Resume af teksten:

Schweiz står over for betydelige økonomiske udfordringer på grund af amerikanske toldsatser på eksport. En blanketafgift på 39% blev pålagt den 1. august 2025, med sektorspecifikke satser op til 50% for metal og undtagelser for vigtige farmaceutiske produkter. Præsident Trump annoncerede en potentiel 100% told på farmaceutiske produkter, medmindre produktionen flyttes til USA. Denne usikkerhed skader forsyningskæden, selvom store selskaber som Roche og Novartis investerer i USA for at begrænse deres risiko. Schweiz’ eksport til USA er steget, men forventes at falde med op til 20% på kort sigt. Den gennemsnitlige told på schweizisk eksport til USA er steget markant, hvilket kan resultere i et samlet BNP-hit på 2,3% på længere sigt. Dog kan nye aftaler med pharmafirmaer som Pfizer mindske skaden. Vækstprognosen for 2026 er nedjusteret til 0,8% på grund af disse udfordringer.

Fra ING:

Switzerland’s economy is under significant pressure due to the imposition of US tariffs on Swiss exports. As such, we have revised down our GDP growth forecasts

We lower our growth forecast for Switzerland due to US tariffs, which is expected to hit the pharmaceutical sector

Switzerland is facing a trade war

For several weeks now, the Swiss economy has been reeling under the threat of US customs duties. A 39% blanket tariff was imposed on Swiss exports on 1 August 2025, with sectoral tariffs reaching 50% for metals and selective exclusions for critical pharmaceutical products and gold.

On 25 September, President Trump announced a plan to impose 100% tariffs on branded or patented pharmaceutical products starting 1 October, unless production is relocated to the US. To date, this announcement has not been enforced.

This policy shift reverses the exemption for medicines and injects uncertainty into the global pharmaceutical supply chain. While Swiss giants like Roche and Novartis have already announced substantial investments in US facilities, likely a strategic move to mitigate exposure, the scope of the tariffs remains uncertain, complicating efforts to quantify the full economic fallout.

Export growth to US still positive but set to decline strongly

Trade uncertainty is already having an impact on the Swiss economy. While the 39% blanket tariffs only came into effect in August, earlier tariff-related developments, including front-loading ahead of the ‘Liberation Day’ announcement in early April and the interim 10% tariffs, have already influenced trade dynamics. As a result, export growth remained strong in the first half of the year, with a 51% year-on-year surge by the end of March and still a 9.4% increase in August compared to the same period last year.

The downward trend is already clear, however. Much like in the eurozone, momentum is weakening, and the full impact of the August tariffs is still to come. Assuming all else remains equal, we expect Swiss exports to the US could decline by up to 20% in the short term due to the tariff shock.

Year-to-date year-on-year Swiss export growth (%)

Source: Swiss Federal Statistical Office, ING Research

Switzerland is highly exposed to the US

US tariffs are a significant risk for the Swiss economy as its exposure to the US market is big, amounting to 4% of GDP. Therefore, the impact of tariffs will be much bigger than for the European Union, where direct exposure to the US amounts to 1.9% of GDP.

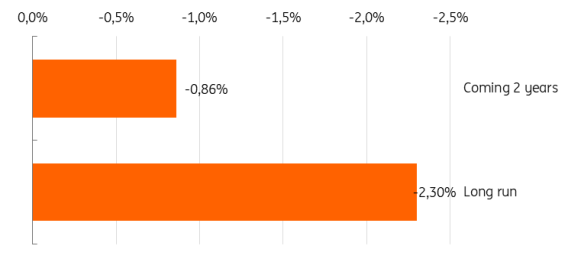

The average effective tariff rate for exports from Switzerland to the US has surged from 0.6% in December 2024 to 25.3%, a 24.7 percentage point increase. Based on the methodology described here , we estimate a cumulative direct impact of the increase of US tariffs on Swiss GDP of about 0.86% in the first two years, also taking into account recent Swiss franc appreciation. If we take out the impact of the Swiss franc appreciation, the impact would be 0.75% of GDP over the next two years. Longer-term projections suggest a 2.3% GDP hit, underscoring the persistent drag on growth.

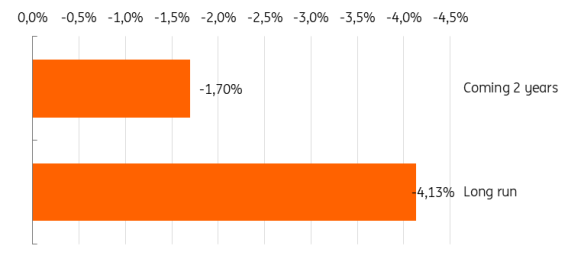

But the reality could be even worse if the pharmaceutical sector were hit with higher customs duties. The chemical and pharmaceutical sector, which accounts for 7-8% of Swiss GDP, has been the main driver of export growth in recent decades. With 60% of Swiss pharma exports destined for the US, the sector is disproportionately exposed to American trade policy shifts. In a worst-case scenario, where 100% tariffs were applied to pharma products, the effective tariff rate for Switzerland would climb to 47%. This would mean an increase of 46.7 percentage points! According to our estimates, this would hit Swiss GDP by 1.7% in the first two years and a 4.13% decline over the longer term. Such a shock could tip Switzerland into recession territory.

Direct impact on Swiss GDP of a 25.3% average tariff from the US (current situation)

Source: ING Research

Direct impact on Swiss GDP of a 47% average tariff from the US (worst-case scenario of a 100% tariff rate on all pharma products)

Source: ING Research

Pfizer deal shows patented pharma a way out from under tariff pressure

Fortunately, the risk of this worst-case scenario materialising has diminished in recent days, particularly since the deal between the Trump Administration and Pfizer , which provides clarity about the near-term future of the US patent-protected pharmaceutical sector. In the deal, it is stated that companies manufacturing and investing in the US will be exempt from tariffs. We expect similar deals to the one with Pfizer to be struck with other branded pharma companies in the next months.

This means that the margin risk from tariffs is lower for the pharmaceutical sector, as branded pharma companies from the US, Europe, and Asia have already announced additional US investments in the next few years. Notably, key Swiss companies Roche ($50 billion) and Novartis ($23 billion) have committed to significant US investment in the next five years. These companies are thus also likely to be exempted from US tariffs, which will mitigate some of the negative effects of the tariffs on the Swiss economy. Small pharma companies will, however, struggle more to strike a deal.

We revise downward our GDP growth forecasts

In sum, while the worst-case scenario may be avoided, the tariff escalation represents a material downside risk for growth in Switzerland. The Swiss economy, long buoyed by pharmaceutical exports, now faces a period of heightened uncertainty and potential deceleration. As a consequence, we revise down our GDP growth forecast for 2026 to 0.8% following a projected growth rate of 1.4% for 2025. In January this year, our forecast for next year was 1.4%.

Hurtige nyheder er stadig i beta-fasen, og fejl kan derfor forekomme.