by Mike Shedlock via MishTalk,

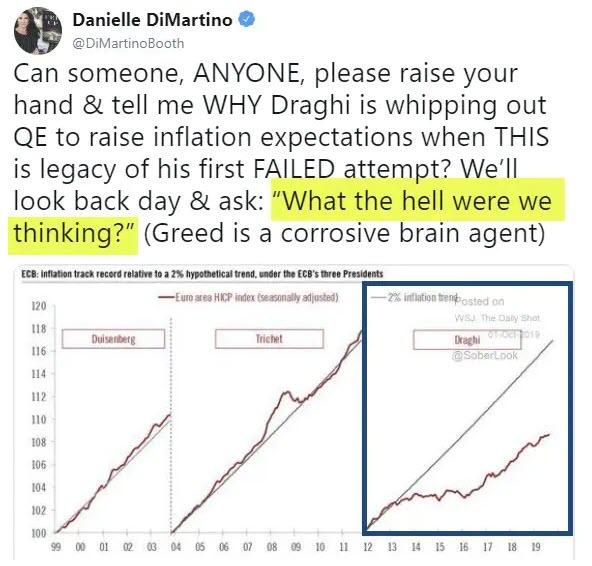

Danielle DiMartino poses an interesting question regarding the ECB. I have a set of answers.

What is the ECB Doing?

I have a set of answers and even started writing this post before DiMartino brought it to the forefront.

There are only two answers. One of them is very unsettling.

- Ignorance

- On Purpose

Occam’s Razor

Occam’s razor is a principle from philosophy. Suppose there exists two explanations for an occurrence. In this case the one that requires the least amount of assumptions is usually correct. Another way of saying it is that the more assumptions you have to make, the more unlikely an explanation.

Occam’s Razor typically eliminates most conspiracy theories. It’s not that conspiracies don’t happen, but that simpler solutions are far more likely.

My corollary to the theory is very easy to understand: If stupidity is one of the possible answers, it is the most likely answer.

I am a normally a big fan of Occam’s Razor.

But this is so bizarre that I have my doubts.

Importantly, this may not be a conspiracy at all. Mario Draghi can easily be acting alone.

My Lead Question

How stupid can things get before one starts believing something else is in play?

I had already been thinking about that question when not only did ECB president Mario Draghi further push interest rates into negative territory but he also said it was a good idea for the ECB to think about MMT.

Shocking ECB Dissent

Lagarde inherits #ECB tinged by bitterness of Draghi stimulus. Draghi has issued veiled criticism of his QE opponents. New president will need to confront fractious policy making. https://www.bloomberg.com/news/articles/2019-09-29/lagarde-inherits-ecb-tinged-by-bitterness-of-draghi-stimulus …

Dissent at the Fed happens all the time. It is rare at the ECB. The ECB builds a consensus and it is typically unanimous.

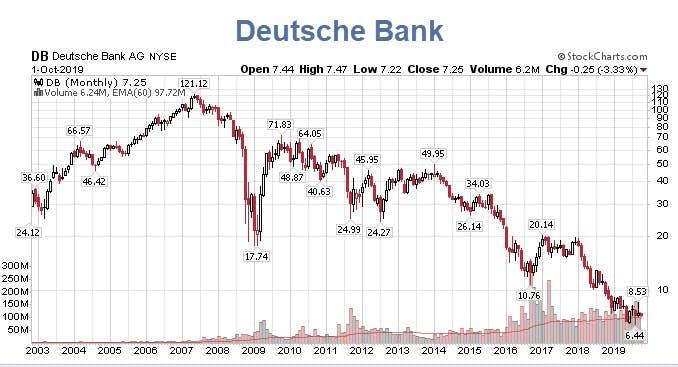

Question on Deutsche Bank and Commerzbank

How is it that Draghi cannot see the damage negative interest rates do to German banks?

Both Deutsche Bank and Commerzbank have complained about negative interest rates.

Deutsche Bank Monthly

Commerzbank Monthly Chart

In Search of the Effective Lower Bound

I discussed negative interest rates on September 25 In Search of the Effective Lower Bound

The concept behind ELF is that at some point further reductions in interest rates hurt the intent.

But what is the intent?

That is one of the new questions I have been thinking about.

And why can’t Draghi see that negative rates helped neither the Eurozone, nor Japan?

Alternatively, Draghi can see that negative rates hurt but he either doesn’t care or actually wants that outcome.

Counterproductive Policy

On September 10, Eric Dor, Director of Economic Studies at the IESEG School of Management in Paris emailed an article with some interesting charts regarding the Counterproductive Interest Rate Policy of the ECB.

I discussed Dor’s article in Questioning Lagarde as Gross Interest Income in Germany Heads Towards Zero

Email from Lacy Hunt

Shortly after posting Dor’s take, Lacy Hunt at Hoisington Management, pinged me with these comments.

“Dor’s article is outstanding. This is consistent with the great theoretical economics of the late Stanford economist Ronald McKinnon who argued that even before interest rates fall below zero, the counterproductive feedback loops outweigh the benefits of the lower rates even if the interest rates are lower in real as well as nominal terms. If you are not familiar with McKinnon’s economics, I strongly urge you to do so.”

Bank Margins and Profits with Negative Rates

Lagarde and ECB should read: Negative rates have damaged banks and credit origination. Sad that researchers have to spend time proving the obvious.

Study of 7,359 banks from 33 OECD countries.

Bank margins and profits in a world of negative rates. https://www.sciencedirect.com/science/article/pii/S0378426619301888 …

Bank margins and profits in a world of negative rates

By investigating the influence of negative interest rate policy (NIRP) on bank margins and profitability, this paper identifies country- and bank- spe…

sciencedirect.com

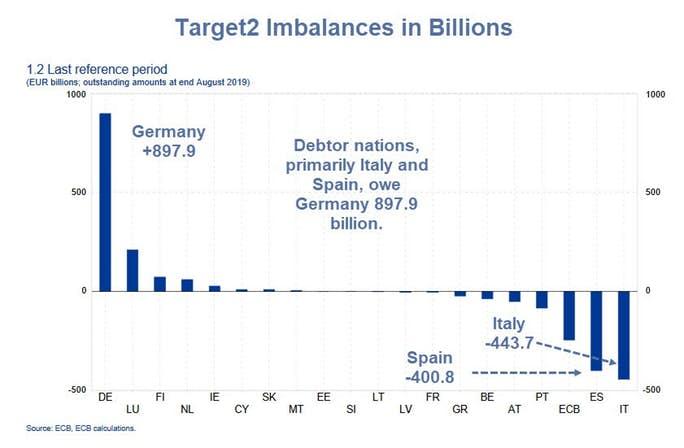

Target2

Target2 is one of the fundamental flaws of the Eurozone. TARGET stands for “Trans-European Automated Real-time Gross Settlement Express Transfer System”.

It is a measure of capital flight and other imbalances from one Eurozone county to the next.

Here’s my own ANYONE question: Can someone, anyone, please tell me how the hell Italy and Spain are going to pay off that debt?

Trade Surplus

Germany runs a huge trade surplus. Make that enormous. German exports are 47.24% of GDP.

I noted that figure and posted many charts two days ago in Nobody Wins, But Germany and EU Hurt Most in Global Trade War.

A reader pointed out that much of that surplus was with other Eurozone countries. Even assuming that is true, so what?

In the US, California (thankfully) does not have its own central bank. But in the EU, Germany does. Spain does. Italy does.

Whereas the central bank of California cannot owe the central bank of Wisconsin, those Eurozone imbalances (and guarantees) are real.

Let’s emphasize Italy. Let’s also investigate Mario Draghi’s background.

Mario Draghi’s Background

Mario Draghi is an Italian economist serving as President of the European Central Bank since 2011. He previously served as the Chairman of the Financial Stability Board from 2009 to 2011 and Governor of the Bank of Italy from 2005 to 2011.

Draghi previously worked at Goldman Sachs from 2002 until 2005. In 2014, Draghi was listed as the 8th most powerful person in the world by Forbes. In 2015, Fortune magazine ranked him as the world’s second greatest leader. In May 2019, Paul Krugman described him as “[arguably] the greatest central banker of modern times”. His term is scheduled to end on 31 October 2019.

Whatever It Takes

Please recall that on July 26, 2012, Mario Draghi gave a speech in which he said “the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.“

I discussed that phrase at the time and also on September 12, 2019 in ECB’s Counterproductive QE: Whatever It Takes Morphs Into “As Long As It Takes”

Negative Interest Rates are Social Political Poison

As discussed on September 23, Negative Interest Rates Are Social Political Poison.

It gets even worse.

Draghi Open to MMT and a People’s QE

On September 24, I noted Draghi Open to MMT and a People’s QE

Mario Draghi proposed investigating MMT, a combined Eurozone budget, and “QE for the people” even though these ideas are counter to the Maastricht Treaty of 1992 which formed the Eurozone.

Why?

- That’s what it takes to save Italy

- That’s what it takes to “preserve the Euro”.

Whatever it takes baby, and that’s what it takes.

Full Circle

We are now full circle.

DiMartino asks “Can someone, ANYONE, please raise your hand …”

Before answering, please ponder a different question: What better way can there possibly be to get Germany to commingle debts and bail out Italy than to destroy German banks, putting the bailout on the backs of German citizens?

New Corollary to Occam’s Razor

When someone who seems to not be stupid, repeats a series of actions that seem amazingly stupid, perhaps the actions are not stupid at all. Rather, we need to understand the real intent.

So, what is that intent?

Show of Hands

Now, may I please have a show of hands?

- Draghi really is stupid enough to destroy German banks

- Draghi is acting with intent

OK Danielle, and Mish readers, is it number 1 or is it number 2?

There are no other opt