Resume af teksten:

Frankrig står over for politisk usikkerhed, efter Premierminister Sebastien Lecornu trådte tilbage kort efter hans udnævnelse. Regeringen mislykkedes i at danne et tilfredsstillende kabinet, hvilket førte til brud i koalitionen. Muligheden for nye valg er stigende, men det vil sandsynligvis ikke løse landets opdelte parlament. Budgetproblemer fortsætter, da planerne for budget 2026 er usikre. Det nuværende underskud vil sandsynligvis ikke blive reduceret, hvilket lægger pres på Frankrigs økonomi. Derudover kan euroen opleve midlertidige tab, men ECB vil sandsynligvis intervenere for at undgå større markedsforstyrrelser. Frankrig står som et af de mest udfordrede EU-lande med hensyn til politiske og økonomiske problemstillinger.

Fra ING:

France is entering a new phase of political uncertainty following the resignation of Prime Minister Sebastien Lecornu, who stepped down less than a month after being appointed. New elections are becoming increasingly likely but will not solve the fiscal problems

French Prime Minister Sebastien Lecornu stepped down less than a month after being appointed

A very short-lived government

The Prime Minister’s effort to assemble a new cabinet on Sunday night was met with widespread dissatisfaction. Despite earlier signals that Lecornu intended to govern without invoking Article 49.3 of the French Constitution, a mechanism that allows legislation to pass without parliamentary approval, his decision to reappoint several former ministers was seen by opposition parties as insufficiently disruptive and a continuation of Francois Bayrou’s policymaking. It failed to convince critics that a genuine political reset was underway.

The coalition, formerly aligned with the Bayrou government and known as the “common base,” fractured on Sunday night, holding just 211 seats, well short of the 288 needed for a majority. The Republicans, a key right-wing component of the coalition, appeared poised to exit the government, further destabilising the fragile alliance. In response to the mounting pressure and lack of consensus, Lecornu chose to resign pre-emptively, avoiding a forced departure.

What comes next?

The path forward remains unclear. President Emmanuel Macron has yet to announce his next steps, but calls for new legislative elections are growing louder across the political spectrum. In our view, the likelihood of fresh elections has increased substantially, though they may not resolve the underlying issue: a deeply fragmented parliament where multiple parties believe they hold a mandate to govern alone. Moreover, a renewed parliament would not guarantee inter-party cooperation, and the likelihood of one party holding a majority after the elections is fairly low. The RN (far right) is the most likely party to achieve this, but the strategic nature of the two-round parliamentary elections makes this less likely than opinion polls may suggest.

Another possibility is the appointment of a new Prime Minister, potentially from the left. However, this option presents its own challenges. A left-wing PM would need to unify support from both leftist and centrist factions, groups with very divergent views. The probability of successfully forming such a coalition is low given the current political climate, which means that it could also end in parliamentary elections. Elections have therefore become much more likely.

Meanwhile, some voices are calling for President Macron’s resignation. Although this scenario has become slightly more plausible considering recent developments, it remains highly unlikely at this stage, in our view.

Budget 2026 is the looming casualty of political paralysis

The political deadlock is affecting fiscal planning. Recent developments mean that the chances of passing the 2026 budget before year-end have diminished further. Therefore, France is likely to begin the new year operating under an automatic extension of the 2025 budget. This would limit not only new spending initiatives but, more critically, reform efforts.

This delay means that previously promised fiscal consolidation measures will not materialise. The budget deficit, projected at 5.4% of GDP for 2025, will likely remain elevated and, even in the unlikely event that a government is formed and a budget passed, weak economic growth will constrain deficit reduction. In our baseline scenario, we forecast the deficit will hover around 5% in 2026. As a result, public debt is expected to continue rising. We forecast debt levels to reach at least 116.7% of GDP next year, up from 113.1% in 2024. This trajectory places France in the worst fiscal position relative to its EU peers.

This budget delay is a problem for the European authorities, as France is currently subject to an excessive deficit procedure and is expected to submit a budget plan in the coming weeks. In this context, it is likely that the Commission will take a tougher stance with France and insist on the need to restore order to public finances. The deteriorating state of public finances also prevents the European Central Bank from using its Transmission Protection Instrument to limit the rise in spreads, at least on paper. Of course, if the survival of the eurozone were threatened by rising spreads, the ECB would intervene, but we are not there yet and, for the moment, the circumstances are not right for it to use the TPI.

France’s growth will lag behind

France now stands out as the EU member state facing the most acute combination of political and fiscal challenges. These headwinds will weigh heavily on its economic prospects in the coming quarters because they lead to a wait-and-see attitude among business leaders and households. We project GDP growth of just 0.8% in 2026 following a 2025 growth rate of 0.6%, which is below the European average. Unlocking France’s economic potential will likely remain constrained by institutional gridlock and policy inertia.

Charlotte de Montpellier

French bond spreads will remain under pressure

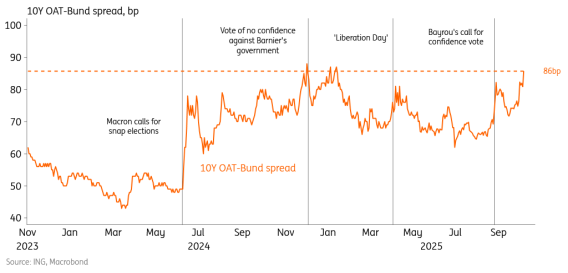

The spread of 10y French government bonds over German Bunds stands 5bp wider at around 86bp on Monday now that Lecornu has resigned. During the collapse of the Barnier government in December 2024, we touched levels closer to 90bp, and the relatively muted reaction reflects the markets’ low expectations to begin with. We can see spreads experiencing more widening pressure as uncertainty lingers on the prospect of new elections, but also as the market is looking at increasing tail risks such as an early end to Macron’s presidency. If the latter concern gains more traction, we think the 10y spread could start to venture well beyond 90bp.

The ultimate backstop to the spread dynamics remains the ECB’s TPI. It has strict conditionality on paper, but the ECB still has some discretion in deploying this tool. Importantly, we think that as soon as monetary transmission is compromised, it will be activated. The issue here is not if things escalate but how far policymakers are willing to let tensions rise before intervening in French bonds – France is just too big and relevant to do nothing.

Benjamin Schroeder and Michiel Tukker

France-Germany spread

Source: Macrobond, ING Research

FX: Temporary impact on euro

The euro has lost around half a percent versus the dollar in reaction to Lecornu’s resignation. But if we follow the script of recent French politics spillovers into the FX market, this is more likely to be a one-off hit to the euro rather than a driver for sustained depreciation.

The latter would happen if sell-offs in OATs start to look dysfunctional and/or there is tangible contagion risk across European government bonds. As discussed above, the generally accepted notion that the ECB would intervene in such a scenario suggests that any negative reaction in the euro is likely to be isolated and short-lived, in our view.

While not triggering a major depreciation in the euro, political and fiscal developments in France (particularly the prospect of snap elections) could dampen investor appetite for the currency, especially in a market where EUR/USD already lacks a compelling catalyst to push toward 1.20. That said, the US dollar leg remains very dominant, and any material deterioration in US data would likely outweigh the political noise. For now, two Federal Reserve cuts by year-end, combined with seasonality effects, remain consistent with EUR/USD at 1.20, in our view – even net of events in France.

Francesco Pesole

Hurtige nyheder er stadig i beta-fasen, og fejl kan derfor forekomme.