Efter en svag periode vinder amerikansk økonomi igen styrke, mens Europa og Kina fortsat halter bagefter. Et stærkere USA plejer dog at smitte af på Europa med en vis forsinkelse, med mindre den stærke Euro ødelægger det. Obligationsrenten igen på vej opad.

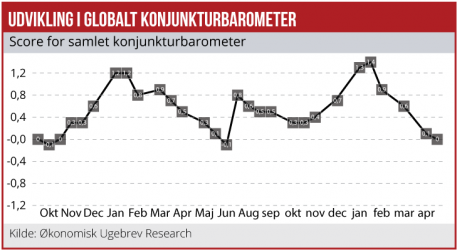

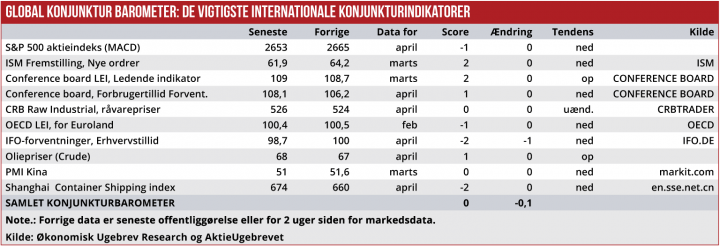

Økonomisk Ugebrev konjunkturbarometer for den globale økonomi er fortsat underdrejet, men der ser ud til at komme fornyet vækst momentum i amerikansk økonomi. Mens hard data for USA’s økonomi fortsat er en smule underdrejede, peger de ledende indikatorer nu klart opad.

Atlanta FED´ ledende indikator siger nu kun to procent BNP-vækst i 1. kvartal i USA, mens Markits nye PMI data for april tyder på et stærkt comeback for amerikansk økonomi. Om udviklingen i USA skriver Markit , at ”the US economy picked up pace again at the start of the second quarter. The April PMI surveys registered the second-strongest monthly expansion since last October. Manufacturing is leading the upturn, with factories reporting the strongest output gains for 15 months, and the vast service sector is enjoying a steady, robust expansion. After a relatively disappointing start to the year, the second quarter should prove a lot more encouraging. The current data point to an annualised GDP growth rate of 2.5%, with scope for some substantial upside surprises in coming months.“

Endnu har der ikke været en positive afsmitning på de ledende indikatorer for europæiske økonomi. Især det tyske IFO indeks fra de tyske indkøbschefer har skuffet gennem de seneste måneder. “High spirits among German businesses have evaporated. The indicator for the current business situation fell and expectations also deteriorated. The German economy is slowing down. In manufacturing the business climate deteriorated for the third consecutive month. Assessments of the current business situation declined but nevertheless remain at a high level. Business expectations dropped to their lowest ebb since August 2016,” skriver IFO.

For Markits PMI måling for Eurozonen er budskabet næ-sten det samme: ”The Eurozone economy remained stuck in a lower gear in April, with business activity expanding at a rate unchanged on March, which had in turn been the slowest since the start of 2017. Growth has downshifted markedly since the peak at the start of the year, but importantly still remains robust. “The April data are running at a level broadly consistent with Eurozone GDP growth of approximately 0.6% at the start of the second quarter,” skriver Markit.

For Conference Boards ledende indikator er udsigten også positiv: ”The U.S. LEI increased in March, and while the monthly gain is slower than in previous months, its six-month growth rate increased further and points to continued solid growth in the U.S. economy for the rest of the year.” MWL

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her