Resume af teksten:

August oplevede en stærkere end forventet stigning i amerikanske detailhandelssalg, med en samlet månedlig vækst på 0,6% og 0,7% eksklusiv biler. Forbrugssektorer som internethandel og beklædning viste betydelige stigninger, mens møbler og sundhedsforsyninger oplevede fald. Arbejdsmarkedet i detailhandlen viste moderate forbedringer med en stigning på 11.000 job. Selvom detailhandelsvolumen kun steg med 0,2%, understøtter det stadig forventningerne om en moderat rentesænkning fra Federal Reserve. Importpriser uden petroleum steg lidt, hvilket kan presse detailhandlernes marginer. Industriel produktion viste også bedre resultater end forventet trods svagheder i bestemte sektorer, såsom produktion, som fortsat er 7,5% under tidligere topniveauer fra 2007. Disse tal indikerer et blandet økonomisk billede, med opmærksomhed på forbrugernes bekymringer over potentielle toldbetingede prisstigninger og en afkølende jobmarked.

Fra ING:

August US nominal retail sales rose more strongly than anticipated, but volume growth remains range-bound with consumers wary of potential tariff-induced price hikes and broadening evidence of a cooling jobs market

US retail sales for August were stronger than expected

August’s increase in retail sales

August retail sales beat expectations

US retail sales were firmer than predicted for August, rising 0.6% month-on-month at the headline level, while ex autos gained 0.7% MoM relative to 0.2% and 0.4% consensus forecasts respectively. The control group, which excludes volatile components such as autos, gasoline, food service and building materials, better tracks broader consumer spending trends and that rose 0.7% versus 0.4% predictions. In terms of components, non-store, so largely the internet, posted a 2% MoM increase, with clothing up 1% and “eating/drinking out of home” gaining 0.7%. Furniture, health, general merchandise and miscellaneous all saw sales fall.

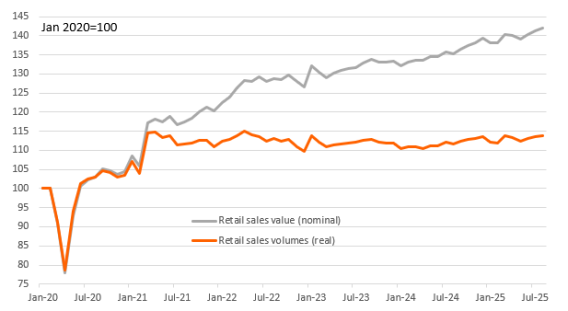

In the August jobs report, retail was one of the very few bright spots, posting job gains of 11,000 while the economy as a whole only saw 22,000 jobs added. At the same time, the average weekly hours worked increased from 29.8 to 30.0 hours, so both metrics hinted at some potential for strength. We need to remember that these numbers are nominal dollar figures, so adjusting for inflation, the volume figures are up a more modest 0.2% MoM, but that isn’t bad and should further dampen any lingering thoughts that the Fed could cut rates 50bp tomorrow. A 25bp cut remains our call. The chart below shows the level of nominal dollar retail sales and the volume of retail sales and implies that retailer profits are being driven by price increases rather than consumers physically buying more items.

Retail sales volumes versus values

Source: Macrobond, ING

Cooling sentiment may constrain profit margins

Meanwhile, import prices ex petroleum rose 0.2% versus 0.1% predicted, but July’s initial figure of a 0.3% increase has been revised down to 0%. So very benign, but no evidence that “foreigners will pay the tariffs” via cutting their prices. This suggests that those retailers’ margins are likely to come under pressure in the months ahead as corporates face the choice of how much of the cost increase to absorb themselves and how much to pass onto customers.

This is going to be difficult as weak consumer confidence suggests many households are feeling some financial stress. Worries about tariff-induced price hikes squeezing spending power are one factor, while concerns about the outlook for jobs and incomes is another that is weighing on sentiment and could see spending growth slow back closer to just 1% annualised growth in the fourth quarter after the mini-revival in the third quarter post the 2 April ‘Liberation Day’ shock.

Industrial production held back by structural manufacturing weakness

US industrial production has also beaten expectations for August, rising 0.1% versus forecasts of a 0.1% drop. That said, there were some substantial downward revisions to the history with output now reported as having dropped 0.4% in July versus the -0.1% outcome initially printed. Manufacturing output increased 0.2% while utilities fell 2% and weak electricity demand, while mining increased 0.9%. Manufacturing output is up 0.9% year-on-year despite ongoing weakness in business surveys, such as the ISM, but to put it in context, manufacturing output is still 7.5% below the peak level of output, which was all the way back in December 2007! Manufacturing now accounts for less than 10% of US economic output and only 8% of jobs. In 1980, it accounted for 21% of all jobs. The chart below shows the level of manufacturing, utility and mining output over the past 30 years – these are volumes, as measured in GDP.

US industrial production levels (Dec 2007 = 100)

Source: Macrobond, ING

Hurtige nyheder er stadig i beta-fasen, og fejl kan derfor forekomme.