Uddrag fra globale finanshuse:

December nonfarm payrolls are expected to print in line with the prior report, with the consensus looking for 70k nonfarm payrolls to be added to the economy vs the 64k in November. The unemployment rate is expected to fall by one-tenth to 4.5%, and follows the Fed’s decision in December to cut rates due to the slowing labor market. The December jobs data will help shape expectations for the January and March FOMC meetings; currently money markets are pricing an unchanged outcome in January (with around 80% probability), and there is around 48% chance rates will have been cut by a further 25bps by March.

According to Newsquawk, labor market proxies in December have generally printed similar figures to the November period; weekly initial jobless claims were little changed across the two survey windows; continuing claims eased but there might be some distorting factors; ADP printed a positive figure vs the negative reading in November, but was short of expectations; the Conference Boardʼs gauge of consumer confidence signaled a softer labor market vs November. JPMorganʼs strategists suggest that the data would be received positively by stocks if the headline came in between 0-105k, but could see some downside outside of that range.

Expectations

- Consensus forecasts call for 70k nonfarm payrolls to be added to the US economy in December, up from 64k in November; Private payrolls are expected to rise to 75k, up from 69K.

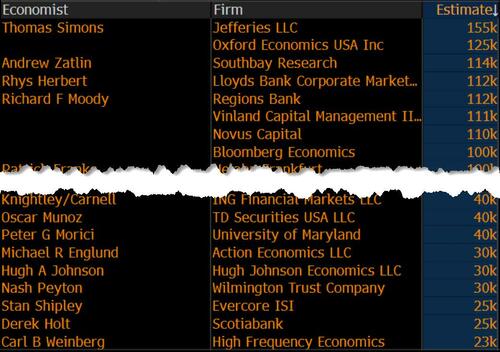

- Forecast expectations range from 23K on the low end (High Frequency Economics) to 155K on the high end (Jefferies). Notably there are no negative estimates.

- The unemployment rate seen edging lower to 4.5% from 4.6% (for reference, the three-month average stands at 22k, six-month at 17k, and 12-month at 78k). Last year, some Fed officials cited a payrolls breakeven rate of between 0k and 50k.

- The FOMC projects the jobless rate to end this year at 4.4%, before falling to 4.2% in 2027

- Goldman expects payrolls to rise by 70k in December, in line with consensus. On the positive side, big data indicators showed a moderate pace of private sector job growth and seasonal distortions look supportive for December job growth on net. On the negative side, the bank expects a 5k decline in government payrolls —reflecting a 5k decline in federal government payrolls and unchanged state and local government payrolls — and sequentially slower construction employment growth after an outsized increase in November and unusually poor weather early in the survey period. Goldman also estimates that the unemployment rate edged down to 4.5% in December from 4.6% in November. The bar for rounding down to 4.5% is not high from an unrounded 4.56% in November, continuing claims have declined slightly, and furloughed federal workers that likely contributed to the spike in workers on temporary layoff that explained most of the increase in overall unemployment in November would have returned to work.

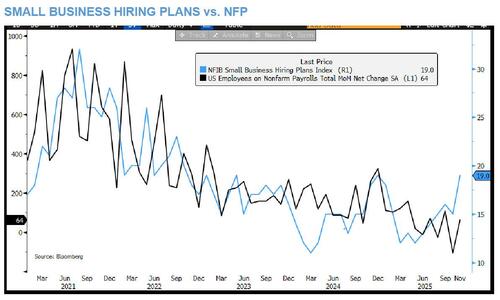

- JPMorgan analysts expect the December jobs report to be in line with, or slightly stronger than, recent readings. They argue that concerns over a late-summer or third-quarter economic soft patch have proved unfounded, with GDP growth remaining robust on resilient consumer demand. However, hiring has lagged the acceleration in spending, making the expansion unusual by historical standards. The NFIB Small Business Survey, which typically leads nonfarm payrolls by one to two months, has trended higher since the summer. While this may not be fully reflected in Decemberʼs data, JPMorgan says it points to faster hiring momentum in the coming months.

Initial Jobless Claims:

In the week that typically coincides with the survey window, initial jobless claims stood at 224k, little changed from 222k in the comparable November period. Continuing claims were 1.913mln, easing from 1.944mln in November. Pantheon Macroeconomics says that while continuing claims appear to signal a firmer labor market, the strength is partly distorted by temporary factors, notably elevated claims in late 2024 due to Hurricane Helene, with affected states such as North Carolina now showing much lower levels.

Beyond claims, Pantheon says broader labor market slack is emerging. New graduates struggling to secure initial jobs and former federal workers who accepted voluntary buyouts are contributing to unemployment but are ineligible for benefits. In addition, longer-term unemployment has accounted for more than one-third of the rise in joblessness over the past year, yet is largely absent from continuing claims as eligibility typically expires after 26 weeks. Pantheon points to forwardlooking indicators, including WARN notices and Challenger layoff announcements, which suggest an increase in job cuts and claims early in 2026. Overall, it says these dynamics imply the unemployment rate is still edging higher, reinforcing expectations that the Fed may be forced to ease policy again in March.

Consumer Confidence:

- The Conference Boardʼs December consumer confidence survey signaled a softer labor market compared with November. Fewer respondents said jobs were plentiful, at 26.7% versus 28.2% prior, while more said jobs were hard to get, at 20.8% versus 20.1%.

- Expectations weakened, with fewer anticipating more jobs at 16.5%, unchanged, and more expecting fewer jobs at 27.4% versus 26.8%. Income prospects were mixed, with a larger share expecting increases at 18.4%

Arguing for a stronger-than-expected report:

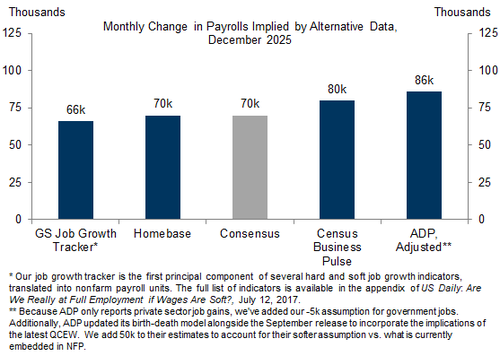

- Big data. Alternative measures of employment growth indicated a moderate pace of job growth in December. The indicators that Goldman tracks averaged 79k in December. The broader job growth tracker has continued to improve from its stagnant pace of the summer and stood at 66k/month in December.

- Retail hiring shifting to December. As discussed in our November preview, Thanksgiving—and thus Black Friday and the start of the holiday shopping season—was relatively late this year (November 27th), which likely weighed on holiday retail hiring in November. We expect a boost of roughly 15k to this month’s reading as a greater share of holiday retail hiring is captured in the December survey period.

- Layoffs. Initial jobless claims declined from 227k on average in the November payroll month to 217k in December. The JOLTS layoff rate declined by 0.1pp to 1.1% in November. Challenger announced job cuts declined by 36k to 36k in December.

Arguing for a weaker-than-expected report:

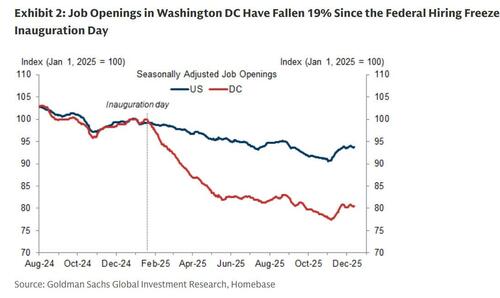

- Government hiring. Goldman expects a 5k decline in government payrolls, reflecting a 5k decline in federal government payrolls and unchanged state and local government payrolls. The bank expects the ongoing federal government hiring freeze to continue to weigh on federal government payrolls.

- Cold and snowy weather. Colder-than-usual weather and snow early in the reference month likely weighed modestly on weather-sensitive sectors, such as construction and leisure and hospitality; Goldman estimates a drag of 20k. Additionally, construction sector employment had an outsized increase in November, increasing the scope for deceleration in December.

Mixed/neutral factors:

- Employer surveys. The Goldman manufacturing survey employment component tracker declined in December (-0.2pt to 49.8), while our services survey employment component tracker increased (+0.5pt to 49.4). Both of our trackers remained in contractionary territory. However, the signal from survey data has been less useful—and at times misleading—during the post-pandemic period and thus has little bearing on our payrolls forecast.

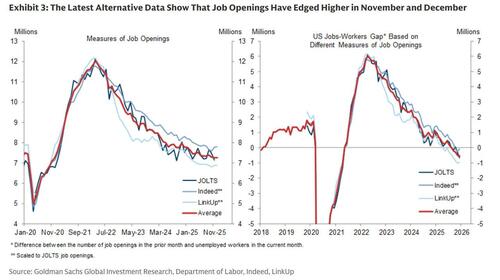

- Job availability. While JOLTS job openings declined by 303k in November, alternative measures of job openings edged higher in November and December on average (Exhibit 3). Goldman estimates that the jobs-workers gap now stands at -0.7mn. The Conference Board labor differential — the difference between the percentage of respondents saying jobs are plentiful and those saying jobs are hard to get — declined by 2.2pt to +5.9 in December, the lowest level since February 2021.

Fed Policy:

The Fed cut rates by 25bps in December to 3.50-3.75%, with most participants seeing policy moving towards a more neutral stance to balance rising employment risks and easing inflation risks. Chair Powell said layoffs and hiring remain low, but labor demand has clearly softened, adding that the labor market is less dynamic and downside risks have increased. Powell said the rate cut was motivated by a gradual cooling in the labor market and suggested payrolls may be running at around -20k per month after accounting for data distortions.

The December jobs report will be key in shaping expectations for Fed policy at its January meeting, following softer-than-expected CPI data and resilient growth figures, which many analysts see as supporting a pause. The latest FOMC minutes showed a finely balanced decision: Most participants backed a rate cut due to rising downside risks to employment, while some preferred no change, and one favored a larger move. Nine members voted for a 25bps cut, one for a 50bps reduction (Miran), and two for unchanged policy (Goolsbee and Schmid). Most judged further cuts would be likely if inflation declines, but several favored holding rates steady to assess lagged effects. Inflation was seen as remaining above 2%, with tariff-related pressures noted and risks tilted to the upside. Participants said labor markets were softening, growth was moderate, and balance-sheet management was focused on maintaining ample reserves. Analysts said the minutes underline a clear split within the Fed and reinforce a cautious outlook.

While most remain open to further easing, confidence is conditional on clearer disinflation, particularly amid concerns that additional cuts could undermine commitment to the 2% target. Barclays said the minutes point to a likely pause in January as policymakers assess the impact of recent cuts, while JPMorgan said stronger hiring could help align employment growth with robust demand but may also add inflationary pressure, complicating the policy outlook.

Government Shutdown:

The December jobs data is expected to be easier to interpret after the October and November releases. October showed a headline decline of 105k, largely driven by a one-off drop of 162k in federal worker payrolls, while November posted a gain of 64k alongside a more modest 6k fall in federal employment. Analysts also expect the impact of Novemberʼs government shutdown on the data to be limited. ADP EMPLOYMENT: ADPʼs national employment report showed private payrolls rose by 41k in December, slightly below expectations for 47k. The median annual pay increase for job stayers was unchanged at 4.4% Y/Y, while pay growth for job changers rose to 6.6% from 6.3%. ADP said small businesses recovered from November job losses with positive end-of-year hiring, even as large employers pulled back.

Market Reaction:

JPMorgan: JPMorgan’s Market Intel team is looking for an inline to slightly stronger print. They write that after hitting what was thought to be a soft patch in the economy late summer / Q3, it was thought that we would see hiring resume. Well, the economy never saw that dip with Q3 GDP printing 4.3% and Q2 3.8%: “This consumer-led expansion has been peculiar due to a lack of hiring as spending / growth accelerated higher. Now, do we see hiring return adding more support to a stronger than average aggregate consumer?” As shown in the chart below, the NFIB Small Business Survey’s Hiring Sub-index has acted as a leading indicator for NFP, typically establishing a trend 1-2 months ahead of the official NFP prints. That sub-index has been trending higher since this summer (see below). This may not be reflected in this week’s print, but JPM looks for the trend to point toward accelerated hiring. It remains to be seen if this resumption in hiring will add an inflationary impulse.

JPM Scenario Analysis: According to the JPM market intel team, this is what the market reaction will look lie post-NFP:

- Above 105k. SPX is down 0.5% – 1%: probability 5%

- Between 75k – 100k. SPX gains 0.25% to 1%: probability 25%

- Between 35k – 75k. SPX gains 0.25% – 0.75%; probability 40%

- Between 0k – 35k. SPX loses 0.25% to gains 0.5%: probability 25%

- Below 0k. SPX is down 0.5% to 1.25%: Probability 5%

Goldman: According to Goldman economists, on the positive side, big data indicators indicated a moderate pace of private sector job growth. On the negative side, we expect a 5k decline in government payrolls—reflecting a 5k decline in federal government payrolls and unchanged state and local government payrolls—and sequentially slower construction employment growth after an outsized increase the prior month and unusually poor weather early in the survey period.

Thoughts from the Goldman trading desk:

- Ryan Hammond (US Portfolio Strategy): We expect the S&P 500 will deliver another year of solid gains in 2026. Our baseline macro forecasts of a stable labor market, above-consensus economic growth, below-consensus inflation, and continued Fed easing is a friendly mix for US equities. In particular, our economists expect growth will accelerate in early 2026. The equity market has not fully priced the growth acceleration embedded in our economic forecasts: Sector rotations within the equity market appear to be pricing an outlook for modestly above 2% real GDP growth. We expect a solid set of labor market data would support equity investor belief in an economic reacceleration, leading to outperformance in cyclical equities. We recently highlighted opportunities among middle income consumer stocks and nonresidential construction stocks. If strong labor market data results in higher bond yields, it could constrain the magnitude of equity market upside, especially in low quality slices of the cyclical trade. However, high equity valuations and cyclical pricing suggest that equities remain vulnerable to a very weak set of labor market data. Defensive sectors Health Care and Consumer Staples trade at low valuations relative to their history and profitability but carry among the highest short interest relative to history.

- Joe Clyne (Index Vol Trading): Heading into NFP, we see the street as quite long gamma, particularly to the topside in SPX. That’s reflected in pricing with the one day straddle looking like it will go out under 50 bps for a day that has both NFP and a potential Supreme Court tariff ruling. Despite the positioning, we like owning gamma better than vega for the event and think the short-dated straddles are underpriced, particularly in the case of a negative surprise when we could rapidly move away from concentrated dealer long strikes. Our client base has primarily been directing attention toward a continuation of the broadening trade, with upside buys and inquiries concentrated in RSP and IWM. The IWM narrative makes more sense to the topside as it has a similarly low vol hurdle to SPX without the overhang of long dealer gamma positioning. Another hedge that looks attractive here is short-dated VIX calls and call spreads, both in Jan and Feb expiries. Even with a recent uptick in call spread buying in VIX, we think vol of vol is still cheap enough to own. The desk is constructive delta here, but thinks hedges are cheap enough to hold, especially the short-dated topside in SPX held delta neutral or as a delta replacement.

- Karen Fishman (Senior FX Strategist): Our economists’ forecast for around-consensus payrolls and a rounding back down to 4.5% on the unemployment rate should be an ideal mix for procyclical assets. In our outcome, markets likely price in slightly better growth and even lower odds of near-term Fed cuts, but also have little reason to expect an imminent hawkish policy pivot. That would leave growth pricing in the driver’s seat and, in FX, should mean that currencies like AUD, NZD, SEK, and high-beta EM outperform. Such a backdrop should also reinforce our open trade recommendation to be short CAD/ZAR, especially if Canada’s labor market report shows some payback after the outsized drop in the unemployment rate in November. (As an aside, the sharp move lower in CAD/ZAR over the past week warrants some caution. But we still see room to run in ZAR on strong fundamentals and think CAD should be a lower-vol funder than USD, JPY, or EUR.) The other standout should be JPY underperformance as it tends to weaken most clearly in a positive growth shock, when yields and equities rise together—though a sharp rally in USD/JPY could refocus attention back on intervention risk. The asymmetry probably lies in a meaningful upside surprise, where the Fed cuts priced through this year can quickly get thrown into greater doubt. But at the same time, a big miss should raise recession risk from the little that is priced. EUR probably proves to be among the biggest movers in those scenarios (weaker on a beat and stronger on a miss), though second to JPY on a miss.

- Louis Miller (Custom Baskets / Thematics): Tech sector share of total US employment has gone down as a share of total employment since ChatGPT was publicly released 3+ years ago, and if AI productivity really takes hold across corporate America one can imagine a world where headcount reductions in corporate America are somewhat of a drag on payrolls in the future in 2026 or 2027 depending on the pace of adoption. This could lessen the impact of payrolls on equity markets overtime, especially if the markets perception of reflation/strong growth due to smaller tariff drag, tax cuts, and easier financial conditions remain. I like being long AI Productivity basket (GSXUPROD) ahead of 4Q earnings season on the back of this narrative of a strong economy and less strong labor market. Similarly, I quite like our recently rebalanced depressed cyclicals basket as the backdrop of a slowing labor market should keep the fed in check or supportive, and strong growth should allow the reflation impulse to continue.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her