Resume af teksten:

I denne uge er der fokus på data fra Sydkorea, Japan og Taiwan. Taiwans eksportordrer forventes at stige med 28,2% i juni, hvilket afspejler en fortsat stærk vækst drevet af teknologisektoren. Sydkoreas BNP for andet kvartal forventes at stige med 0,3% kvartalsvist efter et fald i første kvartal, primært understøttet af nettoeksport. Japans Tokyo forbrugerprisindeks for juli forventes at falde til 3,0% år-til-år, selvom kernetal forbliver stabile, idet Banken i Japan overvåger inflationstrenden nøje. I Kina forventes ingen ændring i prime lending raten, trods fortsat pres på priser og låneefterspørgsel. Yderligere politikændringer fra Kinas centralbank kan komme senere på året.

Fra ING:

The highlights of the week are data on South Korean GDP, Japanese inflation and Taiwanese industrial production and exports. China is expected to hold its prime lending rate steady

Source: Shutterstock

Taiwan: Industrial production and exports expected to grow

Data on Taiwan’s export orders, out Tuesday, is expected to show an additional acceleration in June to around 28.2% year on year. The economy’s exports have consistently beaten forecasts this year.

On Wednesday, Taiwan releases industrial production data. IP has seen strong growth in the past few months, rising more than 20% YoY in April and May amid strong contributions from the tech sector. We expect this trend to continue in June with growth of around 26.8% YoY.

South Korea: Second-quarter GDP expected to rebound slightly

South Korea’s second-quarter GDP is expected to rebound modestly by 0.3% quarter on quarter, seasonally adjusted, after a 0.2% contraction in the first quarter. Recent data suggests net exports will contribute positively to overall growth. Although exports have been quite volatile, they still recorded a gain thanks to strong orders for semiconductors, vessels, and pharma goods. Imports contracted due to falling global commodity prices. Consumption is likely to rebound, albeit modestly. A more significant recovery is anticipated from the third quarter, once the government’s consumption voucher programme is implemented in late July. Construction, though, is expected to remain a drag on overall growth.

Japan: Tokyo CPI expected to edge lower

Tokyo consumer price index for July, out Friday, is expected to edge down to 3.0% YoY, while the core CPI should remain unchanged at 3.1%. We believe that food prices softened during the month, yet service and manufactured food costs are likely to rise. This reading will be closely watched by the Bank of Japan. Recent inflation prints have been stronger than the BoJ’s expectations. It’s likely that the BoJ will revise upward its inflation outlook for fiscal year 2025.

China: Loan prime rate expected to remain unchanged

It’s a quiet week in China following last week’s big monthly data dump. On Monday, no change is expected from the monthly update on the loan prime rates. Although continued downward price pressures and sluggish loan demand present a solid case for further easing, the People’s Bank of China may opt to hold off until a more opportune window. We continue to expect one more 10bp rate cut and 50bp reserve-requirement-ratio cut before year-end.

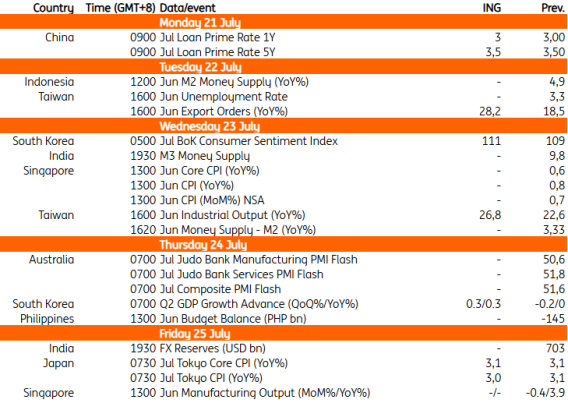

Key events in Asia next week

Hurtige nyheder er stadig i beta-fasen, og fejl kan derfor forekomme.