Den russiske bjørn skubber til Finland under Ukraine-krigen. Som naboland til Rusland er Finland langt mere afhængig af samhandelen med Rusland end Europa som helhed. De finske aktier er faldet langt mere end STOXX-indekset for de europæiske aktier – med over 20 pct. siden nytår i forhold til under 15 pct. for STOXX. Nordea vil ikke udelukke, at de finske aktier kan presses længere ned på grund af den fortsatte krig. Men Nordea tror dog ikke, at der vil ske nogen dramatisk forværring, bl.a. fordi Finland gennem mange år har reduceret energi-afhængigheden af Rusland. Servicesektoren, herunder flybranchen, bliver hårdt ramt af de aktuelle sanktioner. Politisk har krigen haft stor virkning, da der nu er flertal for medlemskab af NATO. Hidtil har Finland holdt en forsigtig kurs over for Rusland, men krigen i Ukraine har skabt frygt i den finske befolkning.

Finland: Will the bear (market) hit Finnish assets?

Finnish assets have been under pressure lately, partly due to the exposure of the Finnish economy towards Russia. Risks of further underperformance remain, but we do not find any signs of a political risk premium in prices.

- Finnish assets have felt pressure lately, but increased Finnish country risk explains only a part of those moves.

- Finnish economic links to Russia are larger than for the Euro area as a whole, but energy dependency is not.

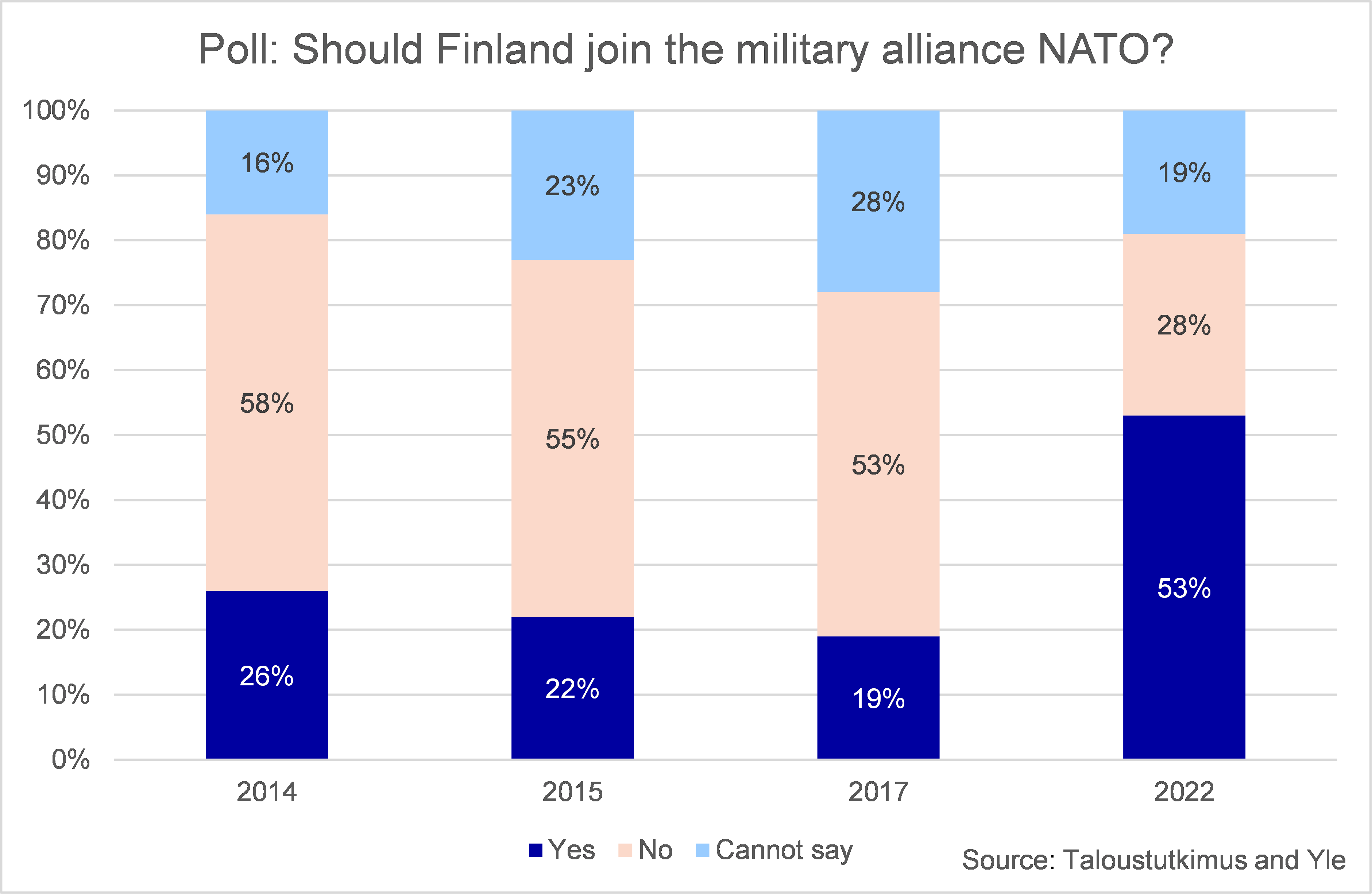

- The security political picture of Finland has changed, with the majority of the Finnish people now supporting NATO membership.

- Finnish bonds have underperformed vs France, suggesting also the Finnish country risk has increased to some extent.

- Risks of further underperformance of Finnish assets remain, but any major hit is not our baseline.

Finland has traditionally had a relatively close relationship with Russia, at least for a Western country, has around 1300km of border with Russia and the economic links between Russia and Finland remain stronger than those for the Euro area on average. It is no wonder then that the Russian attack on Ukraine has raised some questions on the future of Finnish assets as well, also from a security political perspective.

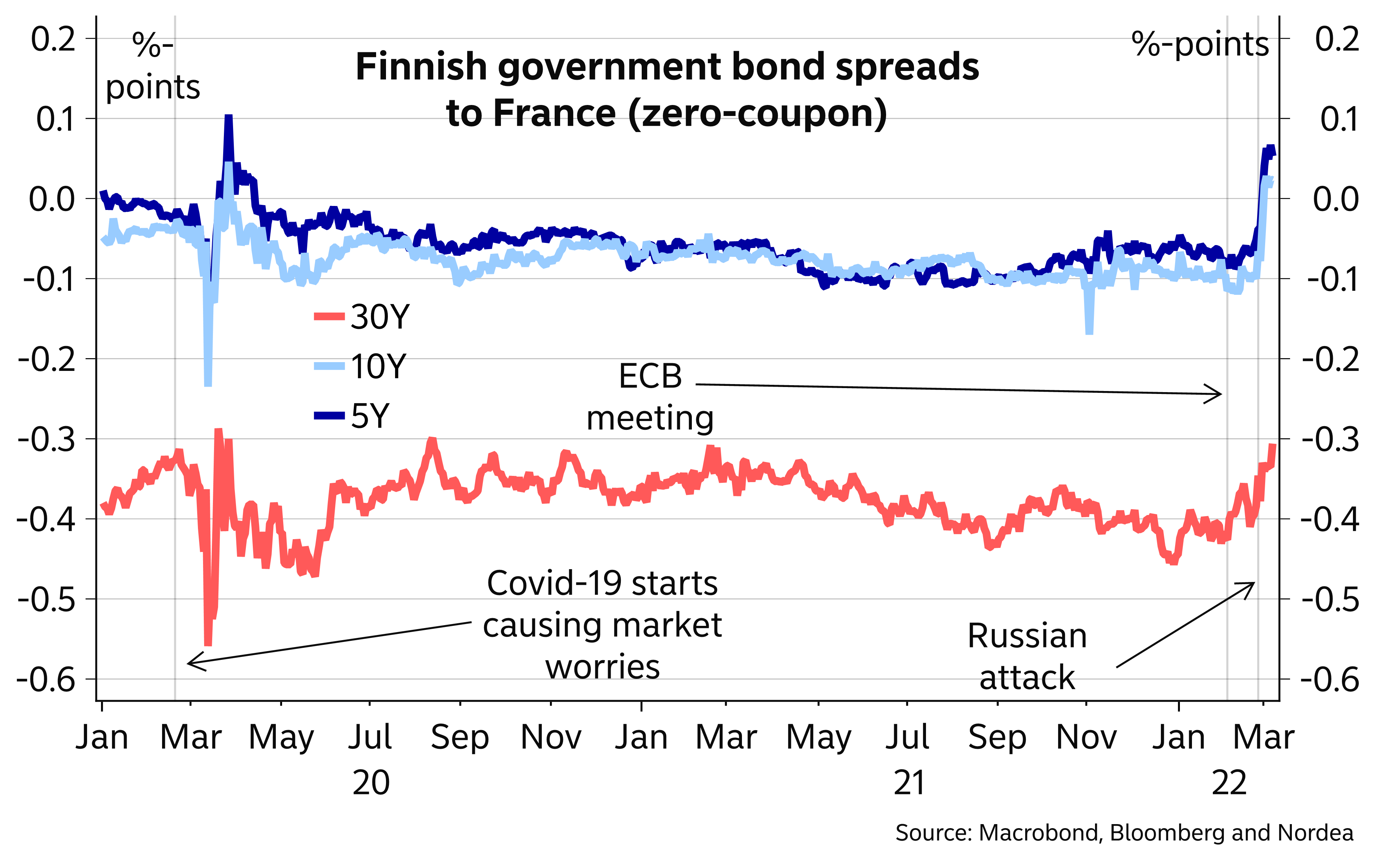

Finnish assets have been under some pressure lately. We note that especially on the bond market, the part of the moves that are due to Finland-specific factors can be explained by economic considerations, and do not see any notable security political premium on Finnish assets due to the proximity to Russia or worries that Russia might target Finland next.

True, there are some similarities in the Finnish situation to Ukraine. Finland is a next-door-neighbour to Russia and has been discussing the prospect of NATO membership for some time, though at least until very recently, membership has been a rather distant prospect. On the other hand, Finland is an EU member with close links to Europe and does not have any sizable group of Russian-born citizens in its population.

Going forward, while Finnish assets could easily face more pressure going forward, especially as the tensions in the Russian war continue, any meltdown in Finnish assets is certainly not our baseline. We also note that as the focus has lately been especially in including Russian energy exports to the sanctions, Finland is unlikely to be among the worst hit Euro-area countries, if such measures are introduced.

NATO membership on the horizon?

The Finnish population as a whole has been relatively sceptical towards a NATO membership, until lately that is. After the Russian attack, a majority of the Finnish people suddenly turned to support NATO membership, according to a recent poll, from under 20% in 2017. While a near-term membership does not look likely, the discussions to join have now picked up in earnest.

Finland is already in close co-operation with NATO, and while it has so far primarily sought to tighten co-operation within the Nordic countries, the recent events may well tilt the scale towards a full NATO membership. President Niinistö already met with President Biden to talk about closer co-operation, so Finland has by no means been standing still.

Such course of events is unlikely to please Russia, and obviously all uncertainty is elevated at the moment. Nevertheless, Russia may be preoccupied with other matters at the moment.

Support for Finnish NATO membership surged

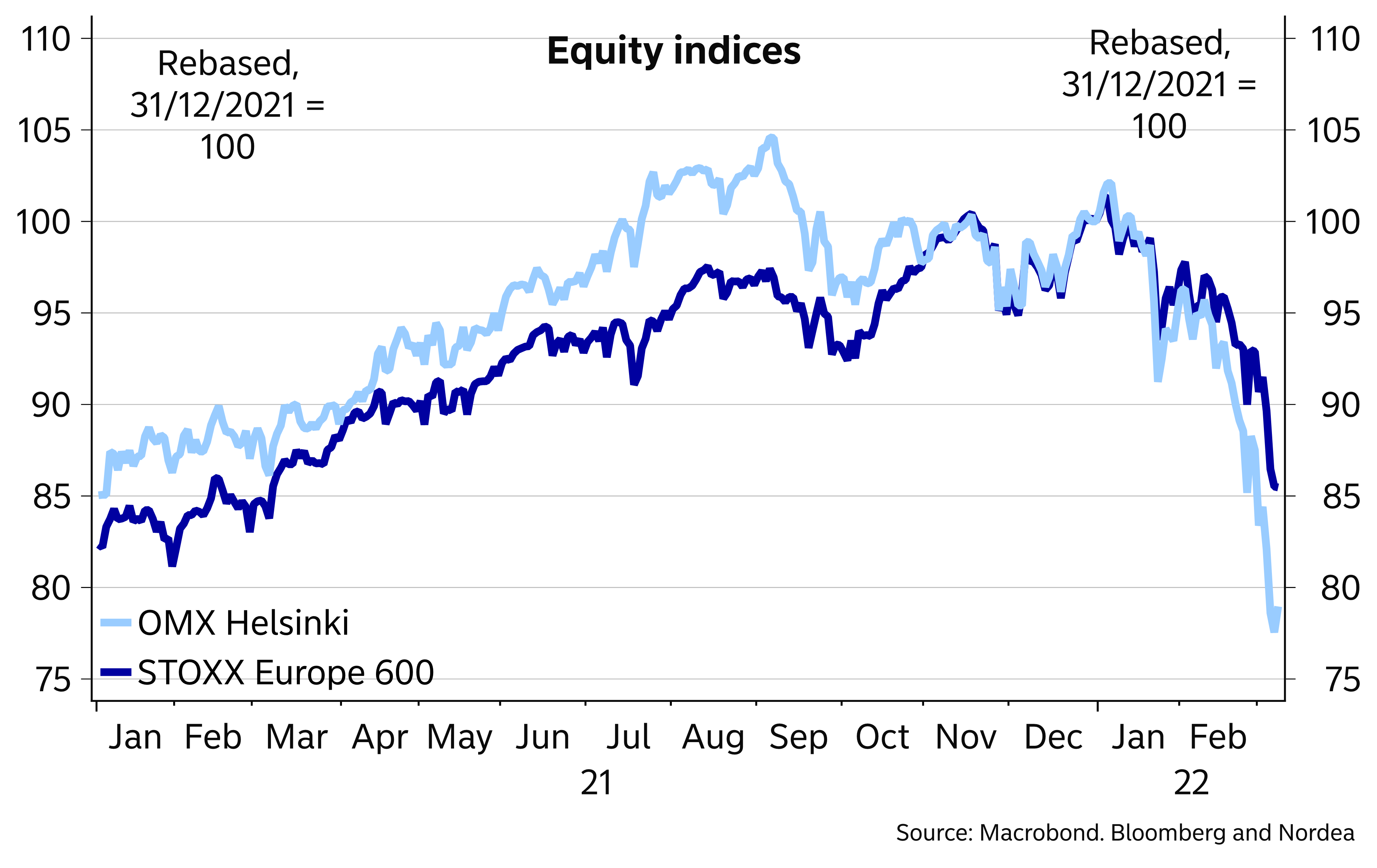

Finnish equities hit – bond market moves smaller

Finnish assets have clearly been under pressure lately. The equity market has slumped much faster than the broader European Stoxx 600 index and the spread between Finnish and German bond yields has climbed. However, there are many other drivers behind these moves than just Finnish country-specific risks.

On the equity side, many Finnish companies have had activities in Russia, and the number of companies withdrawing altogether has been mounting. It should thus be no wonder that the Finnish equity market has been under pressure. In addition, the Finnish equity market is rather small in size in a European context, and such markets often suffer more than bigger ones amidst bouts of uncertainty. Finally, the Finnish equity market is rather cyclical in nature, meaning changes in the economic outlook have a rather strong impact. We thus find the bulk of the Finnish equity market moves is accounted by these three factors rather than a risen Finnish country risk per se.

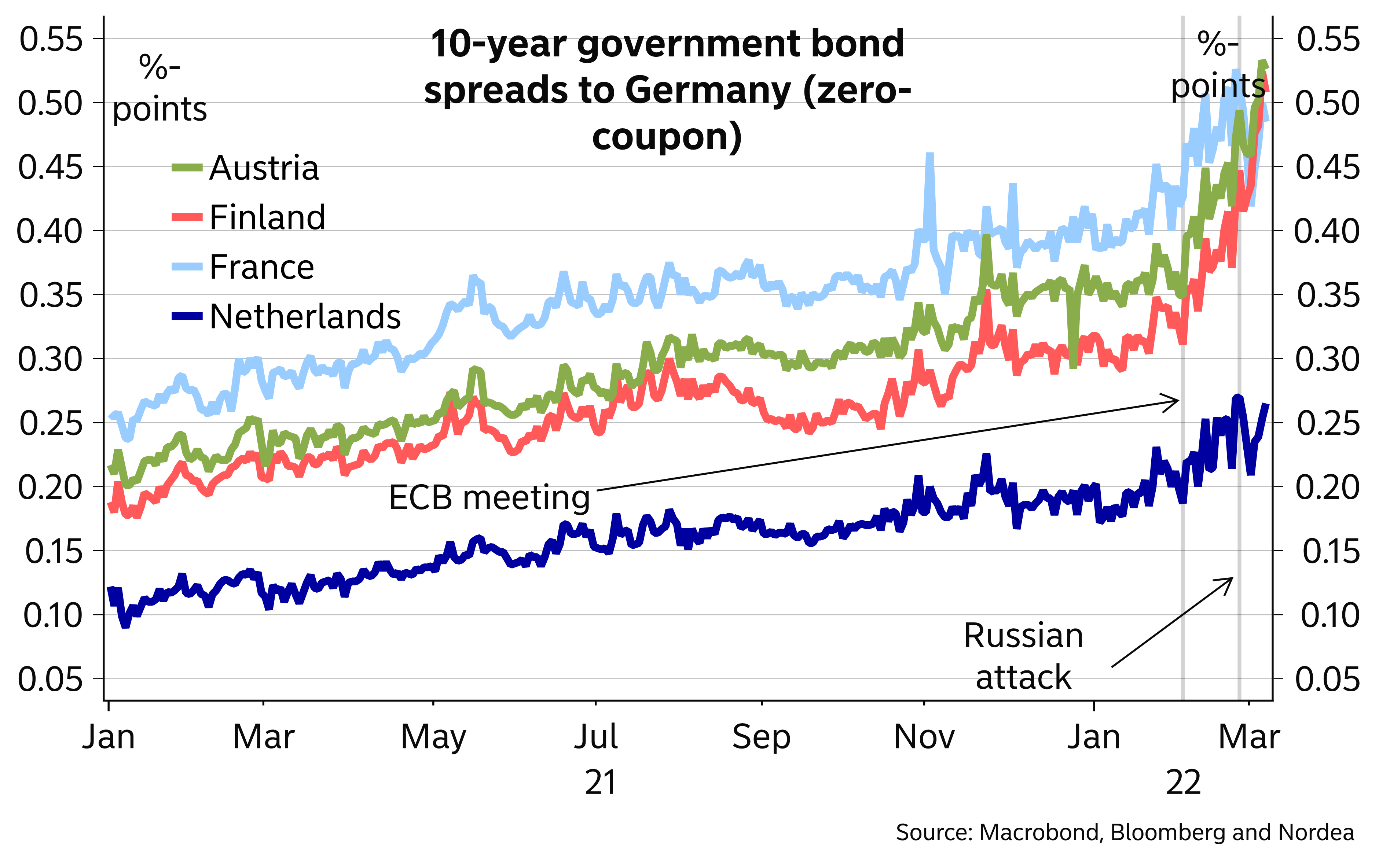

On the bond side, the widening in spreads between Finnish and German bond spreads accelerated in early February. However, the big driver here was the ECB’s hawkish message in early February, which has moved the spread more than risk aversion due to the Russian attack.

A better place to look for Finland-specific market drivers is to look at the spread developments vs. closer comparables, e.g. Austria and France. Finnish spread moves vs Austria appear more limited, suggesting that Finnish-specific reasons have not been a big driver. However, also Austrian bonds have felt some pressure due to the links of Austrian banks to Russia.

Finnish (and Austrian) bonds have underperformed vs. France, suggesting there have been some country specific drivers as well. We think such underperformance makes sense due to the stronger economic links Finland has with Russia compared to the Euro-area average. However, the moves have been limited and can easily be explained by economic considerations. We struggle to find any signs that a higher political premium could be creeping into prices. Finally, we note that France has a much bigger and liquid bond market compared to Finland, which supports French bonds at times of elevated volatility and uncertainty.

Going forward, as long as uncertainty remains elevated or even increases further, Finnish bonds are likely to face more pressure, especially in longer maturities. While we note the risks, our baseline is not for any sizable underperformance of Finnish bonds or any permanent political risk premium to be built in Finnish bonds.

With the caveat of their bond markets even much faller than the Finnish ones and liquidity thus poor in uncertain market conditions, we note that the Latvian and Lithuanian bond markets have seen clearly bigger swings than the Finnish one. However, also there the main driver is likely to be economic rather than political (see more below).

Finnish equities suffered more than broader European indices

ECB a bigger driver of the recent spread widening than Russian aggression

Some of the Finnish underperformance also due to country-specific factors

Stronger-than-average economic links

The trade between Finland and Russia is distinctly above EU average for both exports and imports, making it a tad more vulnerable than European counterparts. Besidesthe actual sanctions, a large number of Finnish companies have decided to cut exports to Russia and shut down local operations across the border. The exports and local presence in Russia of Finnish companies have diminished significantly since the annexation of Crimea in 2014, making Finland economically less vulnerable than before.

The share of Russia in Finnish exports has diminished considerably since 2014 (see the chart below), not only due to sanctions after the annexation of Crimea but also because of general weakness in the Russian economy. Last year, goods exports to Russia amounted to 4.5% of total goods exports, with the majority consisting of machinery and manufactured products. Russian tourists have been the largest travel group in Finland, accounting for one fifth of total tourism revenues in 2019, although travel from Russia has diminished significantly during the pandemic.

Travel and airspace restrictions will probably harm Finnish service exports more than for other European countries, due to flight routes to Asia over Russia. In addition to direct divestures, the sharp weakening of the rouble will decrease the purchasing power for Finnish goods in Russia. Other European countries accounted for 55% of total Finnish exports, thus weaker growth prospects elsewhere in the European Union would trickle down to Finnish trade as well.

Energy and crude materials account for almost 75% of Russian imports, but energy-security and finding alternatives is less of an issue for Finland than for countries in Central Europe as the use of natural gas for heating or electricity production is limited in Finland. Overall, Finland is less dependent on imported energy than other Euro area countries (see the chart below). The new Olkiluoto nuclear reactor will be started up in the summer and will strengthen Finnish autonomy on electricity production even further. At the same time, another nuclear power plant in construction has been put to ice due to Russian funding. Nevertheless, rising energy costs are going to be one major implication from the crisis. Substituting for alternatives sources than Russian imports will come at a cost for both, consumers and companies. Higher energy costs will feed into living expenses and thus weaker purchasing power, hampering the private consumption.

Increased uncertainty is another channel for detrimental economic effects. The elevated uncertainty will likely dampen investments at least in the short-term, and mutual border with Russia could extend this effect into foreign direct investment. For consumers, higher uncertainty could delay and weaken consumption decisions. On the other hand, consumers are highly keen to spend more freely after the unwinding of Covid-19 restrictions. Recent development in Finnish private consumption have been positive especially in the service sector, according to domestic card payment data published by Nordea.

Overall impact from the war on the Finnish economy is difficult to estimate, but the main channels will be seen through weaker exports and investment, combined with higher energy costs cutting the private consumption. Domestic value added from exports to Russia is less than in the Baltic countries but higher than in other Euro area countries (see the chart below), making Finland more prone to negative impacts from the war. However, a more diversified energy mix is making Finland less vulnerable to high gas prices.

The share of Russia in Finnish trade fallen in the past 10 years