nyheder er stadig i beta-fasen, og fejl kan derfor forekomme.