Fra Zerohedge/

On Tuesday, we previewed the coming month-end “clash” between forced selling on one hand, which according to JPM could be as much as $316BN across mutual funds, and vol-control and quant buying now that the March VIX surge is out of the 12-month look back window.

Picking up on this observation, Nomura’s Charlie McElligott notes that it was the latter of these two forces (split into two discrete “flows”) that helped reverse the tide in US equities just after the European close which coincided with a violent initial down-trade. As McElligott explains:

- The Second flow showed the power of Dealer Gamma-hedging in an illiquid underlying tape – where Nasdaq (QQQ) “Short Gamma vs spot” (with Spooz too spending most of the early morning in “short dealer gamma vs spot” territory, at one point trading down to 3843) which initially led to a sloppy overshoot move on the downside in the US morning, with NQ futs trading -2% from high-to-low at one point. But it was also the power of the Dealer “Long Gamma” at the SPX 3895 strike which pulled stocks out of that early hole, as the 47k SPX 31Mar 3895 Calls which traded back on Dec 31st 2020 are the top leg of a PS Collar which the Street is LONG, dominating the OI—that simply meant “insulating flows” BUYING the weakness (yday was ~$4B of ES to buy for every 1% move lower), and which will only grow into next Wednesday, where historically this trade is rolled the morning of expiry each quarter.

That explains yesterday’s action, and validates the our previous preview that month end is shaping up as a dramatic clash between two forced flows, where pension selling continues to find resistance in vol-control buying.

What happens next? Here McElligott writes that after speaking with a wide-ranging group of client types over the past few sessions, the consensus sequencing story status assessment he is hearing goes as follows:

- Folks grossed-down – or have been in the process of grossing-down – into current and upcoming Spring break holiday illiquidity, along with investors’ perceived risk of sloppy quarter-end rebalancing flows.

- This will hit “peak risk” next Friday, where the market is now anticipating a massive upside surprise in the US NFP print (whispers pushing into the millions vs 600k est) and UER data releases, but which just so happens to come on Good Friday holiday, with the Equities market closed and Bonds closing early

- The concern then is that you have experienced this recent short-term mechanical “rebalancing rally” in USTs…which then looks like a headfake, risking a turn into yet-another floodgates “sell bonds” trade following this (potential) monster data beat, with a holiday-shortened and illiquid bond market that day of release—with Equities in even worse shape, unable to trade any move until Sunday night / Monday

- From there, we will have made the turn into April, a new quarter, w pension rebal flows cleared and Equities folks then needing to re-risk after the (expected) big bullish Labor data releases as the market turns its focus back into Spring “vaccine renormalization reflation + stimulus” sentiment green-shoots, which could “impulse turn” back into a very + “Cyclical Value” / – “Secular Growth” dynamic yet again

- From Rates mkt perspective, it will be the magnitude of those (anticipated) “beats” which then determines whether the Fed can continue to pass the story off as simply “transitory” data and curves bear-steepen more…OR conversely, we skip further ahead and see traders pivot towards the bear-flattening “tightening tantrum” trade again, as the QE Taper and expected timing of Fed liftoff are pulled-forward…and this latter scenario is certainly more of a ‘risk off’ trade than the ‘feel good’ of the former

- As a friend put it “They (the Fed) can hide behind transitory inflation for a bit…but that’s unraveling…if the tail stays higher on inflation coming back down—like 2.4 -> 1.7 then becomes 2.5 -> 2.2, then that’s a jailbreak”

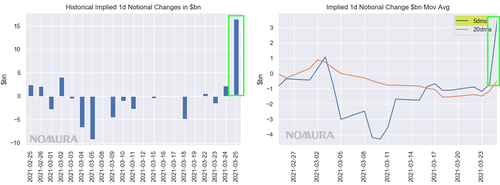

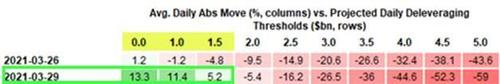

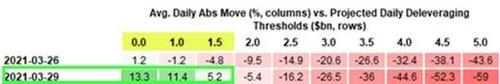

To summarize: Vol control are adding significant equities exposure as trailing 1 month realized vol resets much lower and the string of large “down days” drops out of the recent one month sample, with March 29 set up as the next likely “big buying day.”