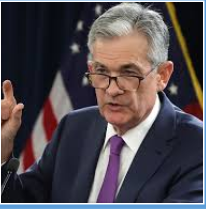

Chefen for den amerikanske centralbank, Powell, ser ingen risiko for en overophedning trods de enorme finanspakker fra regeringen. Men han er parat til at gribe ind, hvis inflationen kommer væsentligt over 2 pct. Det ser han blot ikke tegn på nu, sagde han på et pressemøde i går.

‘Not yet’ for Fed taper

Fed View: Upgrade to economic assessment, and taper talk to come in Q3 –

The April FOMC meeting was largely free of fireworks, with upgrades to the characterisation of the recovery, and no hints yet on when a tapering of asset purchases might happen – as we had flagged in our preview.

The main changes to the policy statement were on economic activity, which is now said to have ‘strengthened’ (rather than ‘turned up’), while inflation was said to have risen ‘largely reflecting transient factors’ (previously ‘continues to run below 2%’).

In the press conference, Chair Powell was repeatedly questioned on inflation and the potential for an overheating of the US economy, given the rapid pace of recovery, and strong fiscal and monetary support. He continued to downplay these risks, saying that the build-up of inflationary pressure takes time, but said that the Fed would not hesitate to act if inflation rose ‘materially above 2% in a persistent way that risks inflation expectations drifting up’.

The effect of bottlenecks on prices was said to have created some uncertainty in this regard, but the Fed judges this to be temporary and not something monetary policy should respond to. Powell was also repeatedly questioned on the issue of tapering, with the response being that it is ‘not yet time’ to talk about tapering given how far the Fed is still from its goals.

Given the degree of labour market slack that will remain in the coming months – not only visible in the unemployment rate, but also in depressed participation – we expect the Fed to reach such a level of comfort with progress towards its goals in Q3, with an actual taper of purchases starting in early 2022.