Uddrag fra Zerohedge:

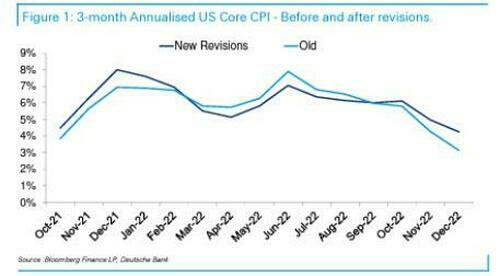

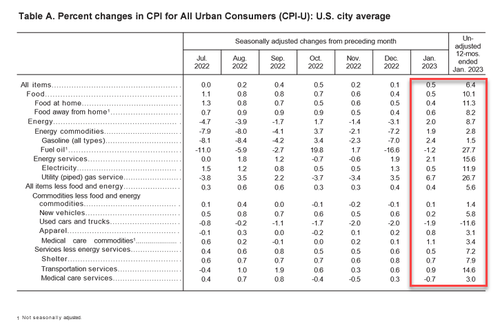

As a reminder, CPI revisions hit Friday – rewriting the entire last twelve months higher by an average of around 0.1% per month – so while the trend going into today’s much-anticipated CPI is The Fed’s friend, we are further away from their target before we see today’s print.

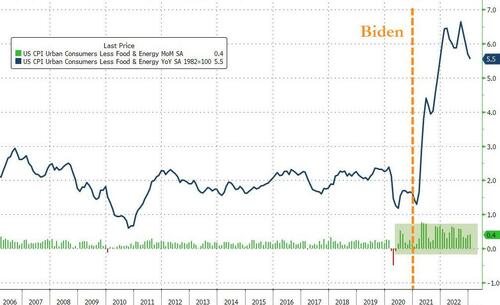

And so, after rising 0.1% MoM last month (up from the initial -0.1% print), consensus was for a reaccleration to +0.5% MoM in January and that is what it printed, prompting a hotter than expected +6.4% YoY CPI print (+6.2% exp)…

Source: Bloomberg

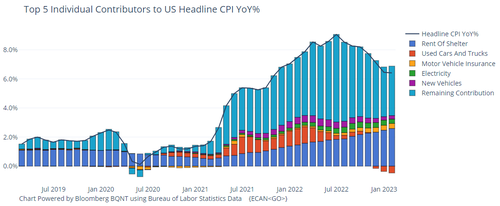

These are the Top 5 contributors to headline CPI…

Core CPI was expected to rise 0.4% MoM and printed in line – the 32nd month in a row of rising Core CPI

Source: Bloomberg

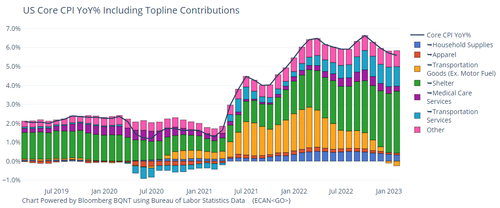

The top drivers of Core CPI…

Source: Bloomberg

The index for all items less food and energy rose 0.4 percent in January. The shelter index continued to increase, rising 0.7 percent over the month.

- The rent index and the owners’ equivalent rent index each rose 0.7 percent since December. The index for lodging away from home increased 1.2 percent in January.

- The shelter index was the dominant factor in the monthly increase in the index for all items less food and energy, while other components were a mix of increases and declines.

Among the other indexes that rose in January was the index for motor vehicle insurance, which increased 1.4 percent over the month, while the index for recreation rose 0.5 percent, and the index for apparel increased 0.8 percent.

- The household furnishings and operations index rose 0.3 percent in January, and the communication index increased 0.4 percent

- The medical care index fell 0.4 percent in January, as the physicians’ services index declined 0.1 percent. The index for hospital services increased 0.5 percent over the month and the index for prescription drugs rose 2.1 percent in January.

- Other indexes which declined over the month include the index for used cars and trucks, which fell 1.9 percent in January, continuing a recent downward trend. The index for airline fares fell 2.1 percent over the month.

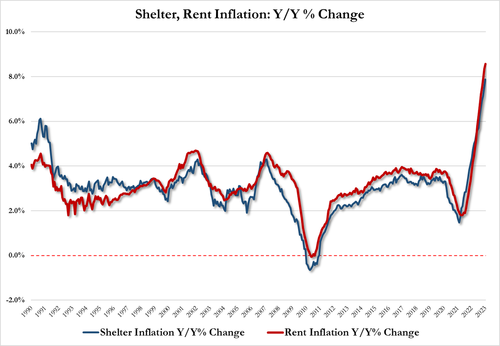

The index for all items less food and energy rose 5.6 percent over the past 12 months. The shelter index increased 7.9 percent over the last year, accounting for nearly 60 percent of the total increase in all items less food and energy. Other indexes with notable increases over the last year include household furnishings and operations (+5.9 percent), medical care (+3.1 percent), recreation (+4.8 percent), and new vehicles (+5.8 percent)

- Shelter inflation +7.88%, up from 7.51% in Dec and the highest on record

- Rent inflation +8.56%, up from 8.35% in Dec and the highest on record

Services CPI soared to its highest since July 1982 and Goods inflation continues to slow…

Source: Bloomberg

Is this stall in the decline of inflation reflecting the lagged pause in M2’s decline?

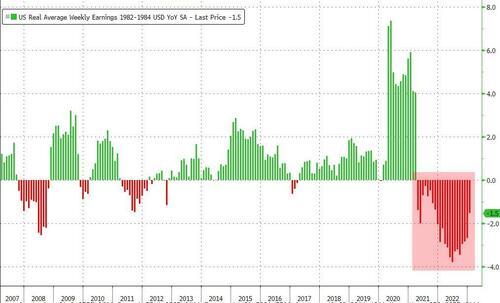

Finally, the rise in Americans’ cost of living outpaced their income gains for the 22nd month in a row (down 1.5% YoY)…

Source: Bloomberg